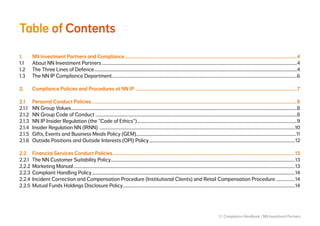

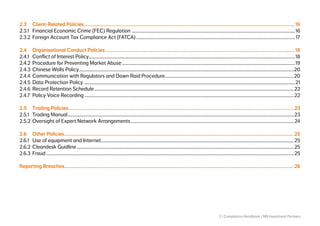

This document provides summaries of the main compliance policies and procedures at NN Investment Partners (NN IP). It outlines NN IP's personal conduct policies such as codes of conduct, insider trading regulations, gifts and entertainment policies, and policies regarding outside interests. It also describes NN IP's financial services conduct policies relating to suitability, marketing, complaints handling, and disclosure. Additionally, it covers client-related policies regarding financial crime and foreign account tax compliance. Finally, it summarizes NN IP's organizational conduct policies including those pertaining to conflicts of interest, market abuse prevention, information barriers, and communications with regulators.