Report

Share

Download to read offline

Recommended

Recommended

More Related Content

Viewers also liked

Viewers also liked (6)

Una revaloración íntima del ocio en la juventud posmoderna

Una revaloración íntima del ocio en la juventud posmoderna

Similar to Eveready Industries

Similar to Eveready Industries (20)

Market Research Report : Lead acid battery market in india 2013

Market Research Report : Lead acid battery market in india 2013

Capital structure Analysis of Indian Oil Corporation Limited (IOCL)

Capital structure Analysis of Indian Oil Corporation Limited (IOCL)

1702797 PAPER Study on Customer Perceptions Guru Basava Motors,.pdf

1702797 PAPER Study on Customer Perceptions Guru Basava Motors,.pdf

Eveready Industries

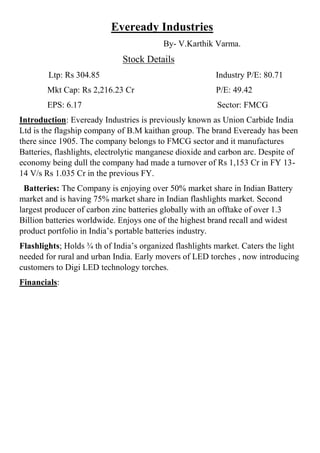

- 1. Eveready Industries By- V.Karthik Varma. Stock Details Ltp: Rs 304.85 Industry P/E: 80.71 Mkt Cap: Rs 2,216.23 Cr P/E: 49.42 EPS: 6.17 Sector: FMCG Introduction: Eveready Industries is previously known as Union Carbide India Ltd is the flagship company of B.M kaithan group. The brand Eveready has been there since 1905. The company belongs to FMCG sector and it manufactures Batteries, flashlights, electrolytic manganese dioxide and carbon arc. Despite of economy being dull the company had made a turnover of Rs 1,153 Cr in FY 13- 14 V/s Rs 1.035 Cr in the previous FY. Batteries: The Company is enjoying over 50% market share in Indian Battery market and is having 75% market share in Indian flashlights market. Second largest producer of carbon zinc batteries globally with an offtake of over 1.3 Billion batteries worldwide. Enjoys one of the highest brand recall and widest product portfolio in India’s portable batteries industry. Flashlights; Holds ¾ th of India’s organized flashlights market. Caters the light needed for rural and urban India. Early movers of LED torches , now introducing customers to Digi LED technology torches. Financials:

- 2. Ratios: Ratio FY 13-14 FY 12-13 FY 11-12 Current Ratio 0.68 0.61 56 Quick Ratio 0.32 0.36 0.32 Operating Profit Margin 7.85 6.31 5.15 Gross Profit Margin 4.22 2.92 2.68 Interest Coverage Ratio 1.40 0.98 0.90 Total Asset Turnover Ratios 4.09 3.64 3.47

- 3. Decrease in the debt level is due to the increase in the retention level. If we can look into the balance sheets the company’s reserves and surplus is increasing over the period , more over company’s ability to pay its obligations is a good sign. Company’s increase in the investments in it current assets is another good sign about the company. Recommendation: As the company is having a good market share in the Country’s battery and flashlights market, moreover company’s well known brand is the added advantage for the increase in the sales. As the company’s investment in the current assets show that company is having a well managed working capital, which in turn meeting its obligations. As the current human life is electronic bounded there is a great demand for the batteries in the remotes and other electronic gadgets. There are many places in India are still in dark where there is a great need of flashlights and I feel this demand will be inelastic. Since the company’s growing this could be a multibagger. The company has recently reached its 52 week high of Rs 309.70. I will give a buy call and hold it for long term.