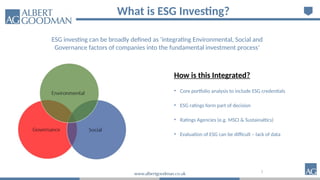

The document provides an overview of ESG (Environmental, Social, Governance) investing, highlighting its importance in addressing global sustainability challenges and its integration into investment strategies. It discusses various types of ESG portfolios, including thematic and systematic investment approaches, and the anticipated benefits of focusing on companies with strong ESG credentials. The document also clarifies that it is educational and does not constitute financial advice.