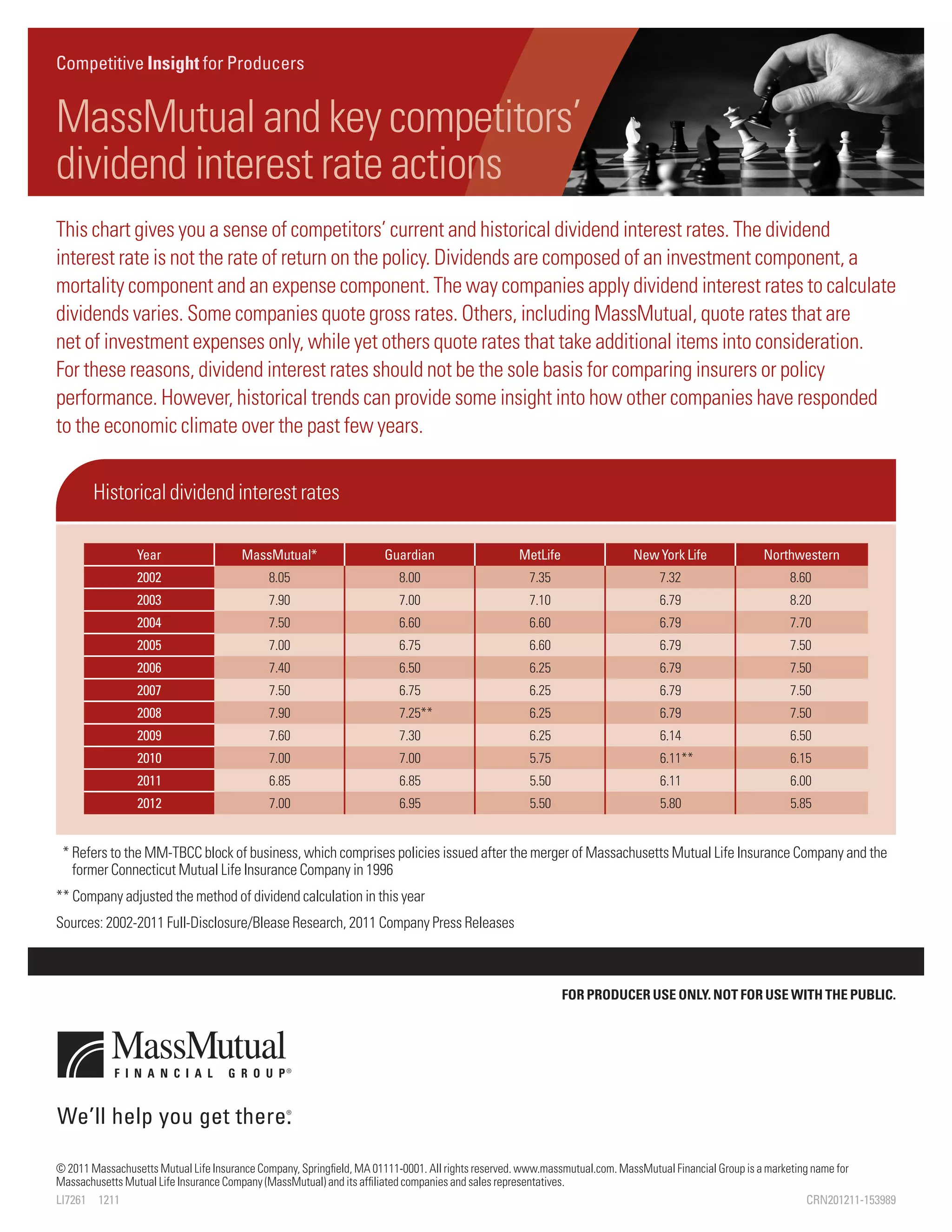

This document provides a chart showing the historical dividend interest rates from 2002 to 2012 for MassMutual and several of its competitors, including Guardian, MetLife, New York Life, and Northwestern Mutual. It notes that dividend interest rates are not the actual rates of return and differ between companies based on how expenses are calculated. While dividend interest rates alone should not be used to compare insurers, the historical trends can provide insight into how companies have responded to economic conditions over the years.