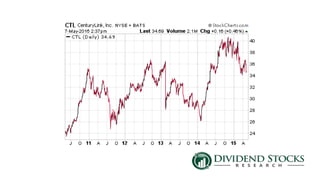

The document discusses the importance of the dividend payout ratio in evaluating dividend stocks, emphasizing that it can indicate a company's ability to pay and sustain dividends. It warns investors about companies that manipulate dividends to attract attention while potentially masking poor financial health. Examples of risk are illustrated through the case of CenturyLink, showcasing how a high payout ratio combined with declining cash flow can signal trouble for investors.