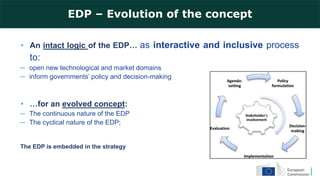

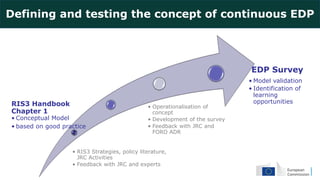

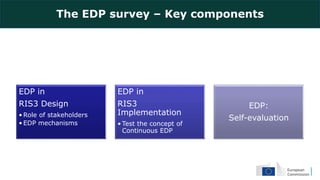

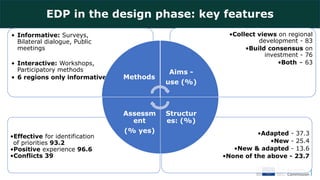

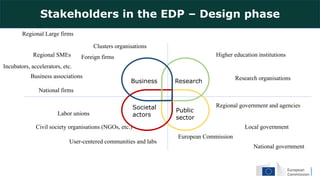

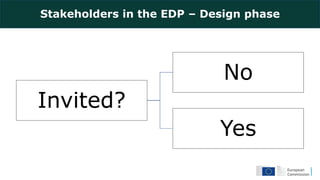

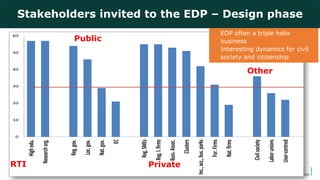

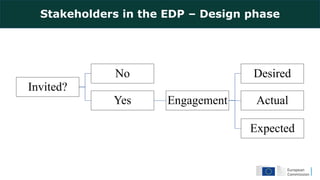

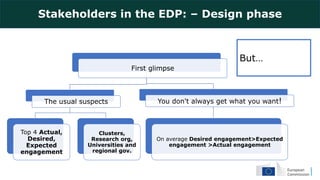

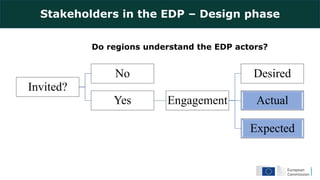

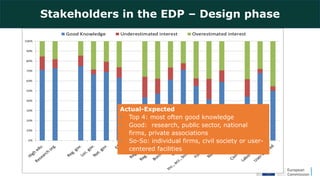

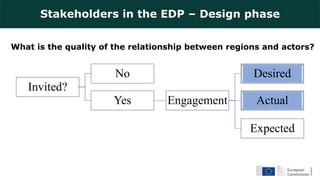

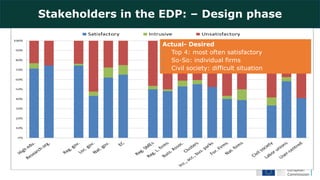

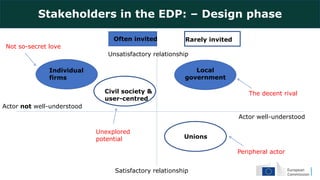

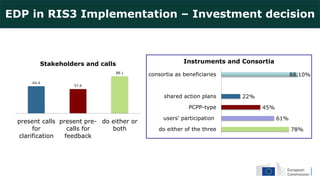

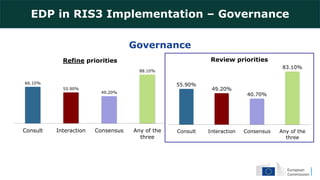

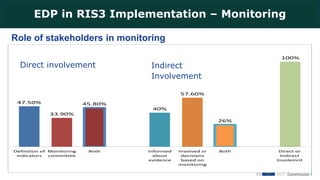

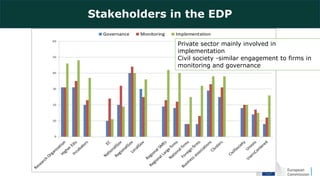

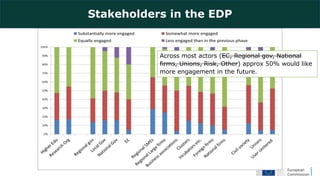

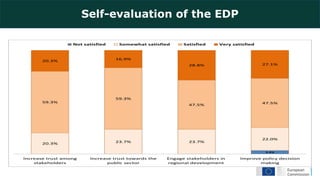

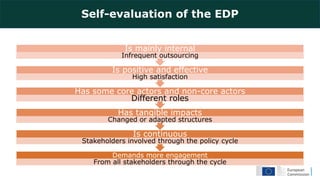

The document introduces the concept of the Entrepreneurial Discovery Process (EDP) and presents results from a survey on its implementation. The EDP is a legal requirement for developing smart specialization strategies and involves stakeholders in an interactive process to identify new economic opportunities. The survey found the EDP often involves a triple helix of public sector, research, and businesses. It also found regions desire more engagement from civil society and citizens. Overall, the EDP is seen as continuous, involving stakeholders through the policy cycle, and having positive impacts and high satisfaction, though some desire more engagement in the future.

![Legal basis

• S3s shall be developed through involving […]

managing authorities and stakeholders […] in

an entrepreneurial discovery process.

• ERDF Regulation

EDP: the legal basis](https://image.slidesharecdn.com/edppptpxl-230219075559-40c52de1/85/EDP-PPT-PXL-pptx-5-320.jpg)