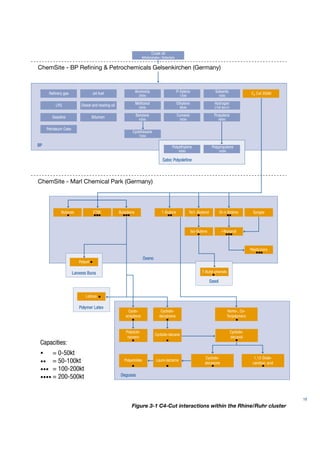

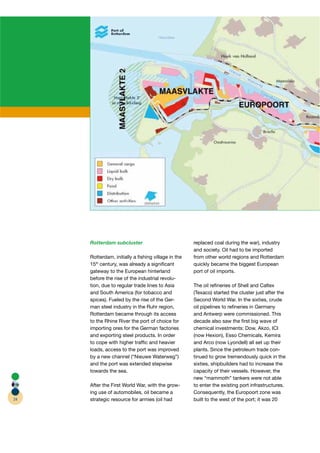

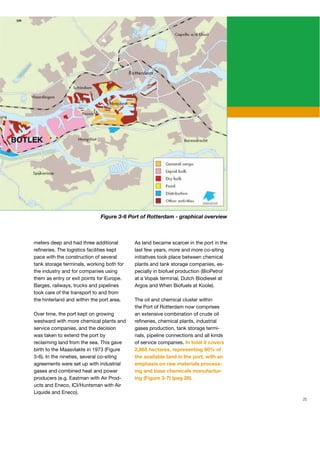

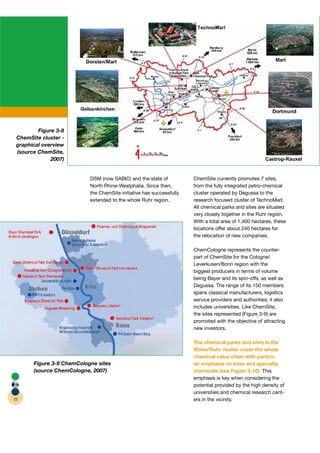

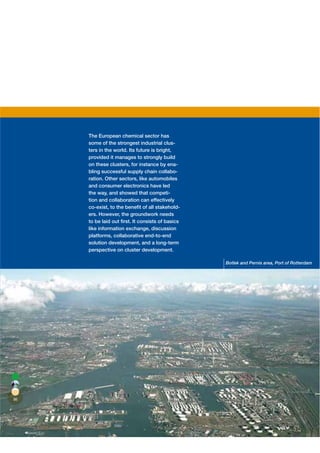

The document discusses a paradigm shift in supply chain collaboration and competition within Europe's chemical clusters, highlighting the importance of cooperative efforts among producers, logistics providers, and authorities to enhance efficiencies and reduce costs. It reports on the results of think tank sessions organized by EPCA, which identified both opportunities and obstacles within clusters, such as Antwerp, Rotterdam, and Tarragona. The report emphasizes the need for better information sharing and the establishment of platforms for collaboration to sustain Europe's competitiveness in the global chemical market.