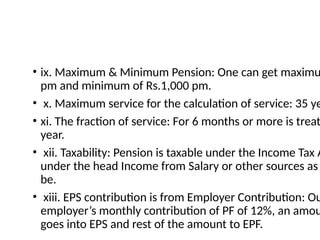

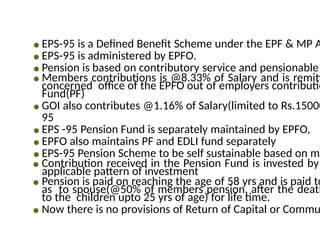

The EPS-95 pension scheme is a defined benefit plan administered by EPFO, based on the member's contributory service and salary. It requires a minimum of 10 years of service for eligibility and offers lifelong pensions, including benefits for spouses and children after the member's death. Contributions are made by both the member and the Government of India, with specific caps for different periods, and pensions are subject to income tax.

![• EPFO manages: This is managed by EPFO of pension a/c

who are contributing to EPF including private trust.

• vi. Capped EPS contribution :

• [8.33%*5,000=Rs. 417 from 16.11.1995 to 07.10.2001]

• [8.33%*6,500=Rs. 541 from 08.10.2001 to 31.08.2014]

• [8.33%*15,000= Rs. 1250 from 01.09.2014 to till date]

• vii. Lifelong pension: Pension is available to the membe

death to the members of the family.

• viii. After 10 years of Service: Eligible for pension only aft

minimum service of 10 years.](https://image.slidesharecdn.com/eps-240807110022-8b25a2c6/85/EPS-pension-details-scheme-schedule-pptx-4-320.jpg)