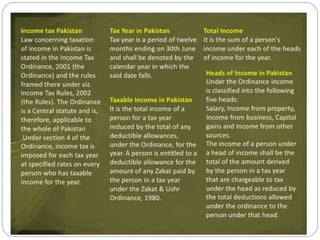

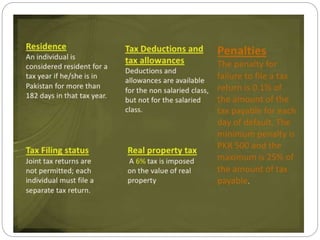

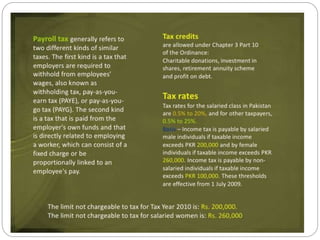

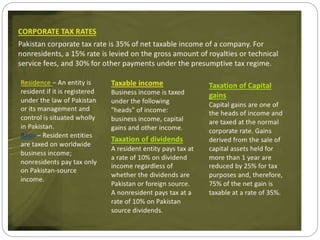

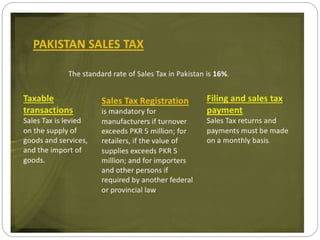

The document discusses taxation in Pakistan and its importance for development. It notes that Pakistan faces obstacles to tax administration like weak capacity and inefficient collection. Properly organized tax systems are now accepted as engines of development. Both direct and indirect taxes are essential for bringing revenue to the state to fund public expenditures and promote economic growth, employment, and stability. However, in developing countries like Pakistan, direct taxation has limited scope so indirect taxation plays a more significant role.