Embed presentation

Downloaded 23 times

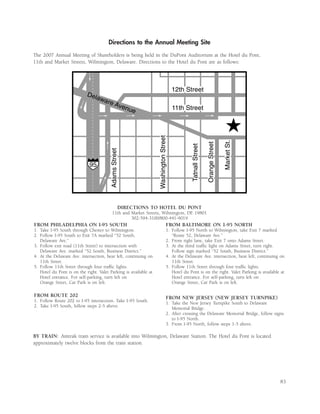

This document is Ford Motor Company's notice and proxy statement for its 2007 Annual Meeting of Shareholders. It provides information about the meeting such as date, time, location, and proposals to be voted on. It explains shareholders' voting rights and the process for voting by proxy or in person. The meeting will address the election of directors, ratification of the independent auditor selection, and 10 shareholder proposals. The Board recommends voting for management's nominees and proposals and against the shareholder proposals. The document provides details on these agenda items and general corporate governance information.