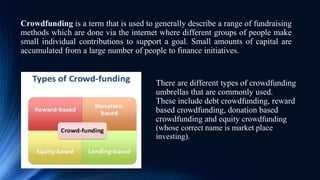

The document discusses the need for Niinue, a Kenyan marketplace investment platform that uses debt-equity crowdfunding. It notes that young Kenyan entrepreneurs struggle to access capital from banks to fund innovations, while middle-class Kenyans' individual investments often fail. Niinue aims to address this by allowing entrepreneurs to raise capital from many small investors, and investors to pool and spread their risks across multiple businesses. The platform facilitates equity crowdfunding through structured debt investments to comply with Kenyan laws.

![Online special purpose vehicles [SPVs] called market place

investment platform [MPI-P] are used to broker-dealer where

entrepreneurs pay a fees for their ventures to be advertised to probable

investors and once investors invest, the [MPI-P] charge a 10%

successful funding fee or if the enterprise deserves technical assistance

then it would charge a 5% successful funding fee and retain 5% of

equity.

The Role of the MPI-P's includes the following:

MPI-P's unite startups and growing companies with investors. The

business ventures pay a fee to have their proposal put up on the

platforms and marketed to all investors on the platform. Investors who

are interested in the venture will then direct interest to the ventures

advertised.](https://image.slidesharecdn.com/entrepreneurinformationpack51-170828020657/85/Entrepreneur-information-pack-5-1-44-320.jpg)