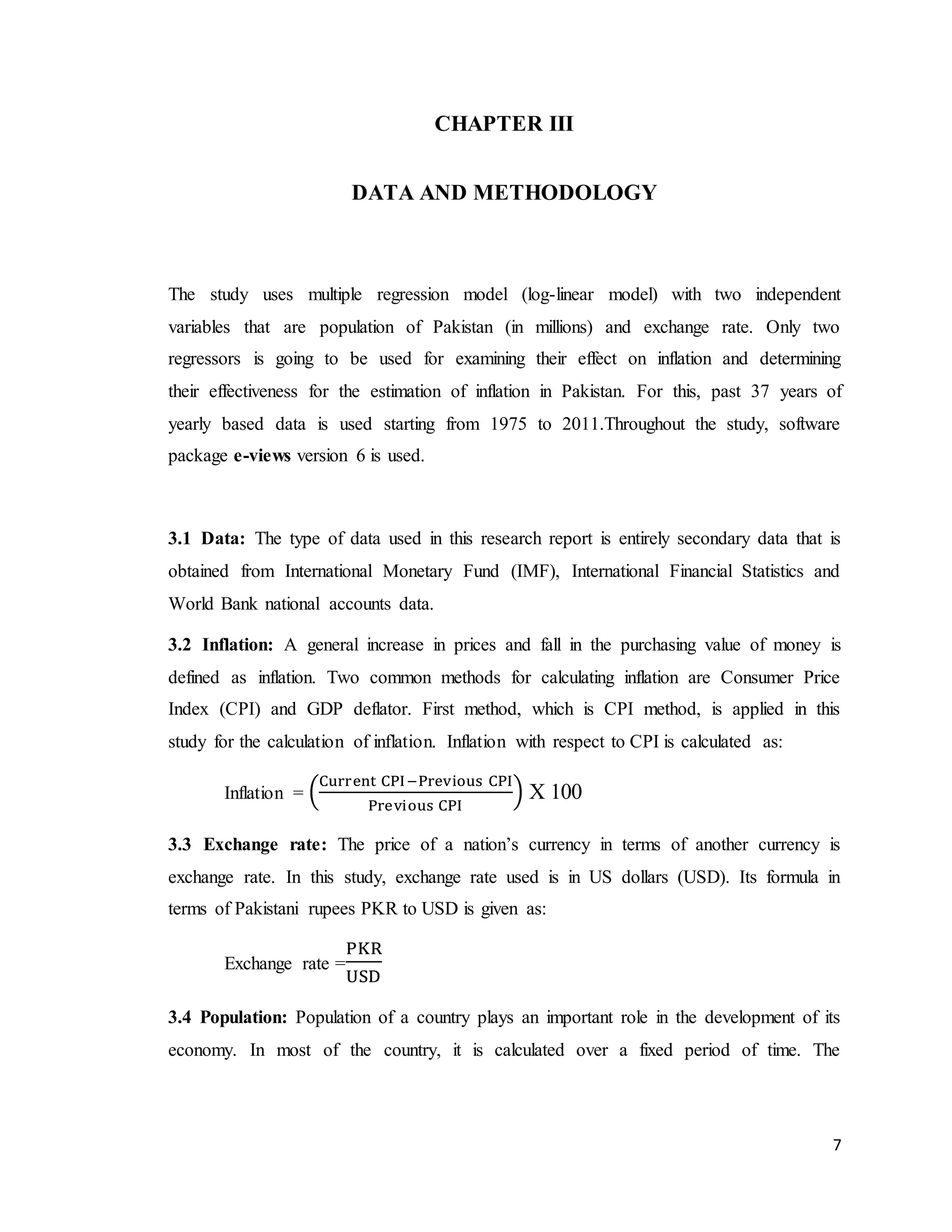

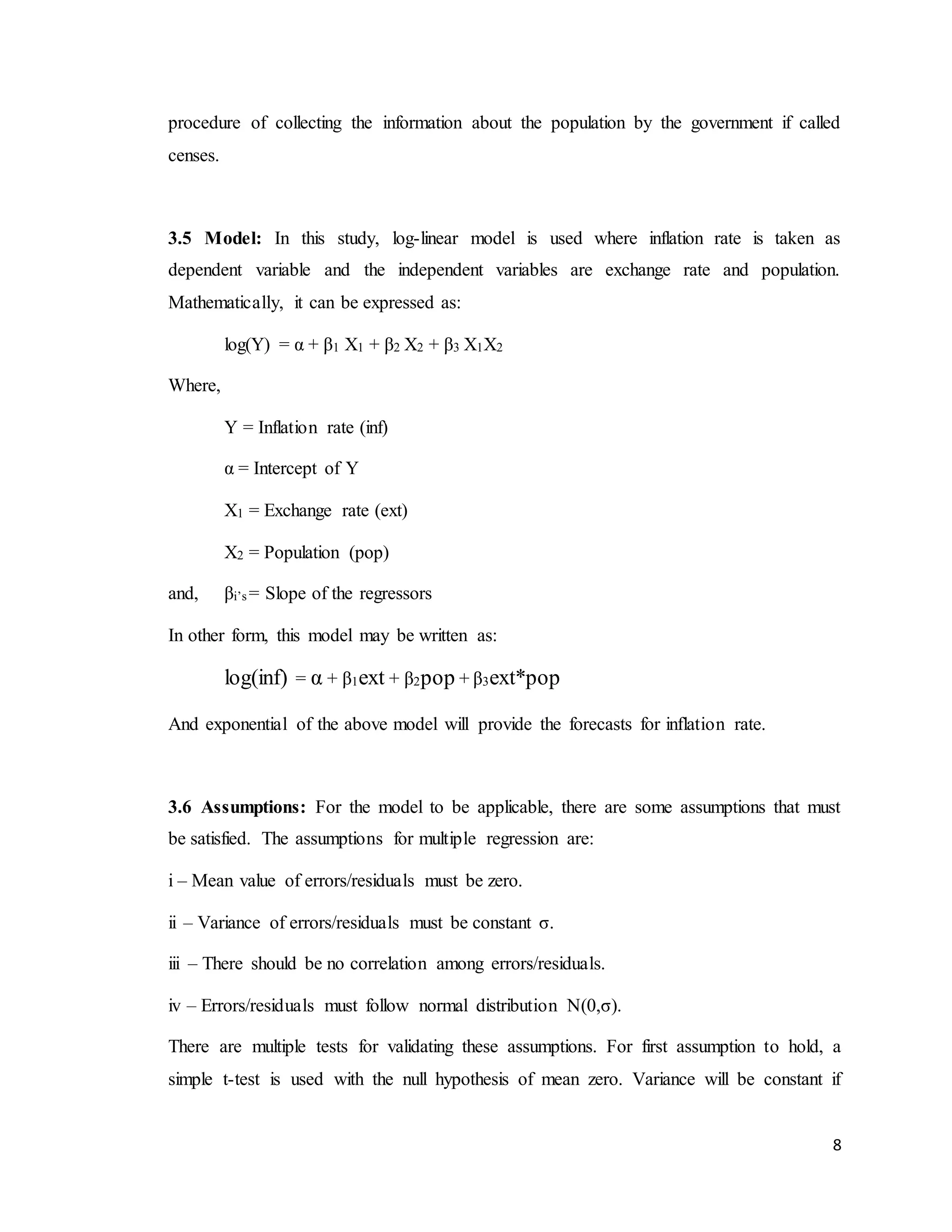

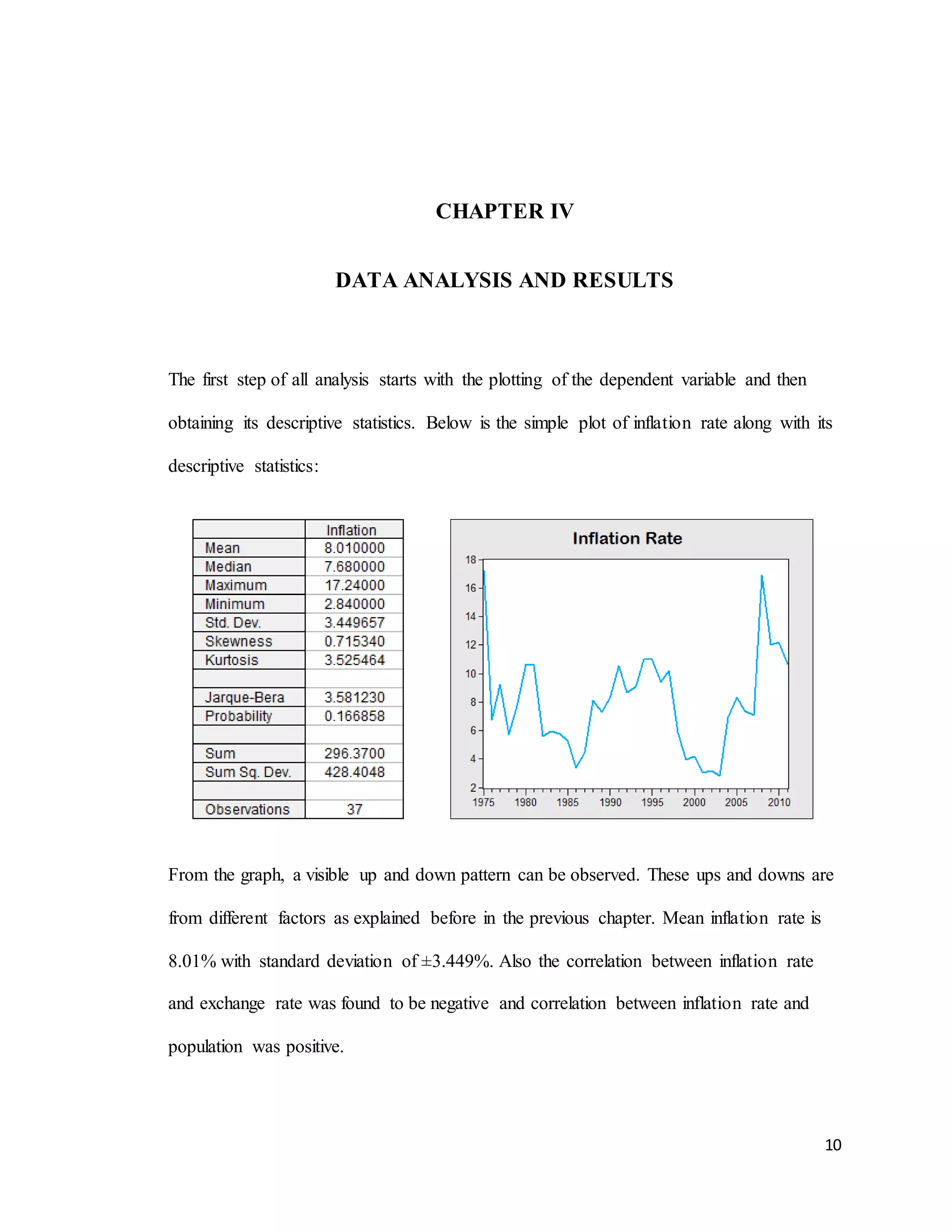

