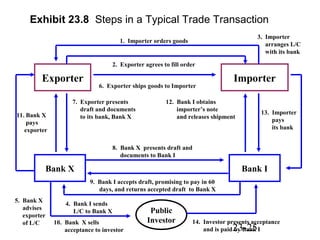

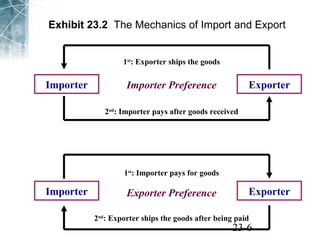

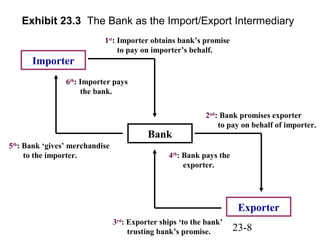

This document discusses international trade finance. It describes how letters of credit, drafts, and bills of lading are used to facilitate international trade transactions while mitigating risks for importers and exporters. Banks play a key intermediary role by providing letters of credit to guarantee payment in exchange for proper documentation. The system allows exporters to receive payment while importers maintain payment terms they prefer.

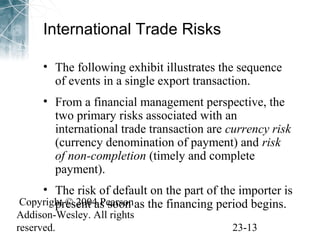

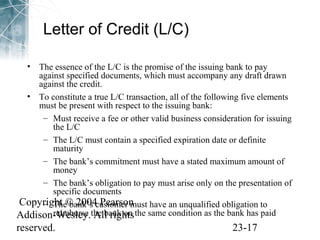

![Exhibit 23.6 Essence of a Letter of Credit (L/C)

Bank of the East, Ltd.

[Name of Issuing Bank]

Date: September 18, 2003

L/C Number 123456

Bank of the East, Ltd. hereby issues this irrevocable documentary Letter of Credit

to Jones Company [name of exporter] for US$500,000, payable 90 days after sight

by a draft drawn against Bank of the East, Ltd., in accordance with Letter of

Credit number 123456.

The draft is to be accompanied by the following documents:

1. Commercial invoice in triplicate

2. Packing list

3. Clean on board order bill of lading

4. Insurance documents, paid for by buyer

At maturity Bank of the East, Ltd. will pay the face amount of the draft to

the

bearer of that draft. Authorized Signature

Copyright © 2004 Pearson

Addison-Wesley. All rights

reserved. 23-19](https://image.slidesharecdn.com/eiteman178912ppt23v1-140826032850-phpapp01/85/Eiteman-178912-ppt23_v1-19-320.jpg)

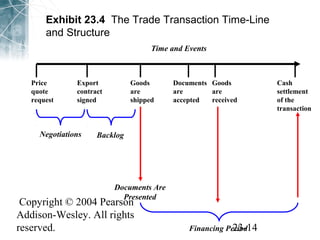

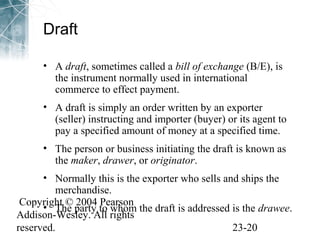

![Exhibit 23.7 Essence of a Time Draft

Name of Exporter

Date: October 10, 2003

Draft number 7890

Ninety (90) days after sight of this First of Exchange, pay to the order of Bank

of the West [name of exporter’s bank] the sum of Five-hundred thousand U.S.

dollars for value received under Bank of the East, Ltd. letter of credit

number 123456.

Signature of Exporter

Copyright © 2004 Pearson

Addison-Wesley. All rights

reserved. 23-22](https://image.slidesharecdn.com/eiteman178912ppt23v1-140826032850-phpapp01/85/Eiteman-178912-ppt23_v1-22-320.jpg)