The daily equity report from Capitalstars Financial Research highlights declines in Indian market indices, with the Sensex and Nifty 50 falling due to investor caution ahead of the Reserve Bank of India's policy statement. Notable market movers included top gainers like Tata Steel and Hindustan Petroleum, while Bharti Airtel and Coal India were significant losers. Additionally, Asian markets ended positively, but U.S. markets experienced declines amidst differing sector performances.

![CAPITALSTARS FINANCIAL RESEARCH PVT. LTD.

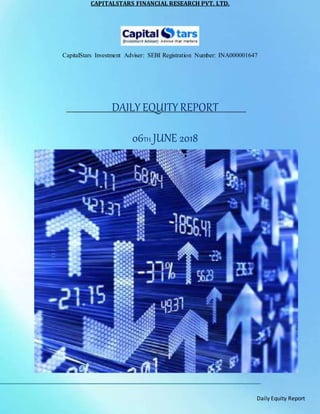

MARKE T MOVERS UPSIDE NIFTY SPOT

CHANGE

SCRIPT CLOSE

TREND STRATEGY

(%)

BEARISH SELL ON RISE

LKVILASBNK 111.05 4.91

PIVOT POINTS

CIPLA 542.10 4.11 S3 S2 S1 P R1 R2 R3

INTELLECT 183.35 3.88

10441 10519 10564 10597 10643 10675 10753

SUPPORT RESISTANCE

SHANKARA 1559.90 3.76 NIFTY S1-10540 R1-10700

S2-10420 R2-10760

MARKE T MOVERS DOWNS IDE

SCRIPT CLOSE

CHANGE

(%)

DBREALTY 40.20 [13.17]

HDIL 21.60 [11.11]

SONATASOF 316.15 [10.32]

IDEA 56.55 [10.10]

FII & DII ACTIVITY

INSTITUTION NET BUY NET

(CR.) SELL (CR)

FII 8939.86 6585.83

DII 3071.28 3783.69 BANK NIFTY FUTURE

TREND STRATEGY

NSE TOTALS BEARISH SELL ON RISE

INDICES ADVANCE DECLINE

PIVOT POINTS

S3 S2 S1 P R1 R2 R3

S S

24813 24971 25060 25130 25218 25288 25446

NIFTY 19 31 SUPPORT RESISTANCE

BANK NIFTY S1-259 00 R1-2651 0

BANK NIFTY 05 07

S2-255 50 R2-2688 0

DailyEquityReport

Investment & trading in securities market is always subjected to market risks, past performance is not a guarantee of

future performance.](https://image.slidesharecdn.com/equityreports07june2018-180607061446/85/Equity-reports-07-june-2018-4-320.jpg)