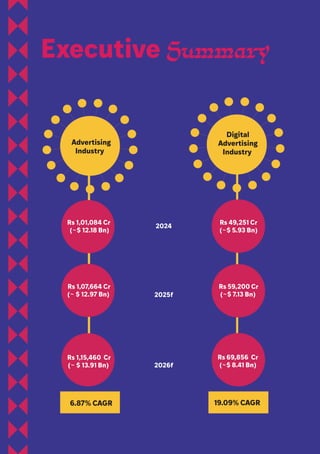

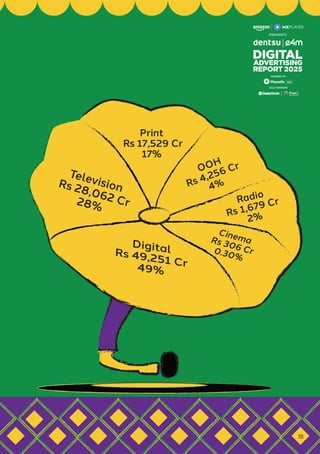

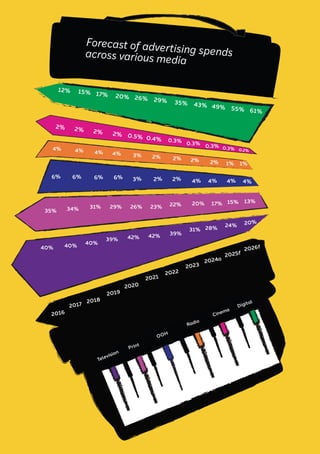

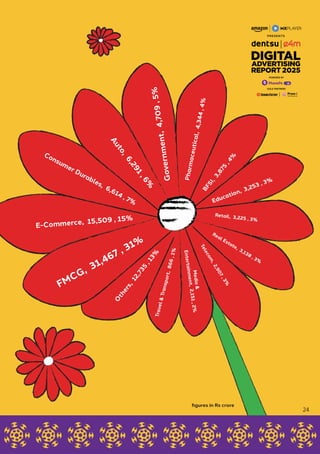

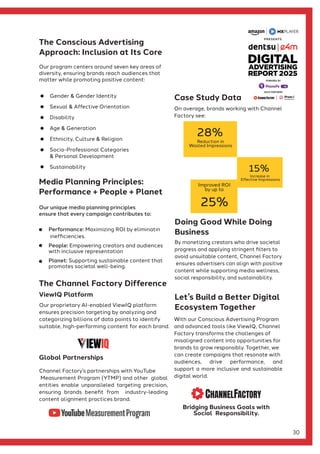

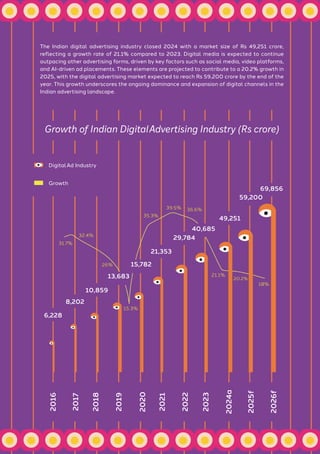

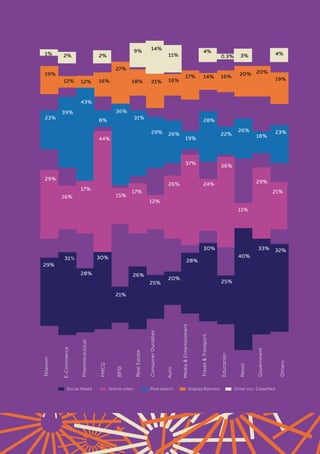

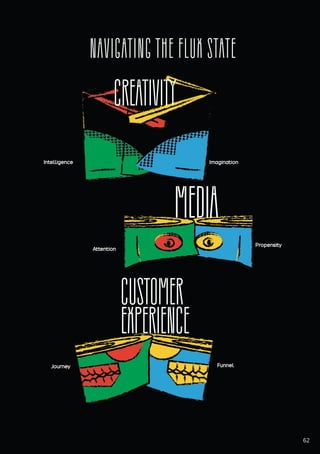

The Dentsu e4m Digital Report 2025 outlines the rapid evolution of the Indian advertising industry driven by digital transformation and changing consumer behaviors, with digital ad spend expected to grow significantly. Key trends highlighted in the report include the rise of AI in marketing, the emergence of hybrid experiences, and the increasing importance of personalized consumer interactions. Overall, the report emphasizes the need for brands to innovate and adapt to the dynamic digital landscape to effectively engage audiences and maintain relevance.