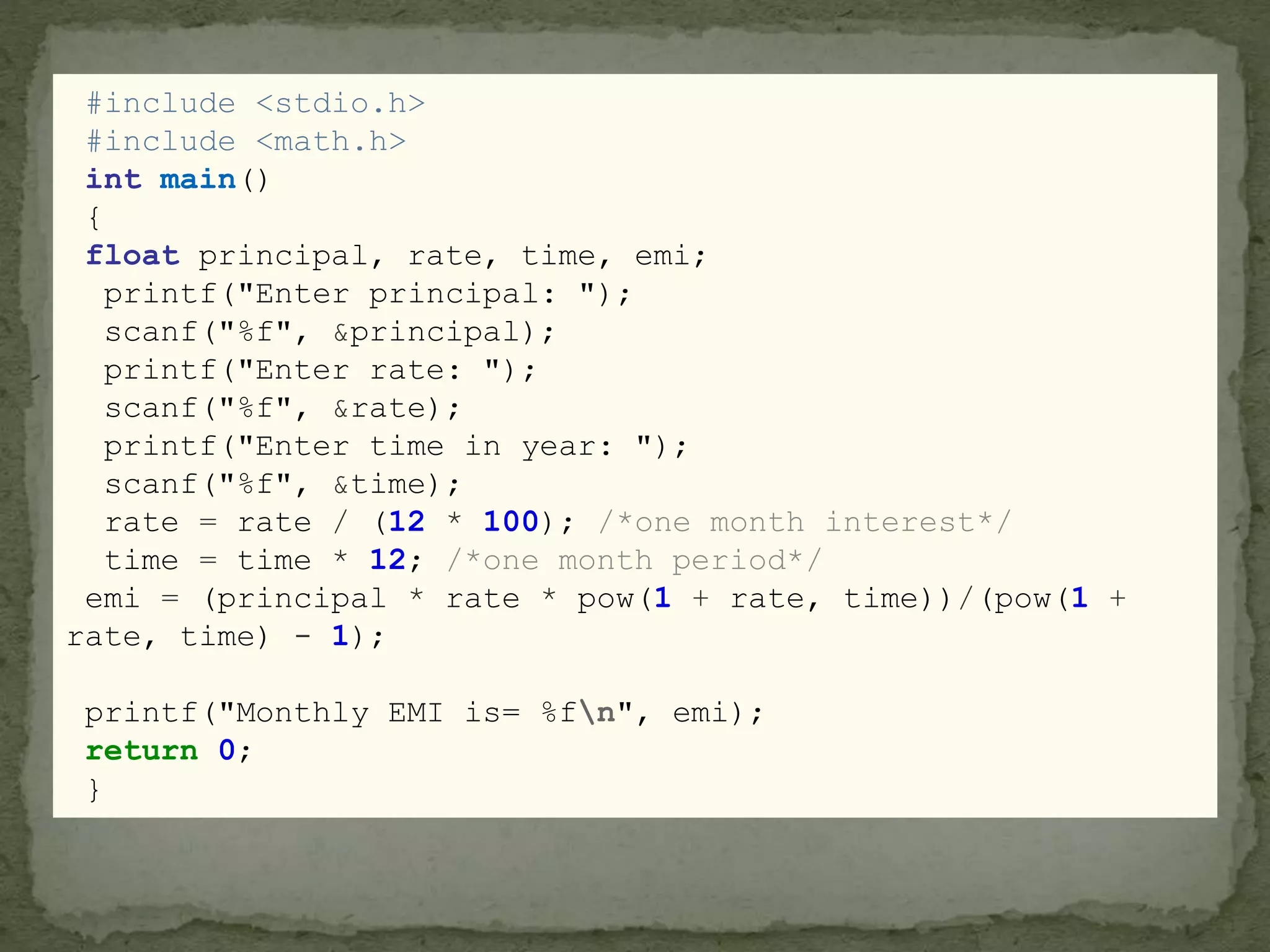

The document discusses creating an Equated Monthly Installment (EMI) calculator using C programming. It explains that an EMI calculator takes in the loan amount, interest rate, and repayment period to calculate the monthly payments. The document then provides code for an EMI calculator in C that takes these inputs from the user to calculate the monthly installment amount. Finally, it outlines some benefits of using an EMI calculator such as comparing loan options and assisting with financial planning and budgeting.