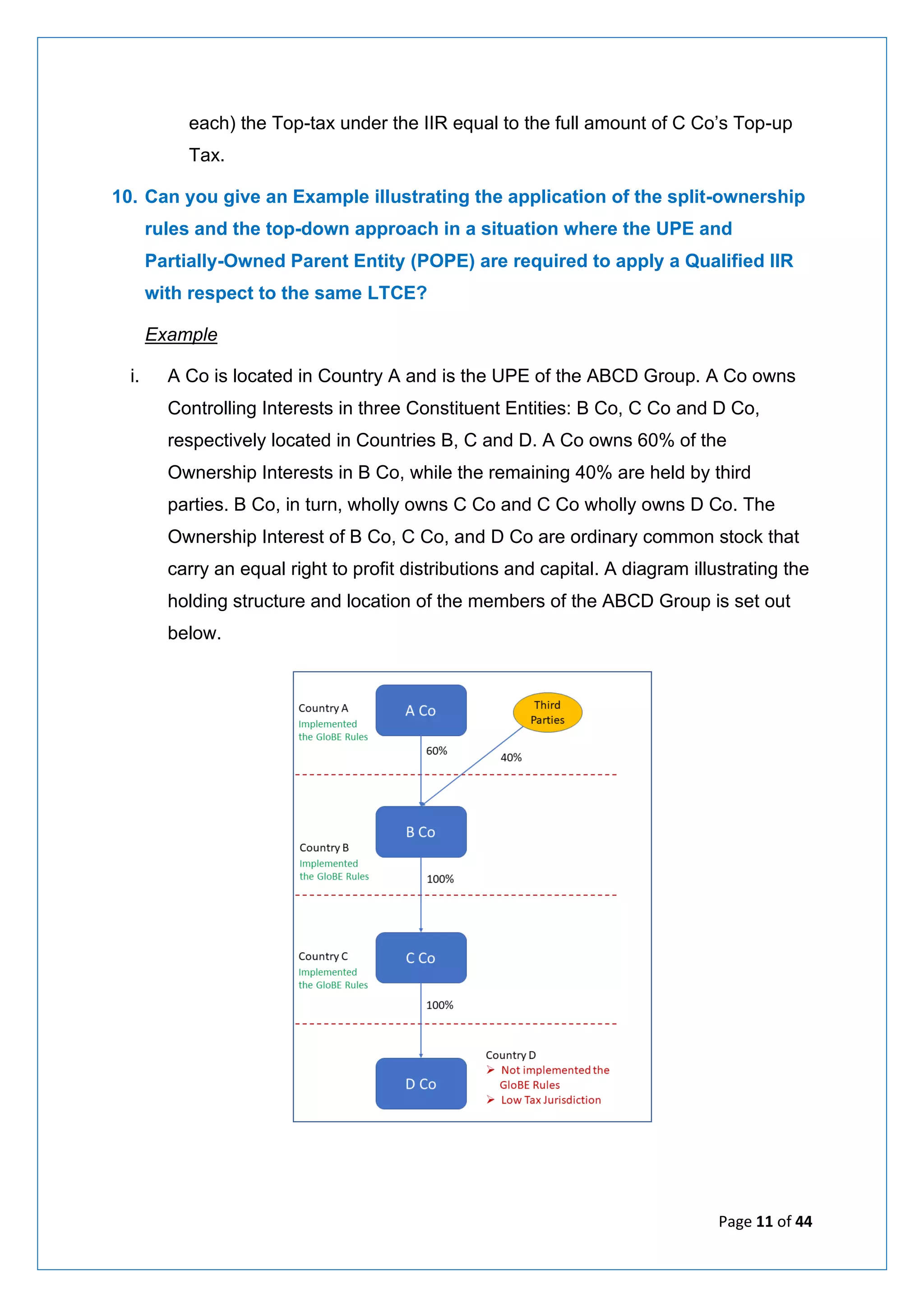

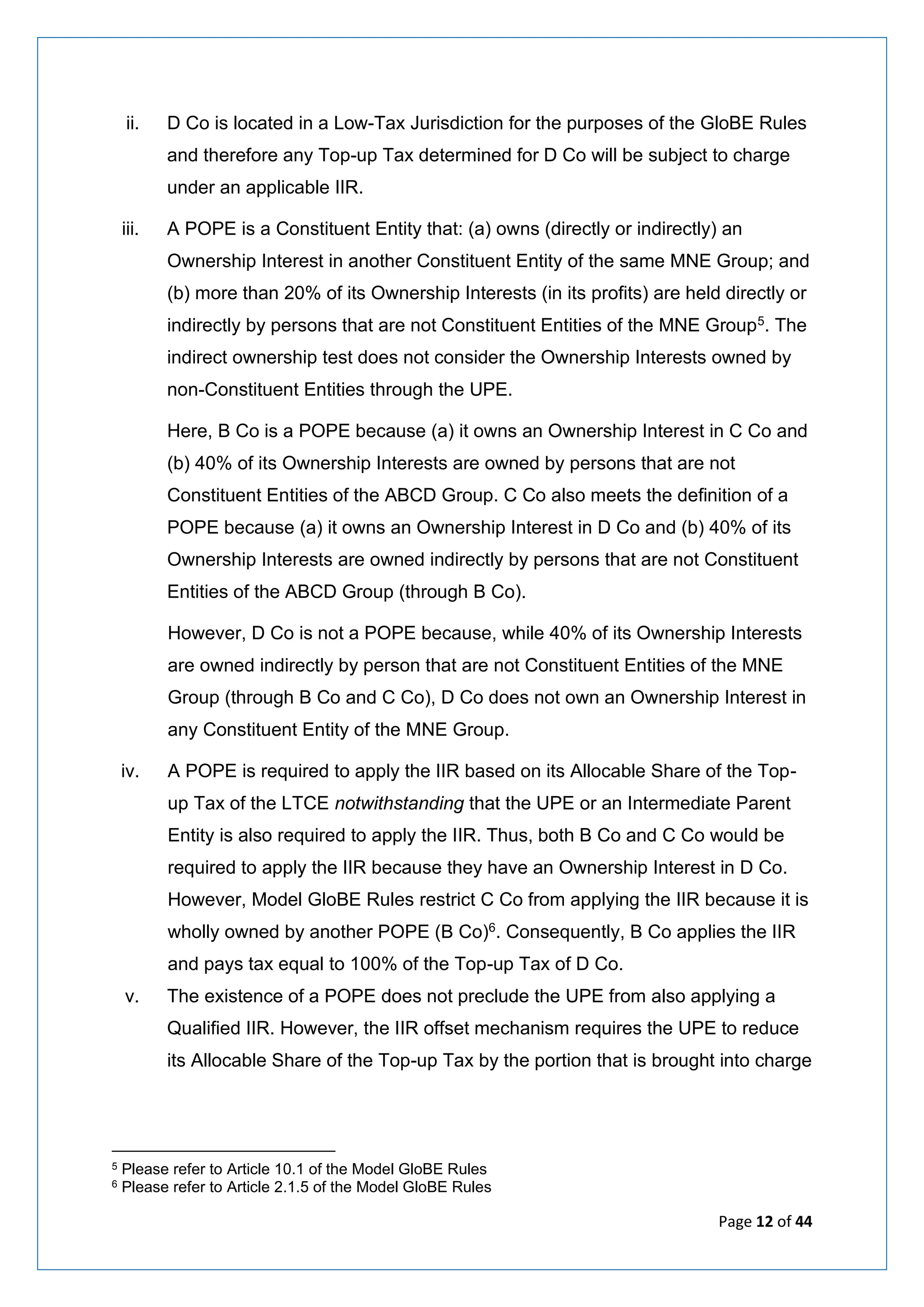

The document outlines the OECD's Pillar 2 model rules designed to ensure that multinational enterprises (MNEs) with revenues above EUR 750 million pay a minimum tax rate of 15% on their income in each jurisdiction. It details the structure of the rules, including the Income Inclusion Rule (IIR) and the Under Taxed Payments Rule (UTPR), and discusses their implications for entities' taxation and operations globally. Additionally, it addresses the role of developing countries and potential benefits under these rules.

