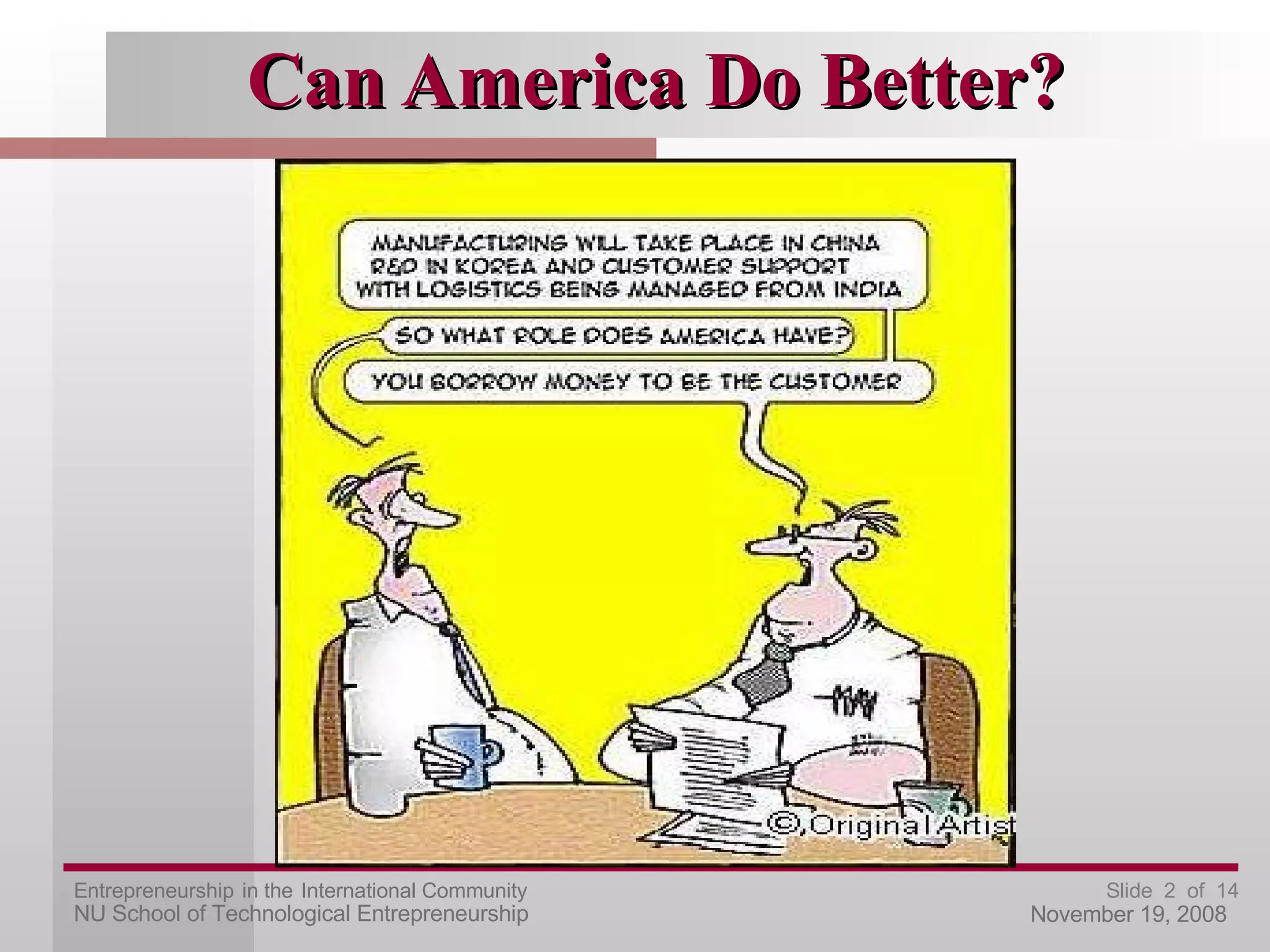

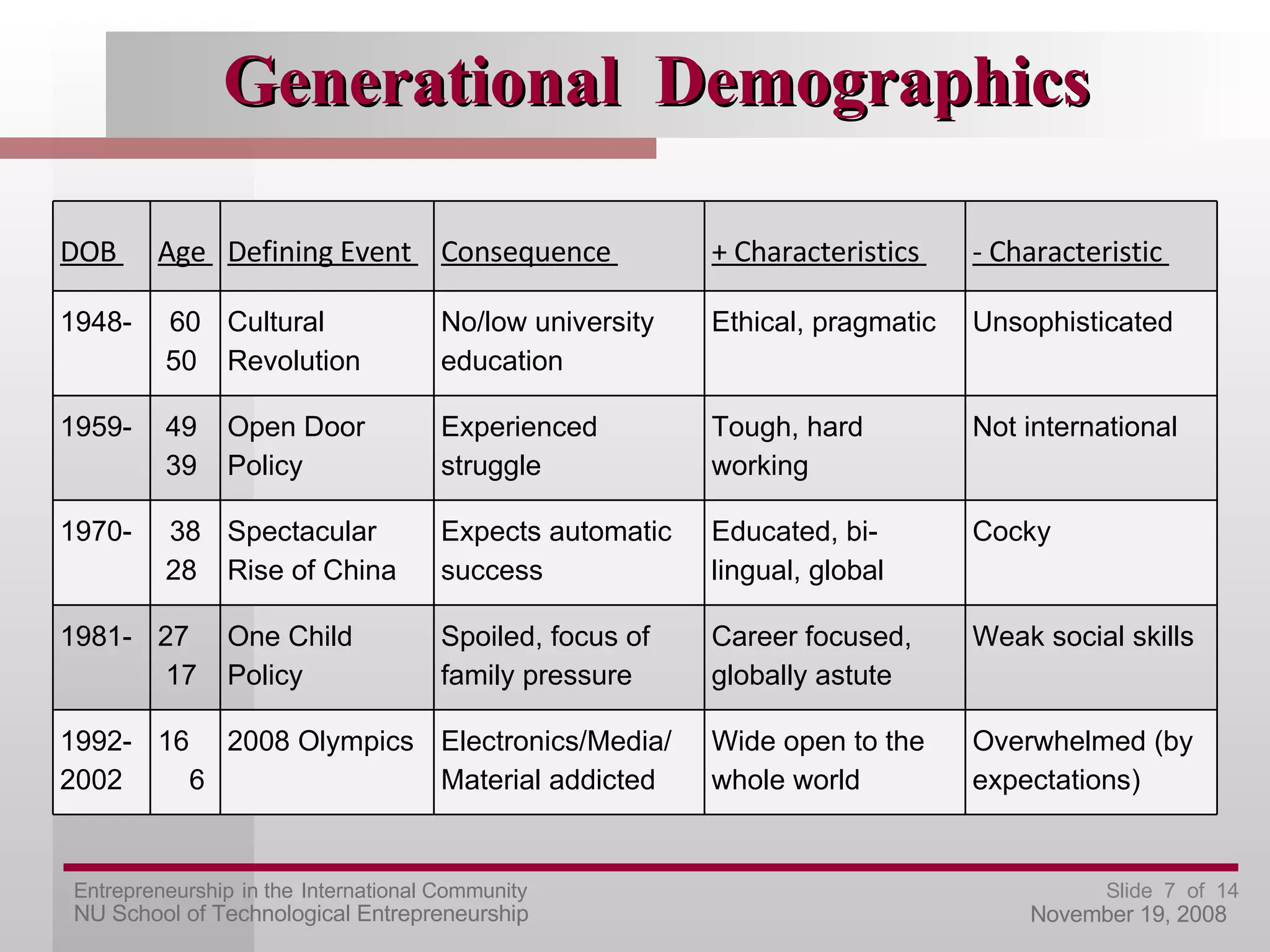

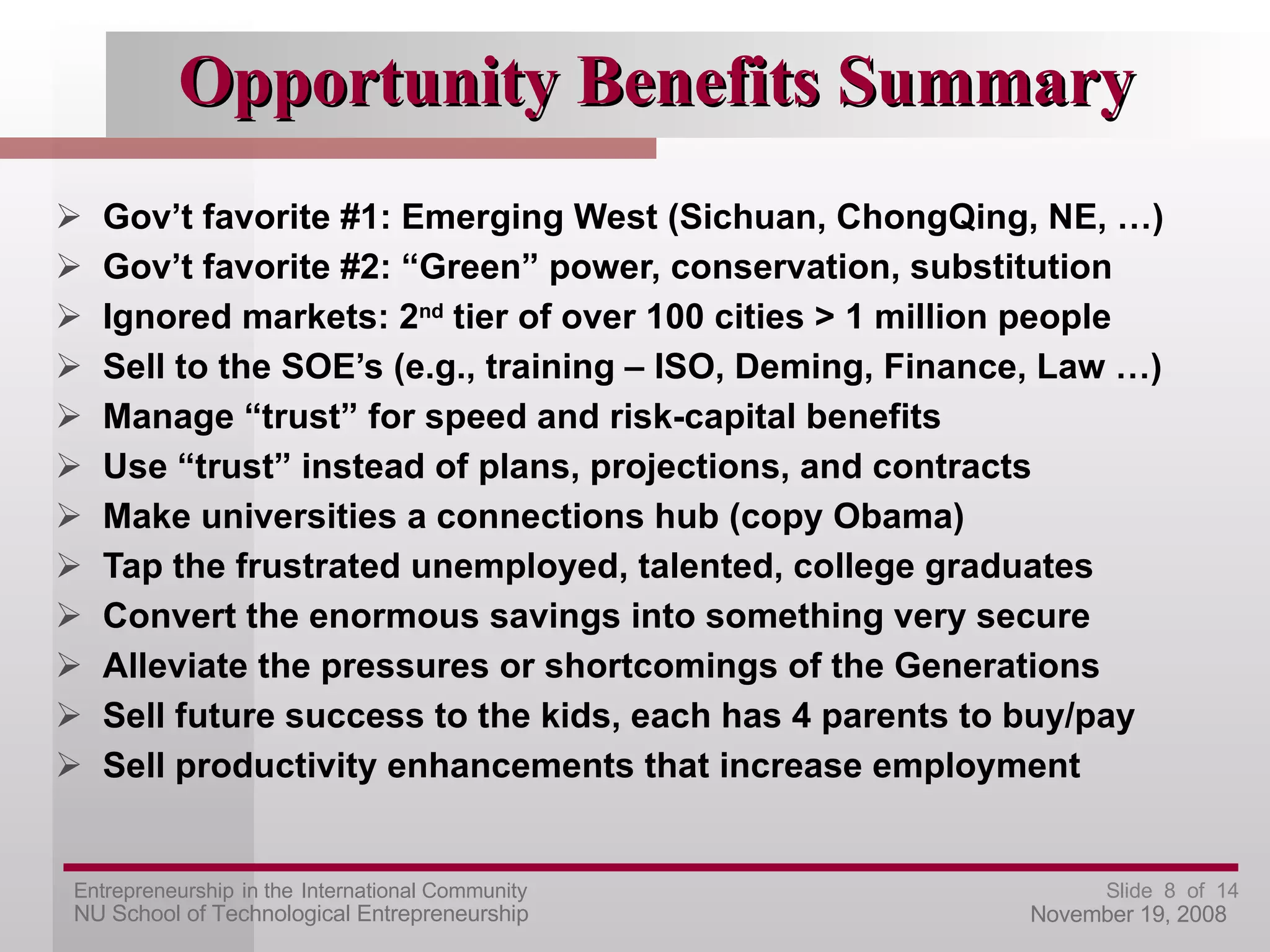

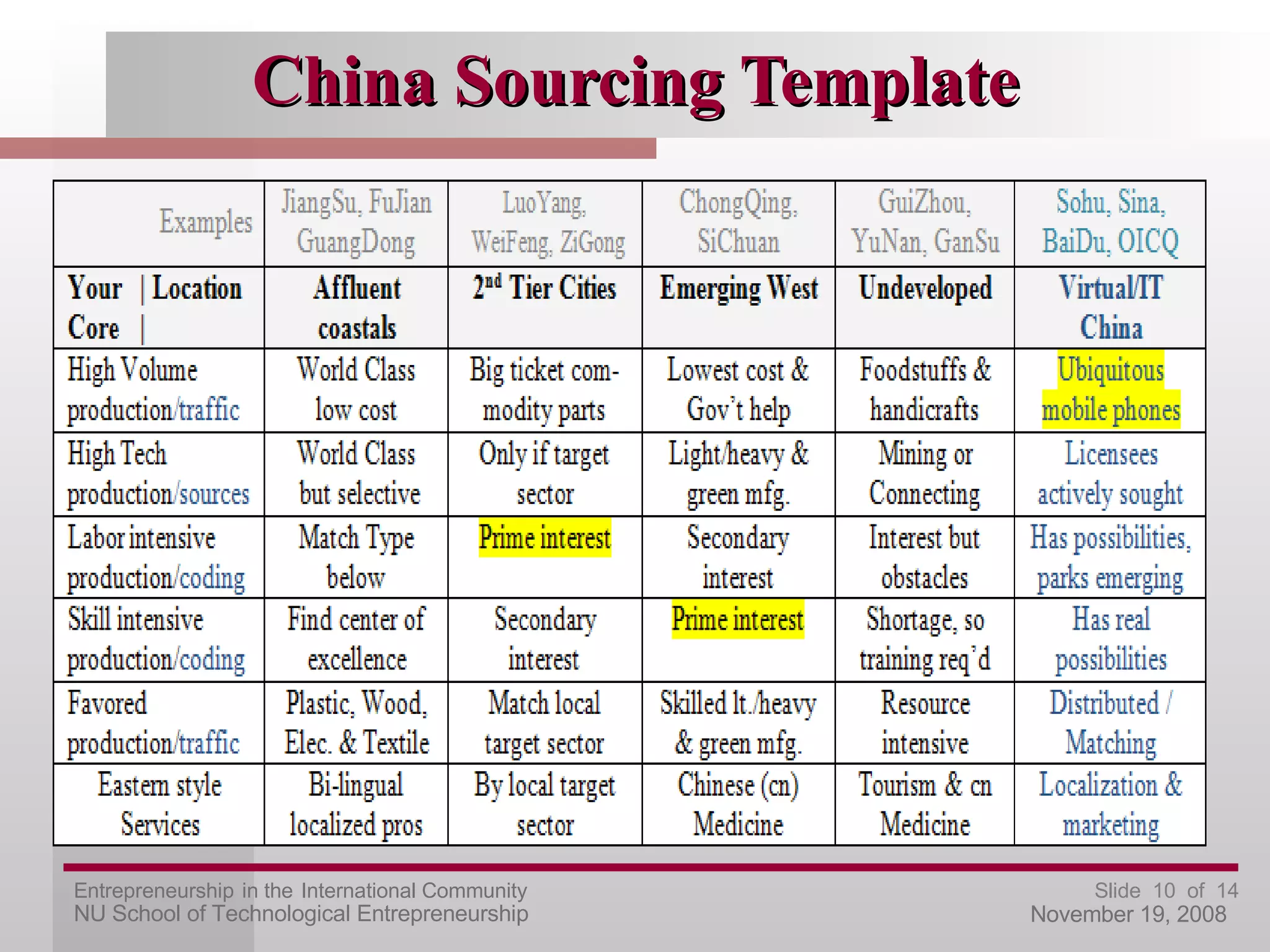

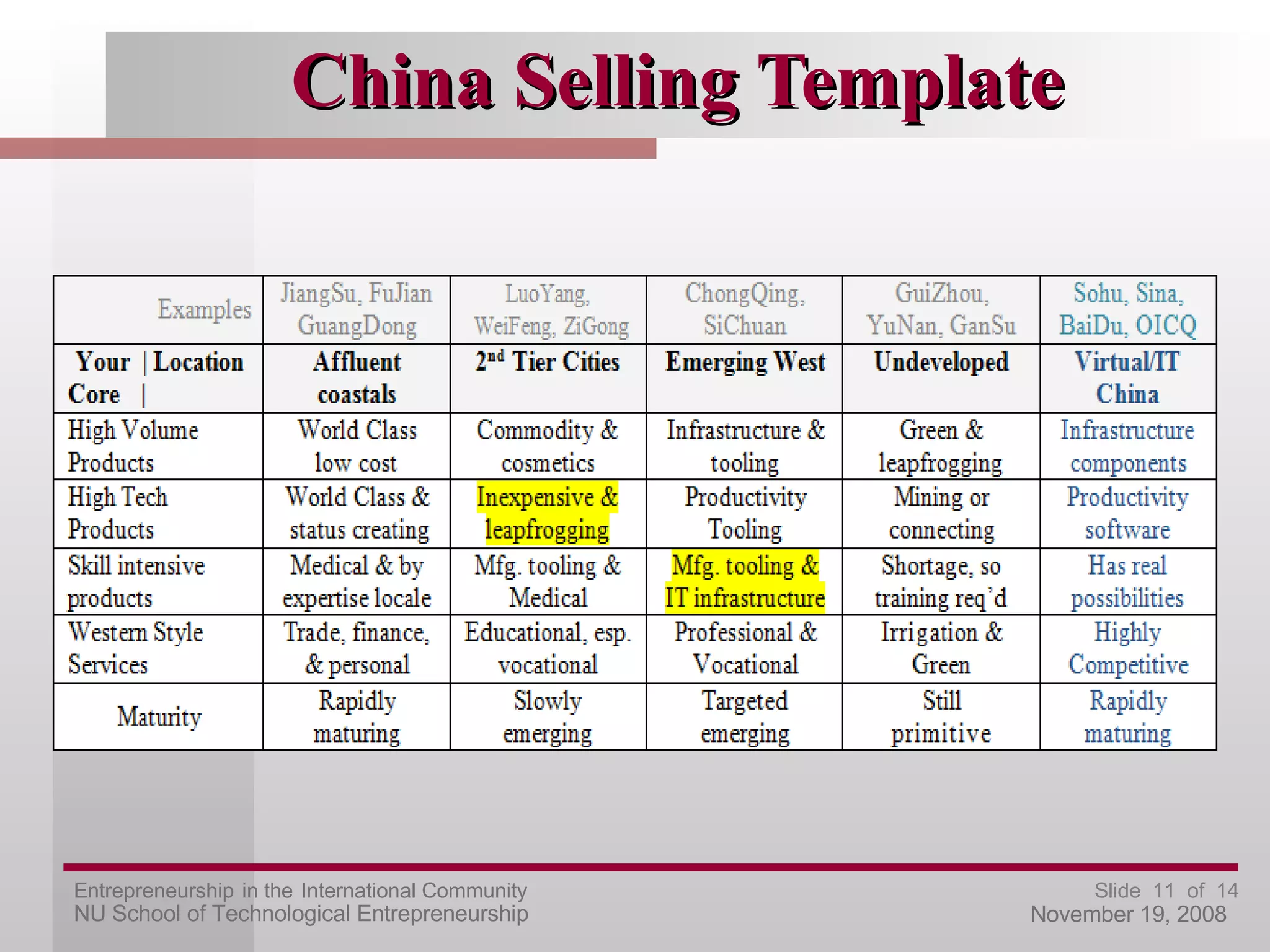

The document provides an overview of entrepreneurship opportunities in China for foreigners. It discusses China's generational demographics and how they present different opportunities. Several tips are provided for sourcing or selling in China, including focusing on emerging western provinces and second-tier cities that are priorities for the government. Relationships and trust are emphasized as more important than contracts under China's system.

![Sourcing/Selling Summary Emerging West for skill intensive production and selling infrastructure and second wave of upscaling (repeat of Affluent coastals of the past twenty years) 2 nd Tier Cities for labor intensive sourcing and selling American product access/franchises (below the Western radar) Gov’t favors: Emerging West (central gov’t), green technology (central gov’t), and centers of excellence (local) [Note: this “West” includes North East and Central China, too] You can count on: High receptivity to locating in government industrial/technology parks Every consumer having a cell phone, credit card, and access to the internet Typically, college graduates having had over 8 years of English schooling](https://image.slidesharecdn.com/eic-124232624972-phpapp01/75/Entrepreneurship-in-China-12-2048.jpg)