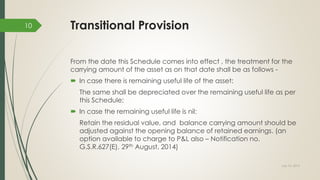

This document discusses key differences between Indian GAAP and Ind AS accounting standards regarding accounting for property, plant, and equipment. It provides an overview of major changes in depreciation methods and useful life calculations between the two standards. Some key differences highlighted include requirements for component accounting, capitalization of replacement costs, treatment of revaluations, and accounting for cash flow hedges under Ind AS. The document also illustrates transitional provisions and calculations for depreciation under the new useful life approach.