![Page 3 of 44

OECD Pillar 2: Answers to Some Basic Questions

[October 2022]

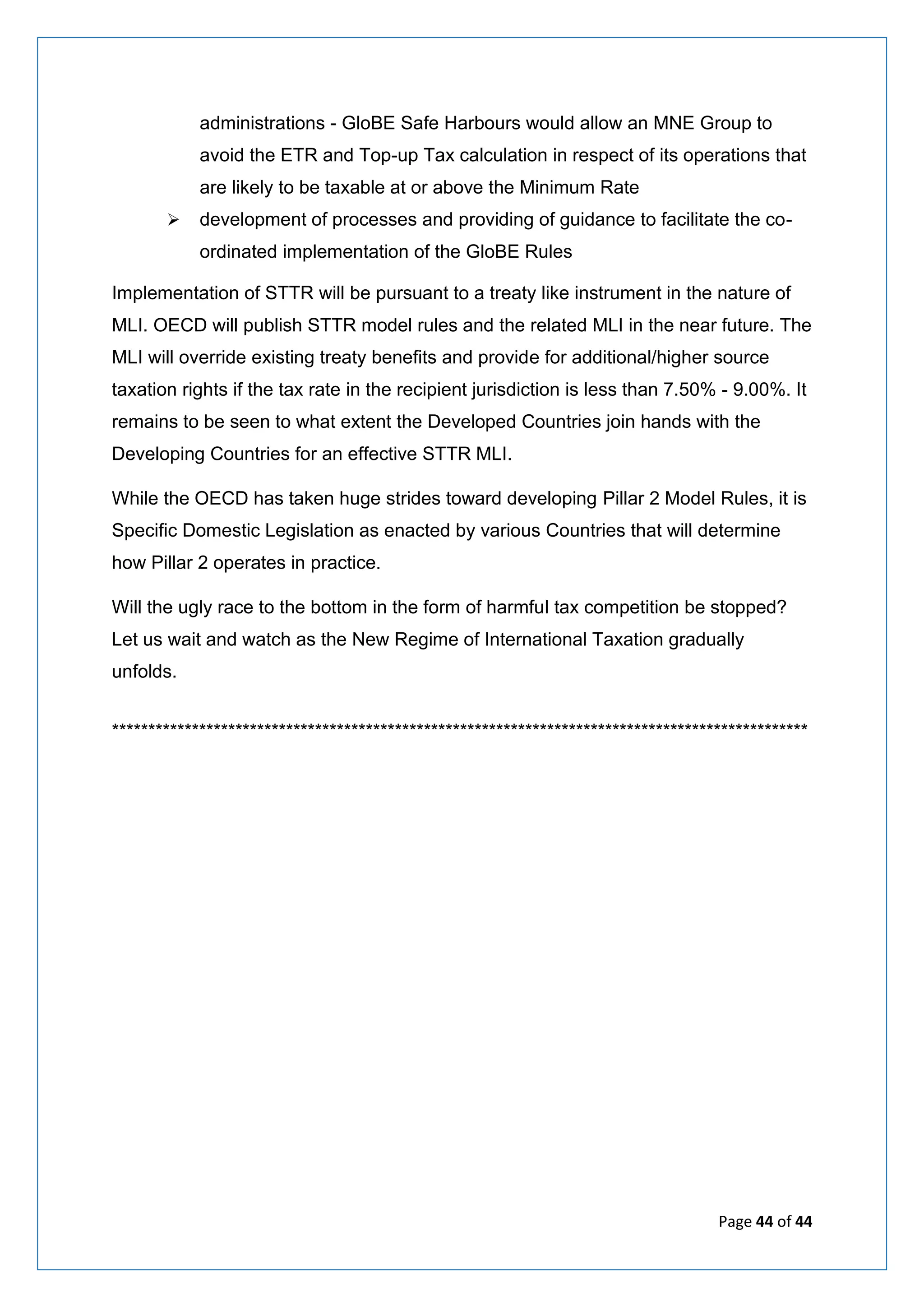

On 20 December 2021, the Organisation for Economic Co-operation and

Development (OECD) released the Pillar 2 Model Rules as approved by the

OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (BEPS). The

Model Rules define the scope and key mechanics for the Pillar 2 system of global

minimum tax rules, which includes the Income Inclusion Rule (IIR) and the Under

Taxed Payments Rule (UTPR), referred to collectively as the “Global Anti Base

Erosion (GloBE) Rules.”

Subsequently on 14/03/2022 the OECD/G20 Inclusive Framework on BEPS

released a Commentary which elaborates on the application and operation of the

GloBE Rules agreed and released earlier on 20 December 2021. The GloBE

Rules provide a co-ordinated system to ensure that Multinational Enterprises (MNEs)

with revenues above EUR 750 million pay at least a minimum level of tax (15%) on

the income arising in each of the jurisdictions in which they operate.

The release of the Commentary to the GloBE Rules now provides MNEs and Tax

Administrations with detailed and comprehensive technical guidance on the

operation and intended outcomes under the rules and clarifies the meaning of certain

terms. It also illustrates the application of the rules to various fact patterns. The

Commentary is intended to promote a consistent and common interpretation of the

GloBE Rules that will facilitate co-ordinated outcomes for both Tax Administrations

and MNE Groups.

The OECD/G20 Inclusive Framework on BEPS will now develop an Implementation

Framework to support tax authorities in the implementation and administration of the

GloBE Rules.

Certain basic concepts of the GloBE Rules are presented in this write-up in the form

of Questions and Answers.](https://image.slidesharecdn.com/v1answerstosomebasicquestionsaboutpillar2-230113051710-595d9394/75/FAQs-on-OECD-Pillar-2-4-2048.jpg)

