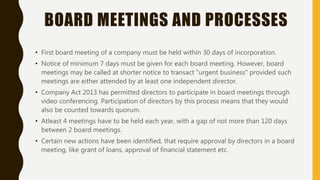

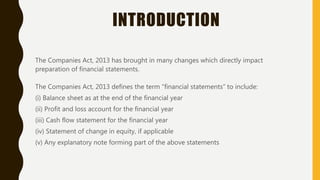

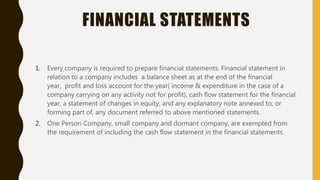

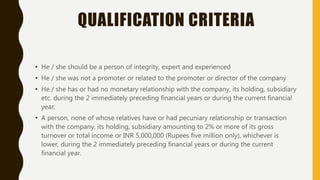

The Companies Act of 2013 aims to enhance corporate governance by implementing stricter disclosure requirements, including a reduction in the threshold for reporting directors' interests, and defining key managerial personnel. It mandates the appointment of independent directors and at least one woman director for certain companies, along with new provisions for board and general meetings. The Act also outlines financial statement preparations and establishes regulations for holding, subsidiary, and associate companies.

![PLACE OF KEEPING REGISTERS AND

RETURNS

The 2013 Act allows registers of members, debenture-holders or any other security

holders or copies of return, to be kept at any other place in India in which more than

one-tenth of members reside [section 94(1) of 2013 Act].](https://image.slidesharecdn.com/ethicsassignment-171130050727/85/Ethics-and-Corporate-Governance-4-320.jpg)

![ANNUAL RETURN UNDER COMPANIES

ACT 2013

The 2013 Act states that requirement of certification by a company secretary in practice

of annual return will be extended to companies having paid up capital of 5 crore INR or

more and turnover of 25 crore INR or more(section 92(2) of 2013 Act and the 1956 Act

requires certification only for listed companies).

The information that needs to be included in the annual return has been increased. The

additional information required, includes particulars of holding, subsidiary and associate

companies, remuneration of directors and key managerial personnel, penalty or

punishment imposed on the company, its directors or officers [section 92(1) of 2013

Act].](https://image.slidesharecdn.com/ethicsassignment-171130050727/85/Ethics-and-Corporate-Governance-5-320.jpg)

![GENERAL MEETINGS

The 2013 Act states that the first Annual General Meeting(AGM) should be held within

nine months from the date of closing of the first financial year of the company

[section 96(1) of 2013 Act]. The 2013 Act states that Annual

General Meeting(AGM) cannot be held on a National holiday.

The 2013 Act states that in case of a public company, the quorum will depend on the

number of members as on the date of meeting. The required quorum is as follows:

• Five members, if number of members is not more than one thousand.

• Fifteen members, if number of members is more than one thousand but up to five

thousand.

• Thirty members, if number of members is more than five thousand [section 103 (1)

of 2013 Act].](https://image.slidesharecdn.com/ethicsassignment-171130050727/85/Ethics-and-Corporate-Governance-10-320.jpg)