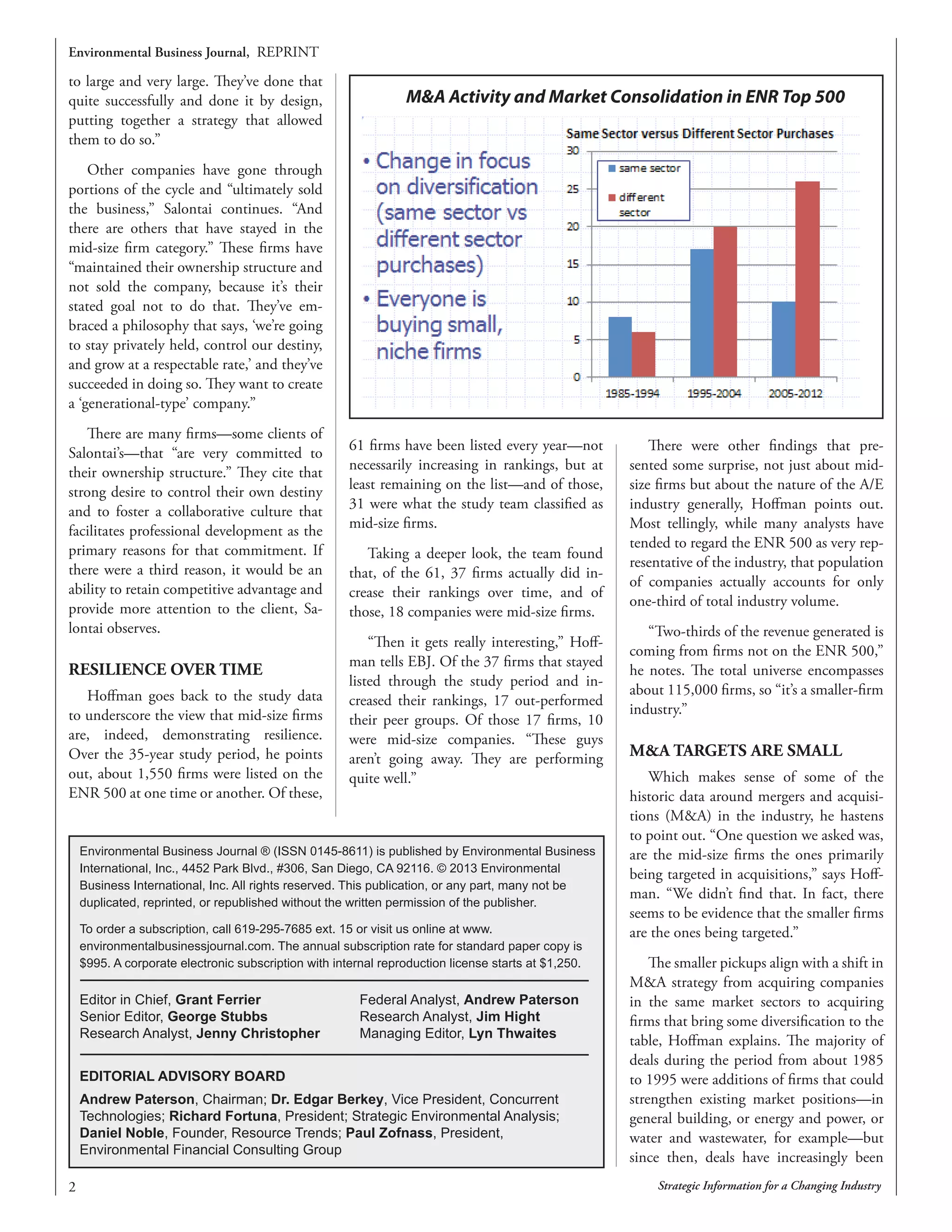

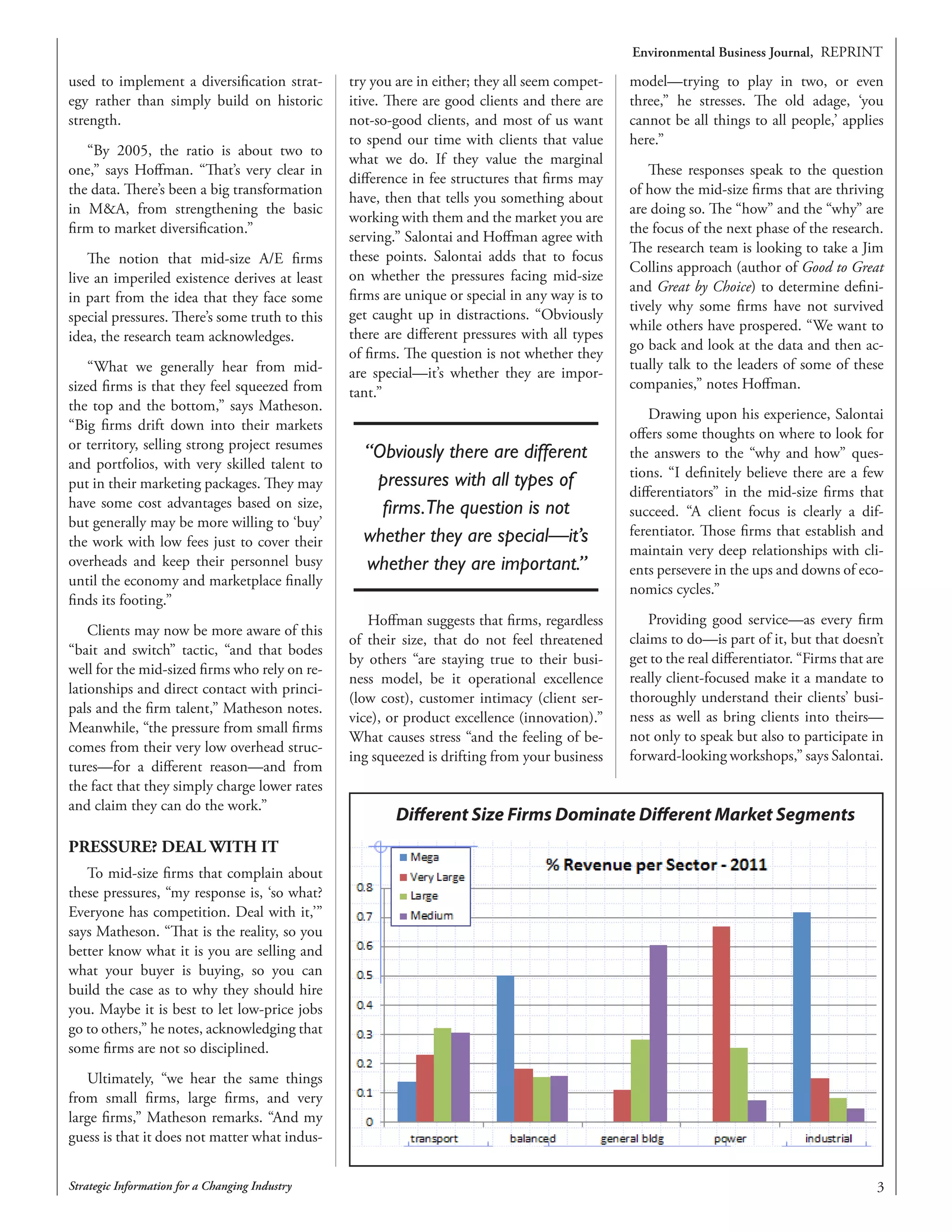

This document discusses a study analyzing whether mid-sized consulting and engineering firms are poised for demise as some analysts have suggested. The study analyzed data from Engineering News-Record's Top 500 Design Firms lists going back to the 1970s. It found that mid-sized firms with revenues between $17-113 million maintained or increased their market share and numbers over time. Specifically, mid-sized firms in transportation remained constant, while those in general building increased by 11.6% over the years. This suggests mid-sized firms have more resilience than expected and can thrive without needing to grow into large firms or be acquired. The study challenges the view that mid-sized firms cannot survive long-term.