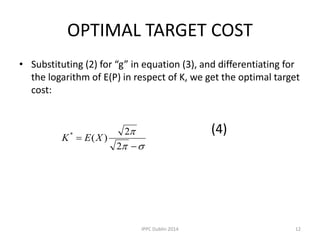

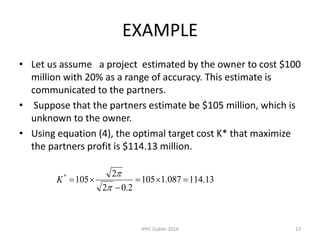

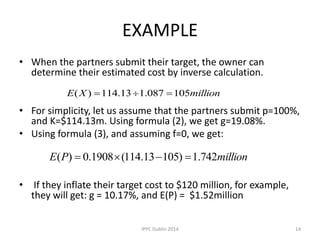

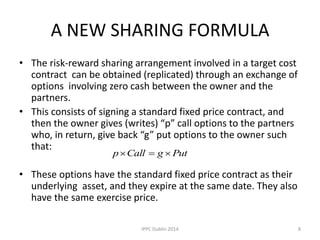

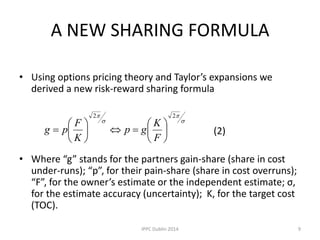

This document discusses efficient project alliances in the public sector. It proposes a new risk-reward sharing formula that incentivizes partners to submit their target cost truthfully. The formula consists of an exchange of options between the owner and partners where the gain share decreases exponentially as the target cost increases compared to the owner's estimate. This penalizes inflated target costs and finds the optimal target cost that maximizes partner profit without competition. The new formula fosters trust and collaboration while avoiding costs of competitive target cost alliances.

( XEKgfPE

11IPPC Dublin 2014](https://image.slidesharecdn.com/efficientpureprojectalliancesinthepublicsector-140827055517-phpapp01/85/Efficient-pure-project-alliances-in-the-public-sector-11-320.jpg)