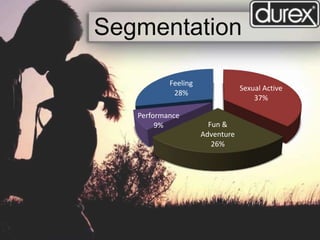

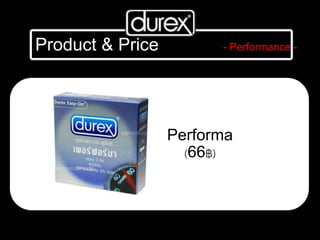

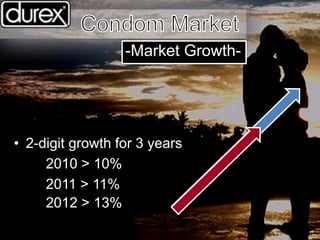

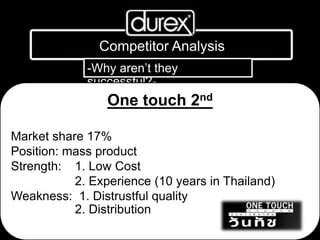

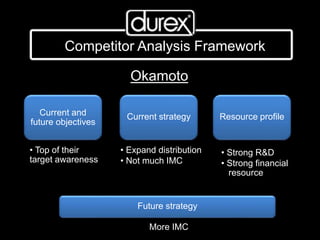

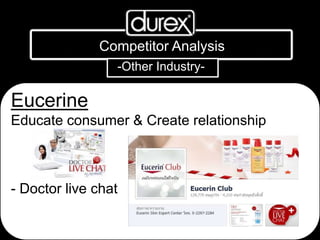

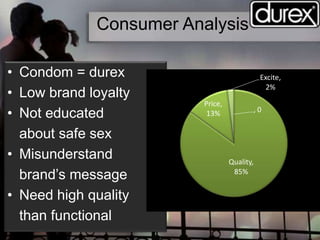

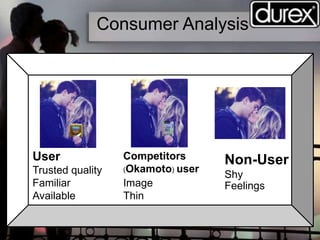

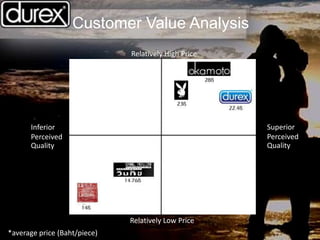

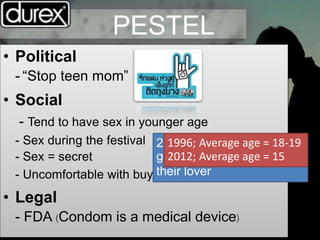

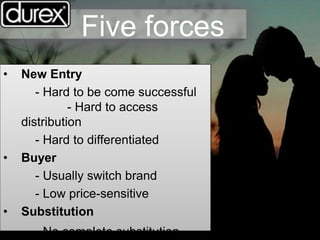

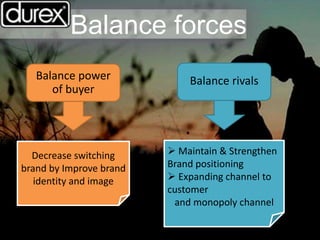

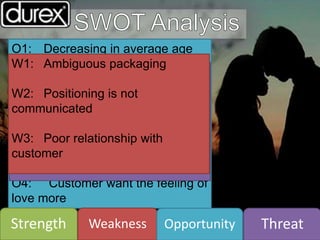

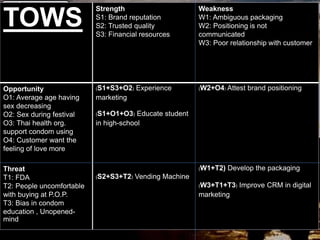

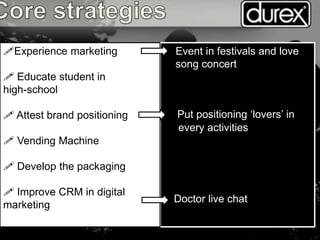

The document discusses Durex's market presence in Thailand, its product range, and pricing strategies while identifying competitors like One Touch and Okamoto. It highlights the challenges Durex faces, including market saturation and consumer education regarding safe sex, along with proposed strategies for increasing market share and awareness. Key recommendations include enhancing brand positioning, expanding distribution channels, and improving consumer relationships through marketing initiatives.