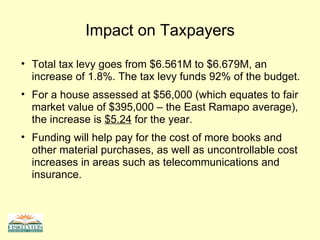

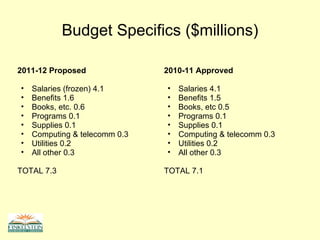

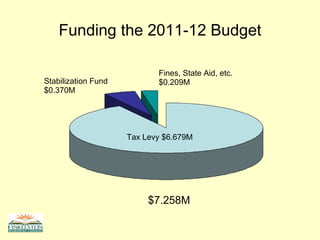

The Finkelstein Memorial Library is proposing a 1.8% increase to its budget for the 2011-2012 fiscal year, raising its total tax levy from $6.561M to $6.679M. For the average home assessed at $56,000, this increase equates to $5.24 more per year. The budget increase is needed to fund rising costs of materials, telecommunications, and insurance, despite efforts to cut expenses by freezing salaries, not filling vacancies, and reducing other costs. The vote on the proposed $7.258M budget will take place on June 6 from 7-9pm at the library.