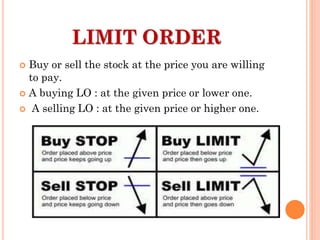

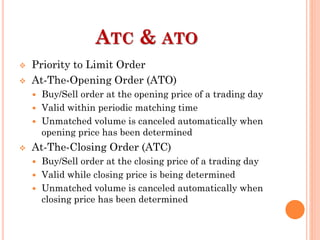

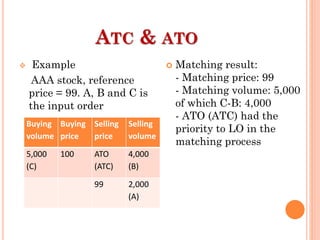

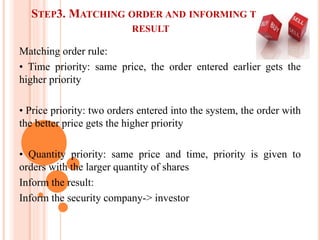

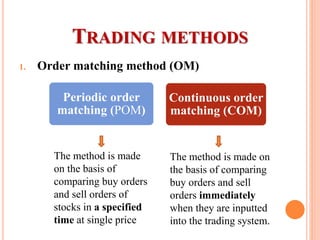

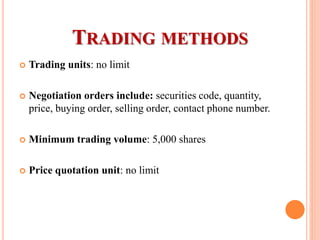

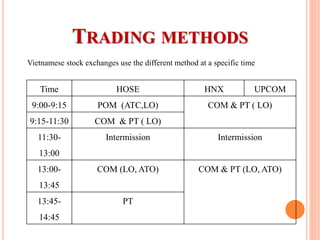

This document summarizes information about stock exchange operations and trading in Vietnam. It discusses the two main stock exchanges, HOSE and HNX, including when they were established and their number of listed stocks. It also describes the trading venues, listing rules, order types like market orders and limit orders, the trading process involving account registration, order placement, matching, clearing and settlement, and the different trading methods used including periodic order matching, continuous order matching and put-through trading. Matching is done based on price, time and quantity priorities.