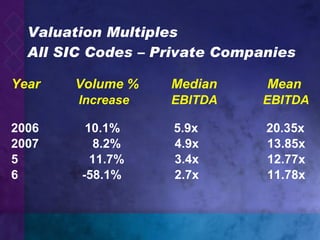

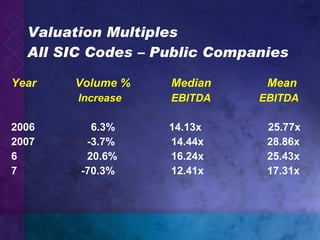

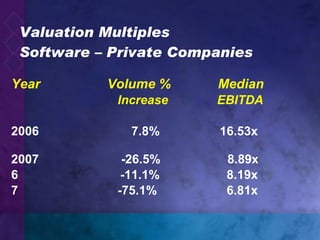

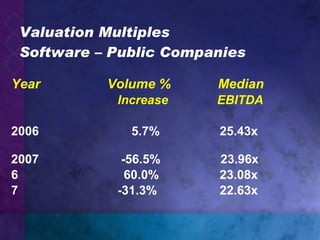

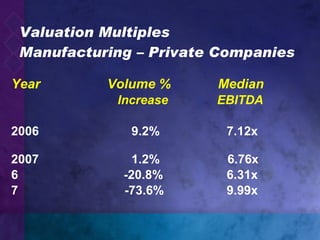

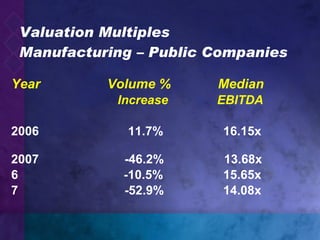

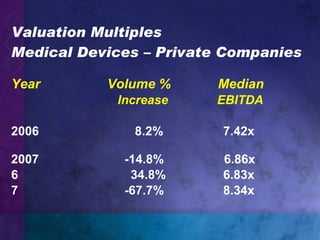

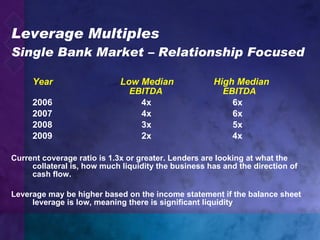

The document discusses trends in valuation multiples across different industries from 2006 to 2009 based on data from private and public company transactions. Valuation multiples, which compare a company's enterprise value to metrics like EBITDA, generally declined across industries during this period. The median debt leverage multiples that banks were willing to provide also decreased from 2006 to the present day, as lenders focused more on collateral, liquidity and cash flow.