Embed presentation

Downloaded 16 times

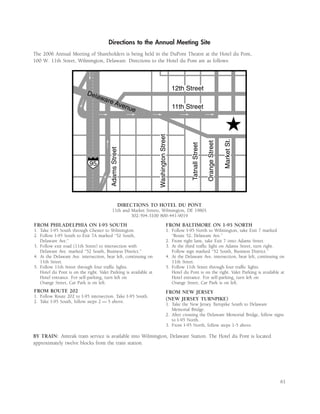

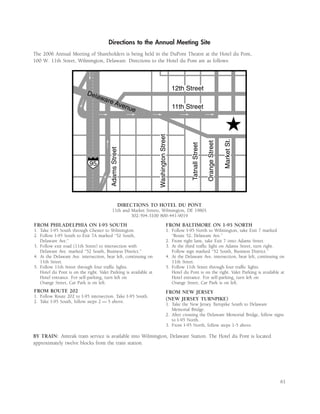

Ford Motor Company will hold its annual shareholder meeting on May 11, 2006. Shareholders are being asked to vote on 10 proposals, including the election of directors, ratification of the independent accounting firm, and 8 shareholder proposals. Shareholders can vote by proxy via mail, phone or internet in advance of the meeting or in person at the meeting. The Board recommends voting for the election of directors and ratification of the accounting firm, and against the 8 shareholder proposals.