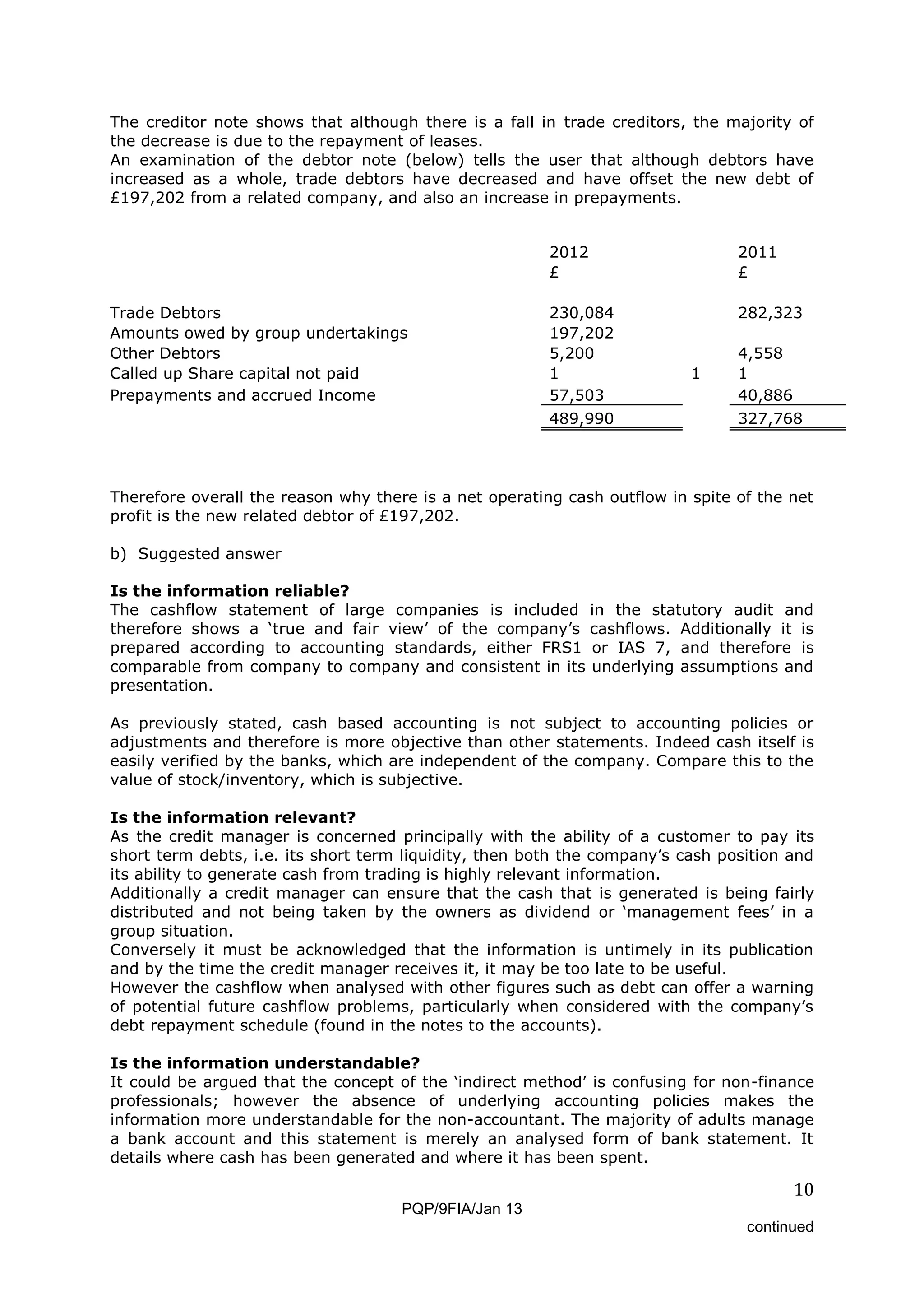

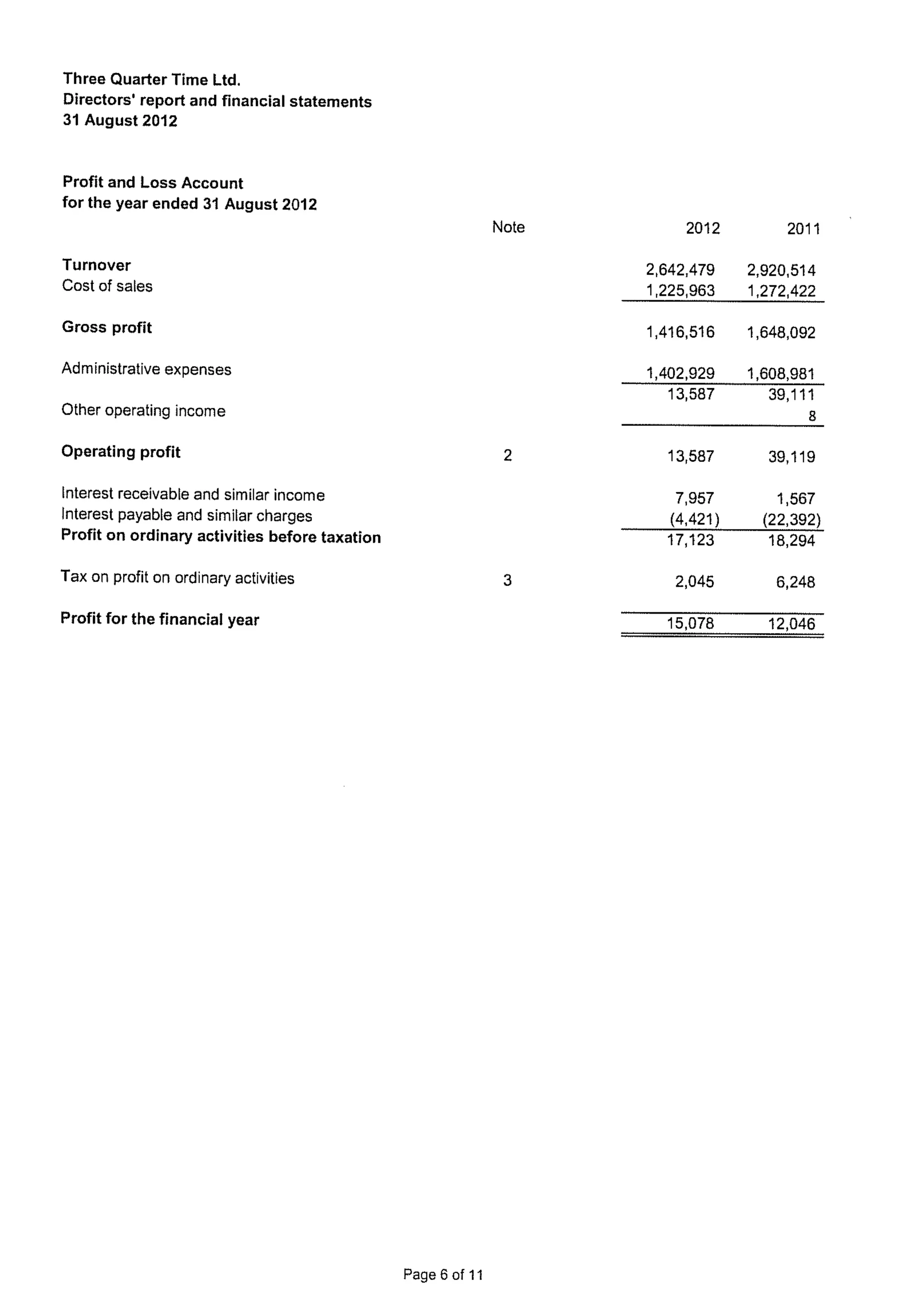

The document provides an examiner's report on candidates' performance on a Level 5 Diploma in Credit Management exam from January 2013. The examiner notes that answers seemed to reflect poor preparation and understanding of applying theory to practical situations, as required at Level 5. Candidates appeared to feel success could be achieved without thorough preparation in all subject areas. The examiner was disappointed candidates could not accurately apply basic ratio analysis and hopes future candidates will prepare more effectively. The report then provides the exam questions, suggested answers, and comments on areas candidates struggled with or failed to address sufficiently.