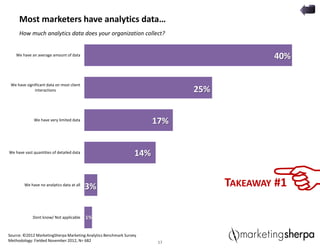

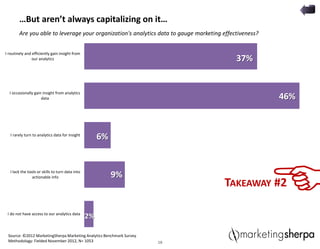

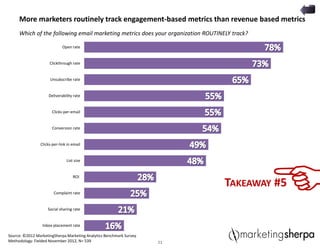

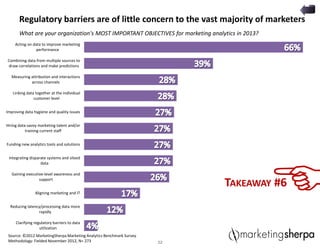

The document discusses how marketers can improve their digital campaigns through analytics. It argues that most marketers focus on reporting metrics rather than using analytics to improve campaigns. To achieve success, marketers must go beyond launch and measurement to continuously reflect on analytics data, react with changes, and repeat the process. Analytics now provide insights into user behavior that can be used to personalize experiences and optimize websites and campaigns for better performance and results over the long run.