This document provides an equity analysis of Time Technoplast Ltd. It discusses the company's background, operations, product segments, facilities, financial performance, industry and competitors. Some key points:

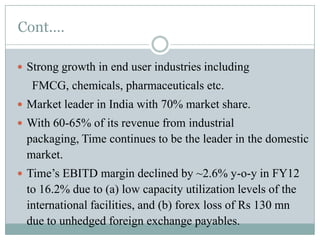

- Time Technoplast is a leading manufacturer of technologically advanced polymer products with 46 facilities across 13 countries.

- It has a diverse product portfolio including industrial packaging, infrastructure products, automotive products, lifestyle and healthcare products.

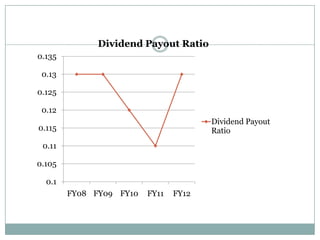

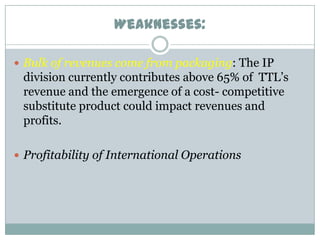

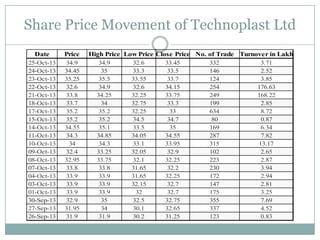

- Financial analysis shows revenues grew 19.92% in FY2012 while profits declined due to lower margins. Ratio analysis tracks company's performance over time.

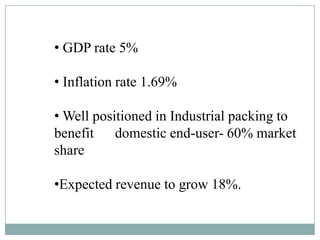

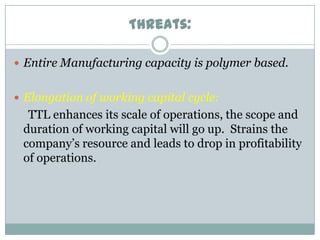

- The plastic industry in India is growing at 15% annually but Time faces challenges from competitors and dependence on polymer-based manufacturing.