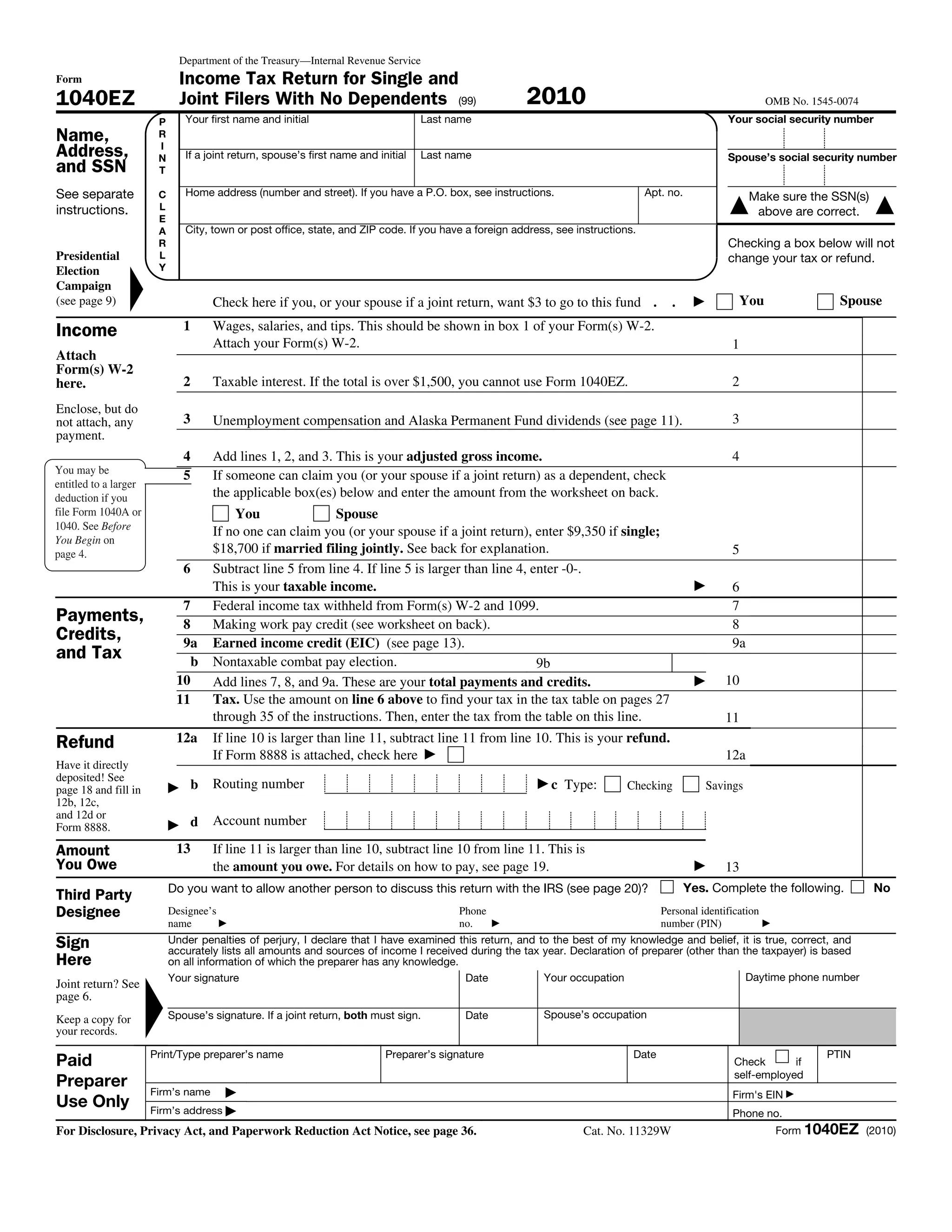

This document is an IRS Form 1040EZ for the 2010 tax year. It is for filing a basic federal income tax return for single or married taxpayers with no dependents who had only wage/salary income, interest under $1,500, and unemployment compensation. The form provides lines to report wages, taxable interest, unemployment income, deductions, tax credits, tax owed or refund amount. It includes worksheets to calculate the standard deduction and making work pay credit.