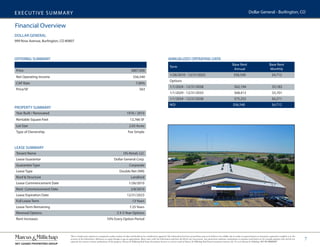

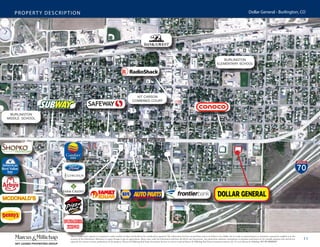

This summary provides high-level information about a net-leased Dollar General property located in Burlington, Colorado. The 12,766 square foot property was built in 1976 and renovated in 2010 when Dollar General became the tenant with a 7.25 year double net lease and three 5-year extension options. Dollar General benefits from excellent visibility and access off major highways near Burlington. The property information is being marketed for sale.