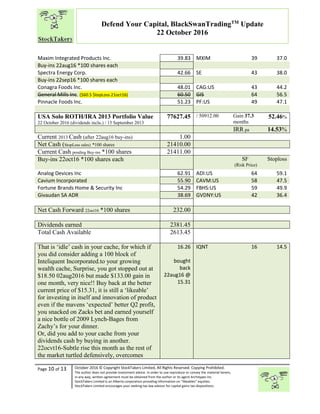

The document discusses 'likeables' equities, which are stocks appreciated by investors due to their consistent performance above a set risk price. It critiques conventional financial advisory practices and promotes the 'blackswantrading' methodology, emphasizing the effectiveness of risk-averse investment strategies. The author shares performance metrics of a specific portfolio, suggesting a significant return on investment while advocating for better capital safety practices.