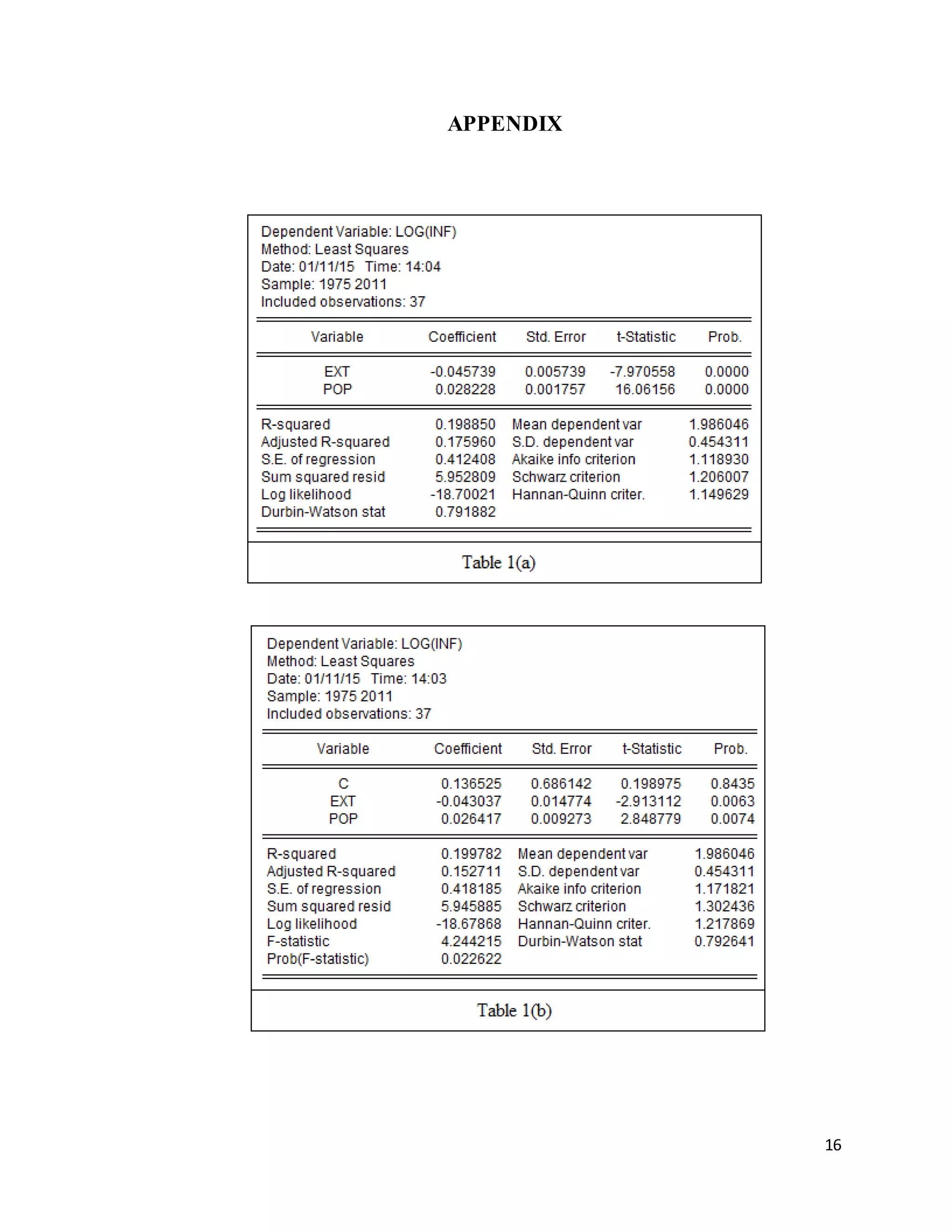

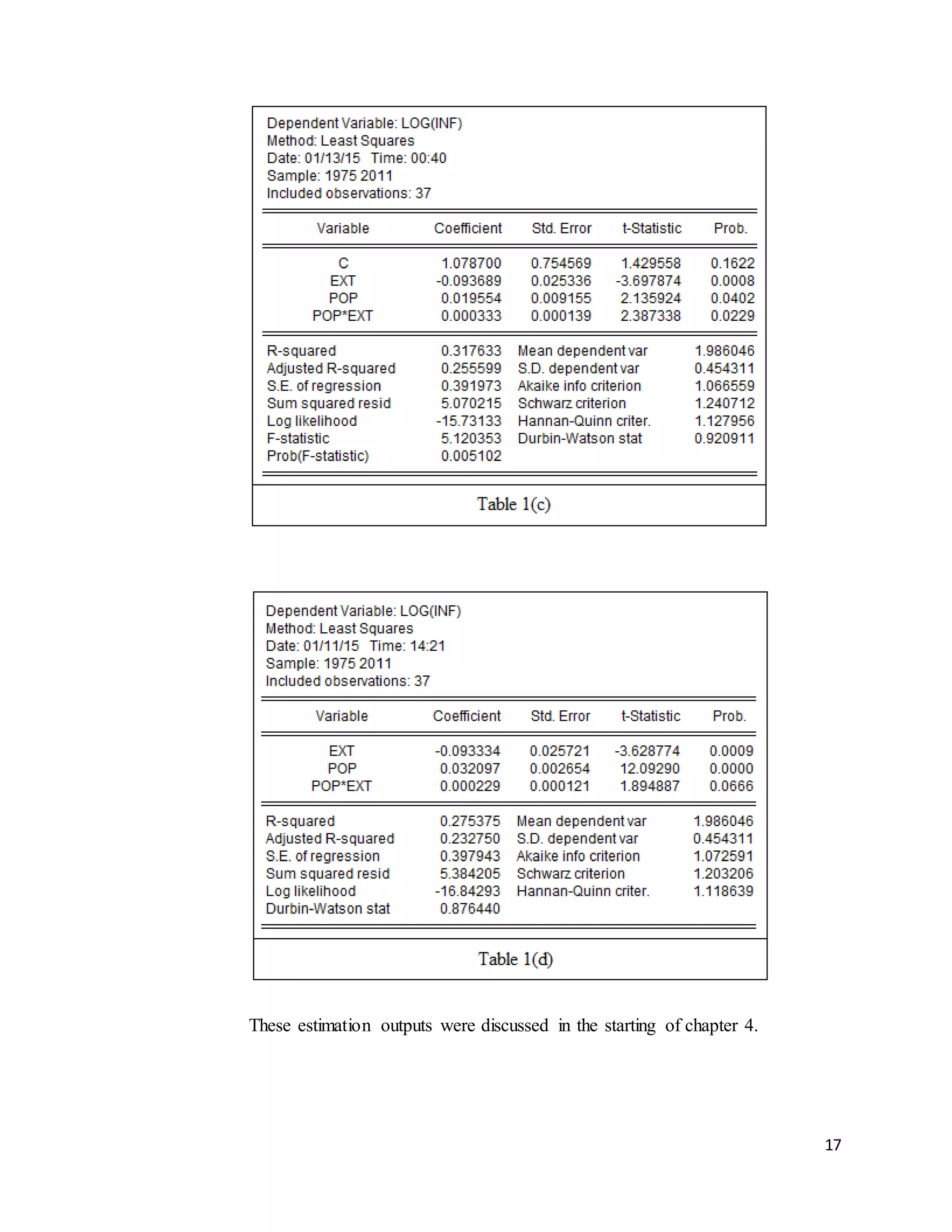

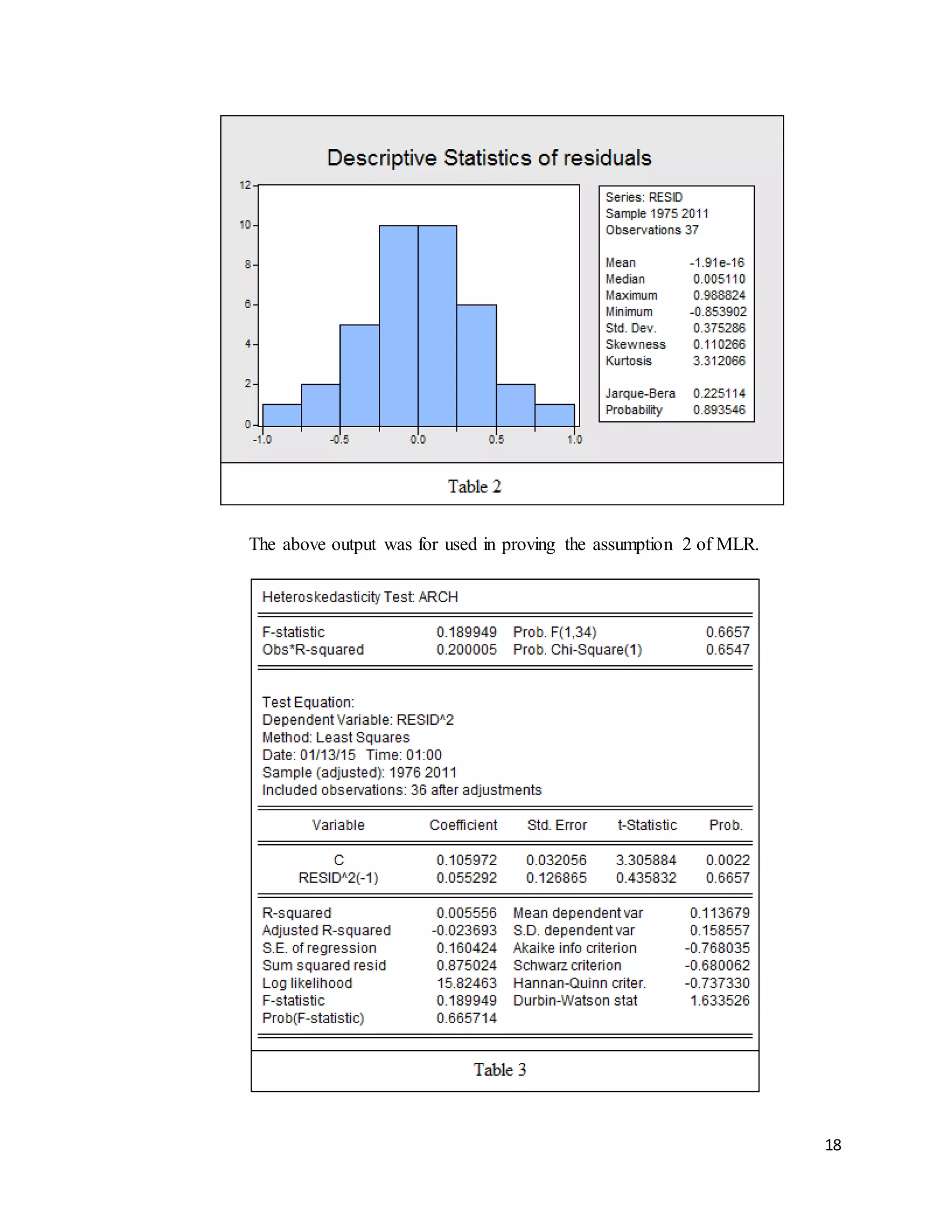

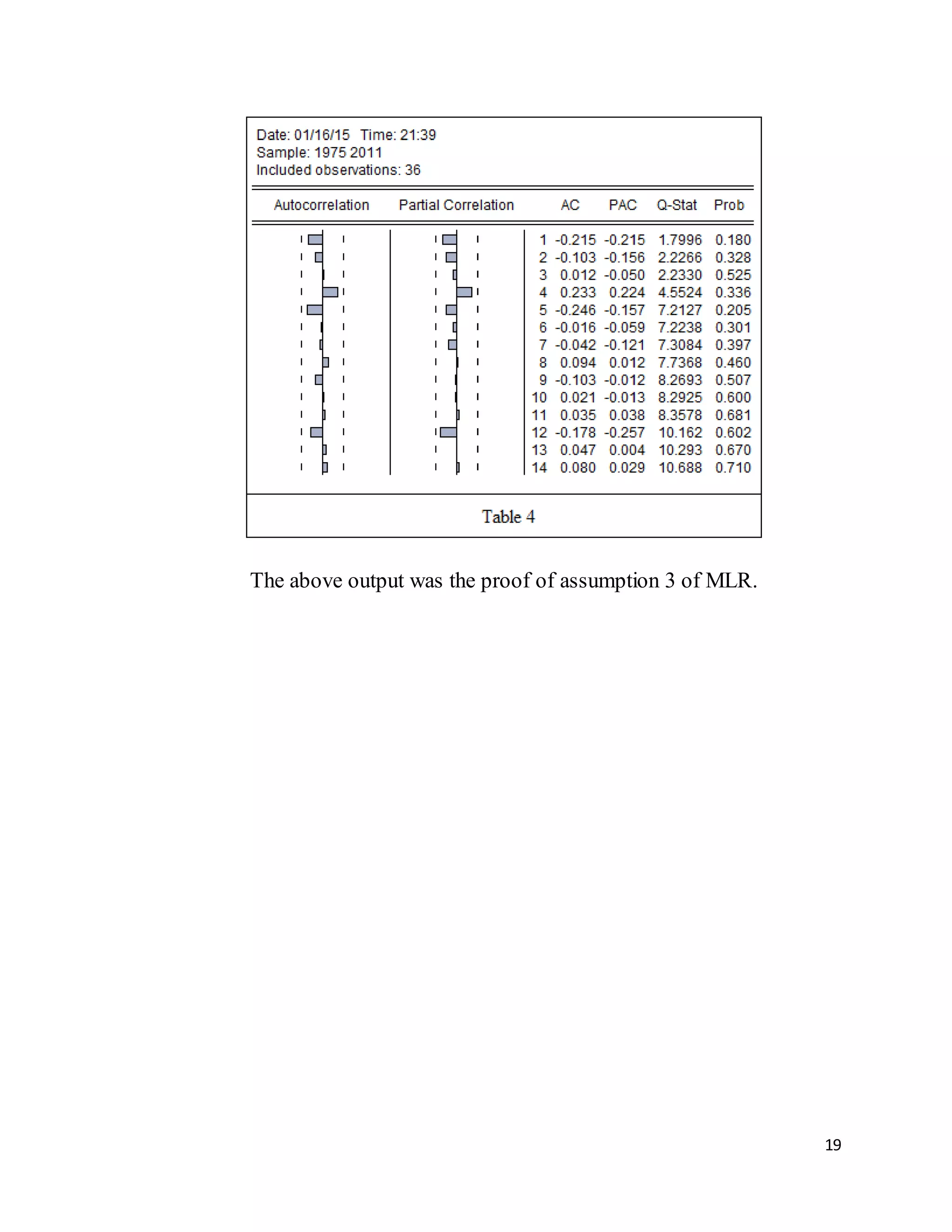

This document analyzes factors affecting inflation in Pakistan from 1975 to 2011. It uses a log-linear model with inflation rate as the dependent variable and exchange rate and population as independent variables. The assumptions of the regression model are validated using statistical tests. Exchange rate is found to have a negative correlation with inflation, while population has a positive correlation. The model is found to be significant for estimating inflation in Pakistan based on the variables of exchange rate and population.