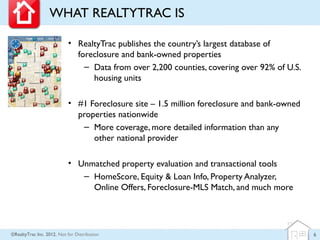

The document provides an overview of foreclosure buying, highlighting RealtyTrac's role as a comprehensive resource for foreclosure and bank-owned properties. It explains the foreclosure process, identifies three opportunities for buying foreclosures (pre-foreclosure, auction, and bank-owned), and outlines five steps for purchasing a foreclosure. Additionally, it emphasizes the potential savings and advantages of buying foreclosures, including reduced competition.