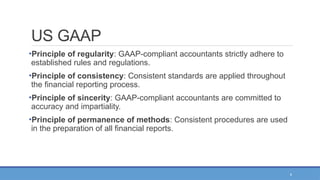

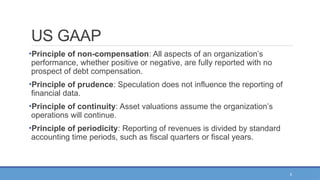

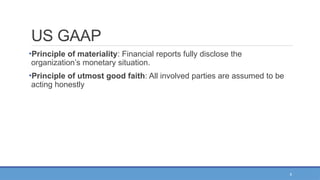

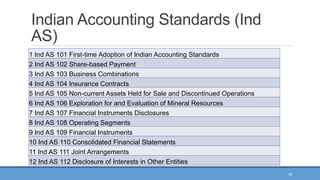

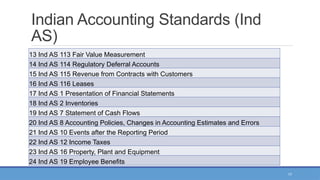

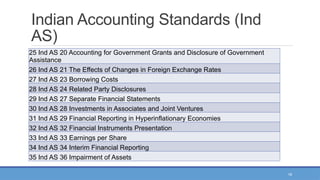

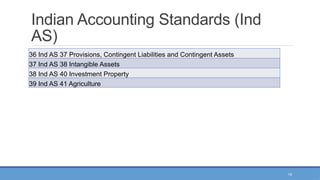

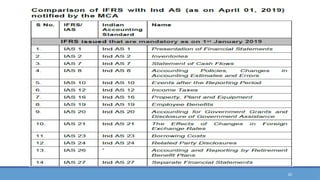

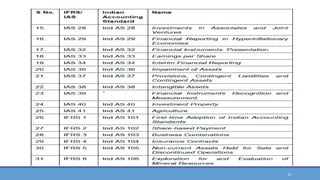

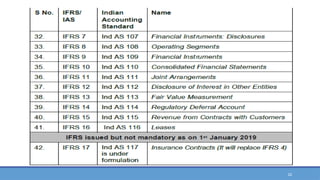

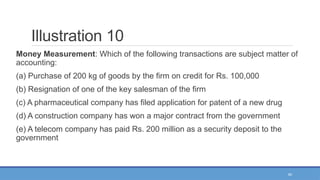

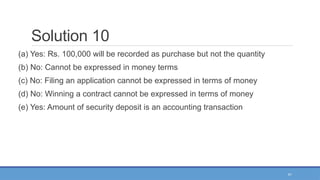

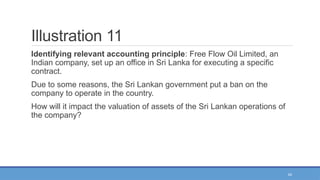

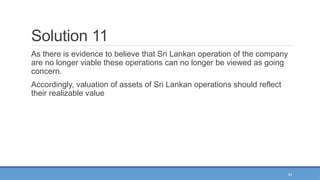

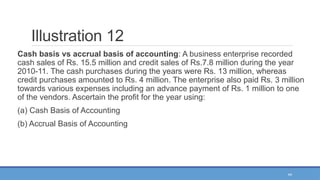

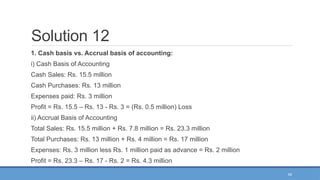

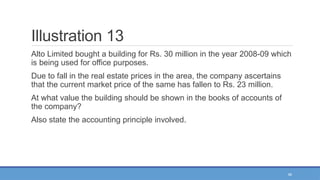

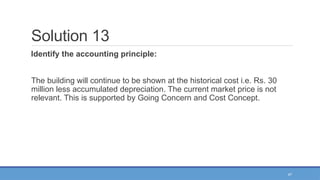

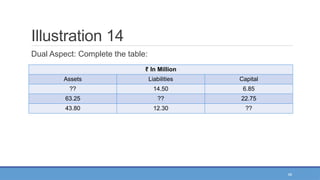

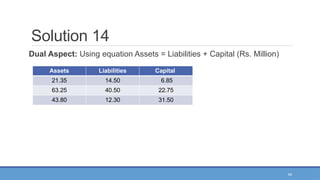

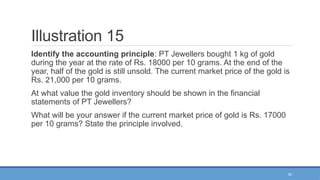

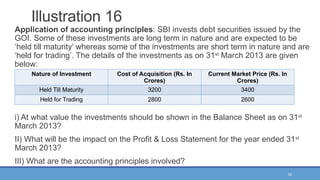

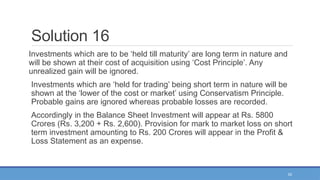

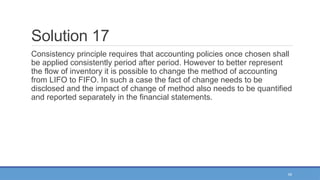

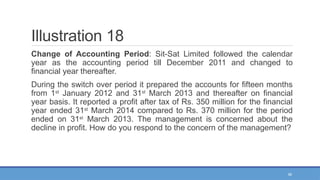

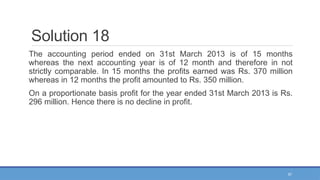

The document provides an overview of financial reporting and accounting standards, highlighting US GAAP principles, international accounting standards, and Indian accounting standards (Ind AS) applicable to various companies. It explains the significance of GAAP in ensuring transparency and comparability in financial reporting and outlines the transition guidelines for Indian companies to adopt Ind AS. The document also includes illustrations and solutions to practical accounting scenarios, emphasizing adherence to established accounting principles.