![Page 6 of 44

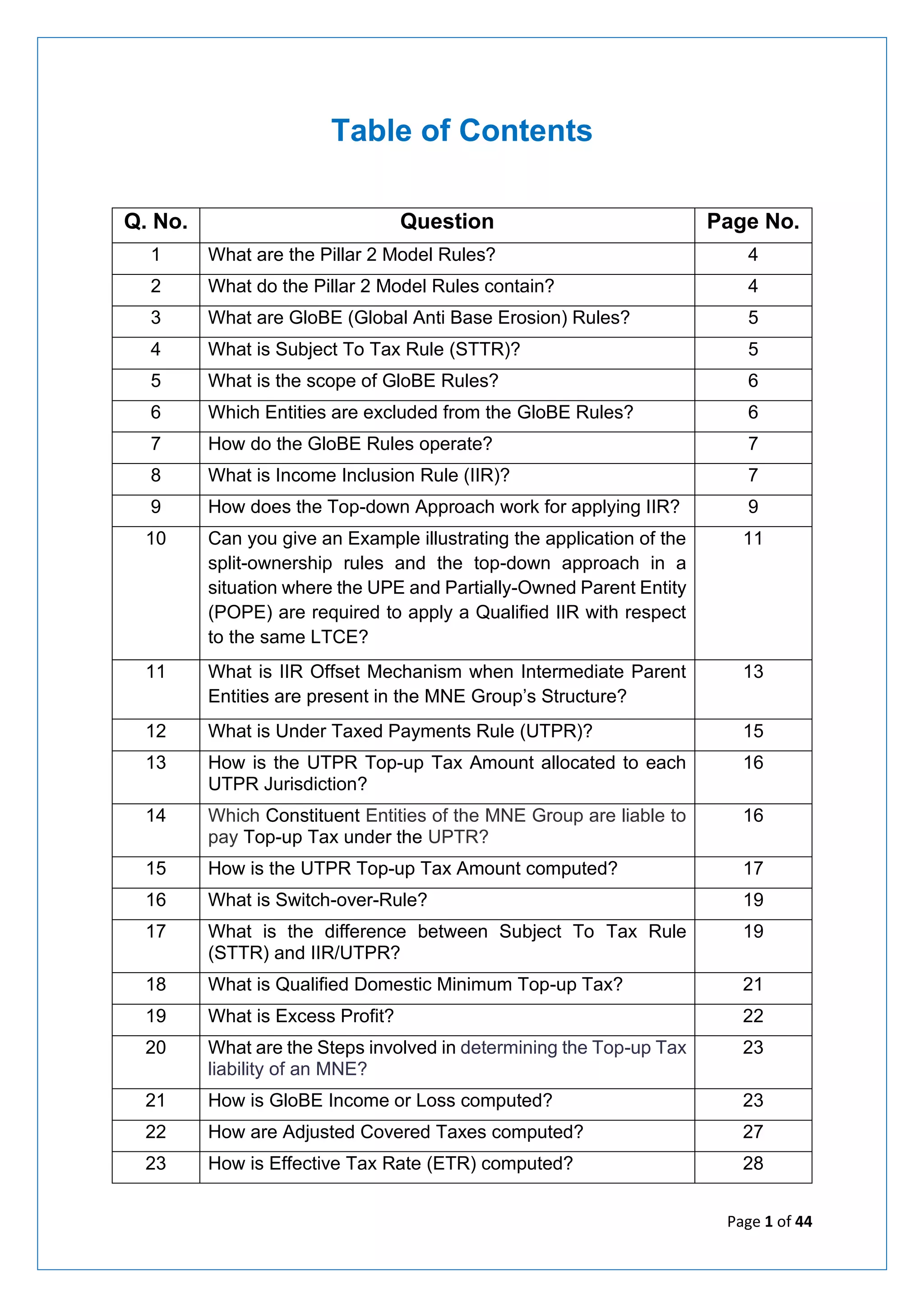

The STTR entails revision of Tax Treaties and may be implemented by way of a

Multi-Lateral Instrument.

Where the STTR applies, treaty relief that would otherwise have been provided

may be denied, with the maximum applicable withholding tax expected to be

7.5% to 9.00%. The STTR will apply before the GloBE Rules [consisting of

Income Inclusion Rule (IIR) and Under Taxed Payments Rule (UTPR) discussed

below]. Any tax collected under the STTR will be factored into the Global

Minimum Tax calculations for the purposes of the IIR and UTPR.

Currently, the Pillar 2 Model Rules do not provide guidance on the STTR.

Instead, the STTR has been left for future guidance.

5. What is the scope of GloBE Rules?

The GloBE Rules [consisting of Income Inclusion Rule (IIR) and Under Taxed

Payments Rule (UTPR) discussed below] apply to Constituent Entities that are

members of an MNE Group that has consolidated annual revenue of EUR 750

million or more in the Consolidated Financial Statements of the Ultimate Parent

Entity (UPE) in at least two of the four Fiscal Years immediately preceding the

tested Fiscal Year3. In certain cases, the application of the consolidated revenue

threshold is modified. If one or more of the Fiscal Years of the MNE Group is of a

period other than 12 months, for each of those Fiscal Years the EUR 750 million

threshold is adjusted proportionally to correspond with the length of the relevant

Fiscal Year. Entities that are Excluded Entities are not subject to the GloBE

Rules.

6. Which Entities are excluded from the GloBE Rules?

MNE Groups that either have no foreign presence or that have less than EUR

750 million in consolidated revenues are not in scope of the GloBE Rules -

Group Entities of such MNE Groups are Excluded Entities.

In addition, the GloBE Rules do not apply to government entities, international

organisations and non-profit organisations (preserving domestic tax exemptions

for sovereign, non-profit and charitable entities), nor do they apply to entities that

3 Please refer to Article 1.1 of the Model GloBE Rules](https://image.slidesharecdn.com/v1answerstosomebasicquestionsaboutpillar2-230113051710-595d9394/75/FAQs-on-OECD-Pillar-2-7-2048.jpg)