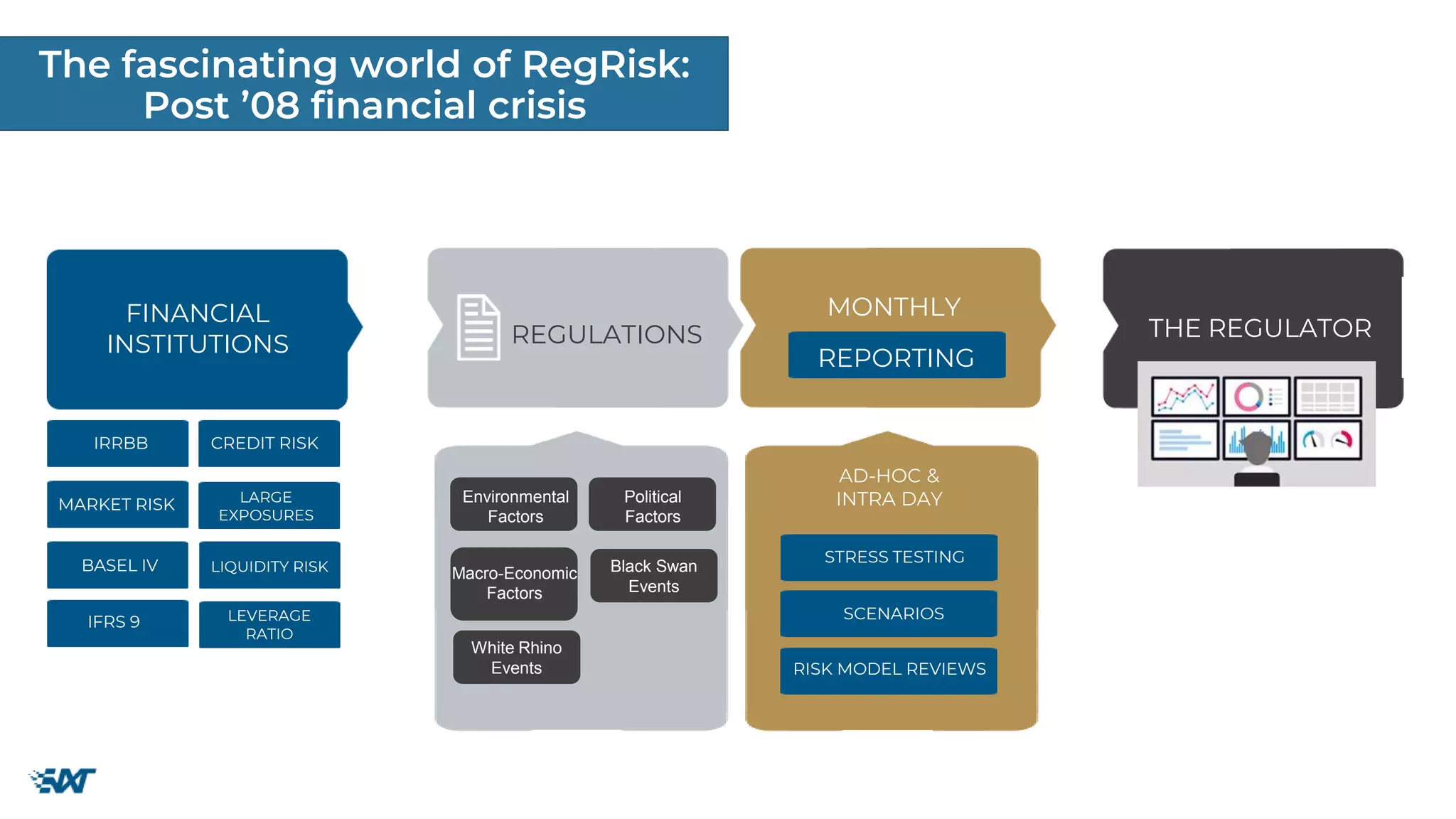

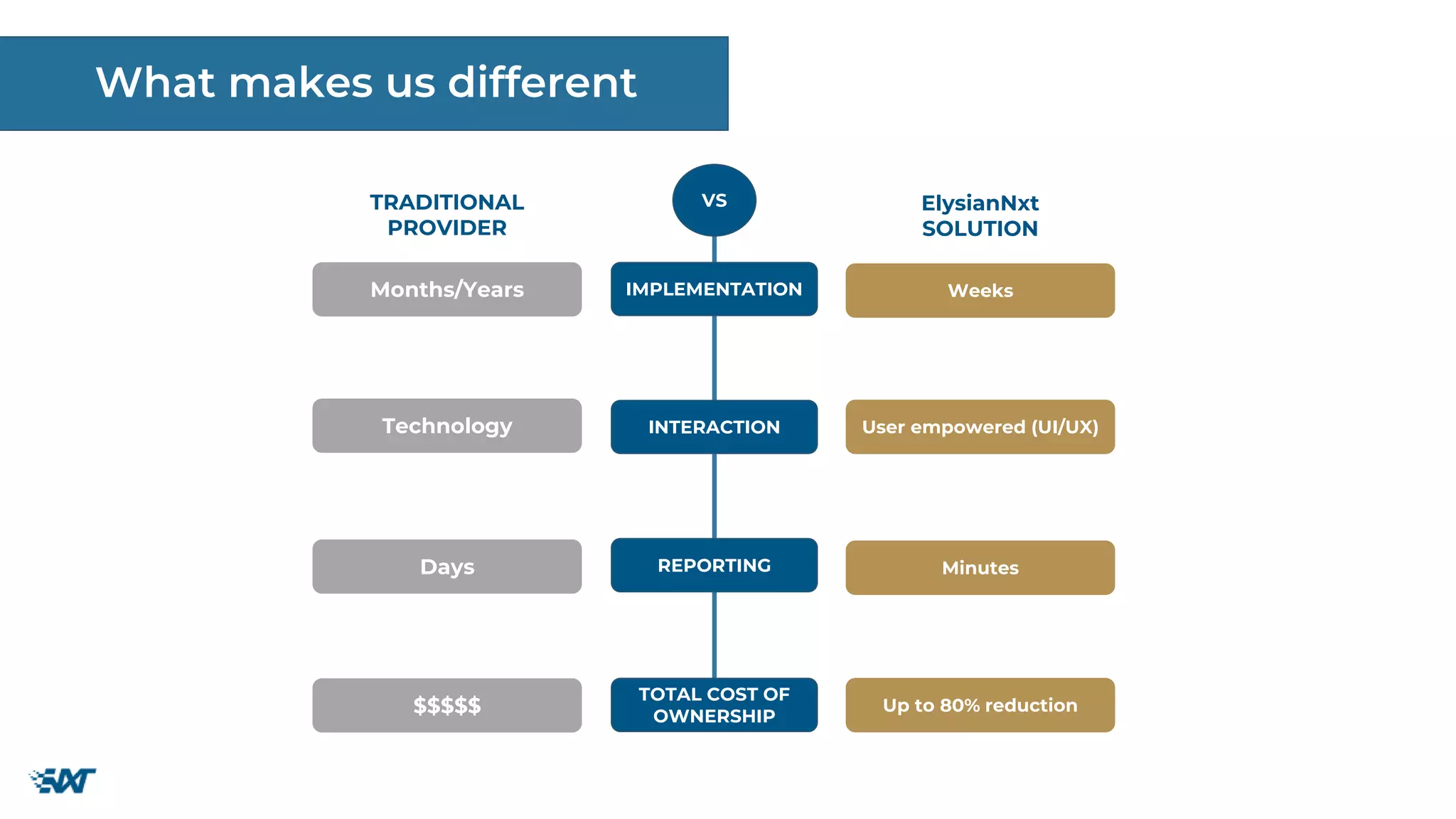

The document discusses the evolving landscape of financial regulations and the management of various risks such as credit, market, and liquidity risks in financial institutions, particularly in the context of post-2008 reforms and Basel IV. It highlights the challenges faced by banks in adapting to regulatory changes and introduces a software solution by elysiannxt that significantly reduces implementation time and costs. Furthermore, it outlines the company's growth strategy and partnership efforts in response to upcoming regulatory demands.