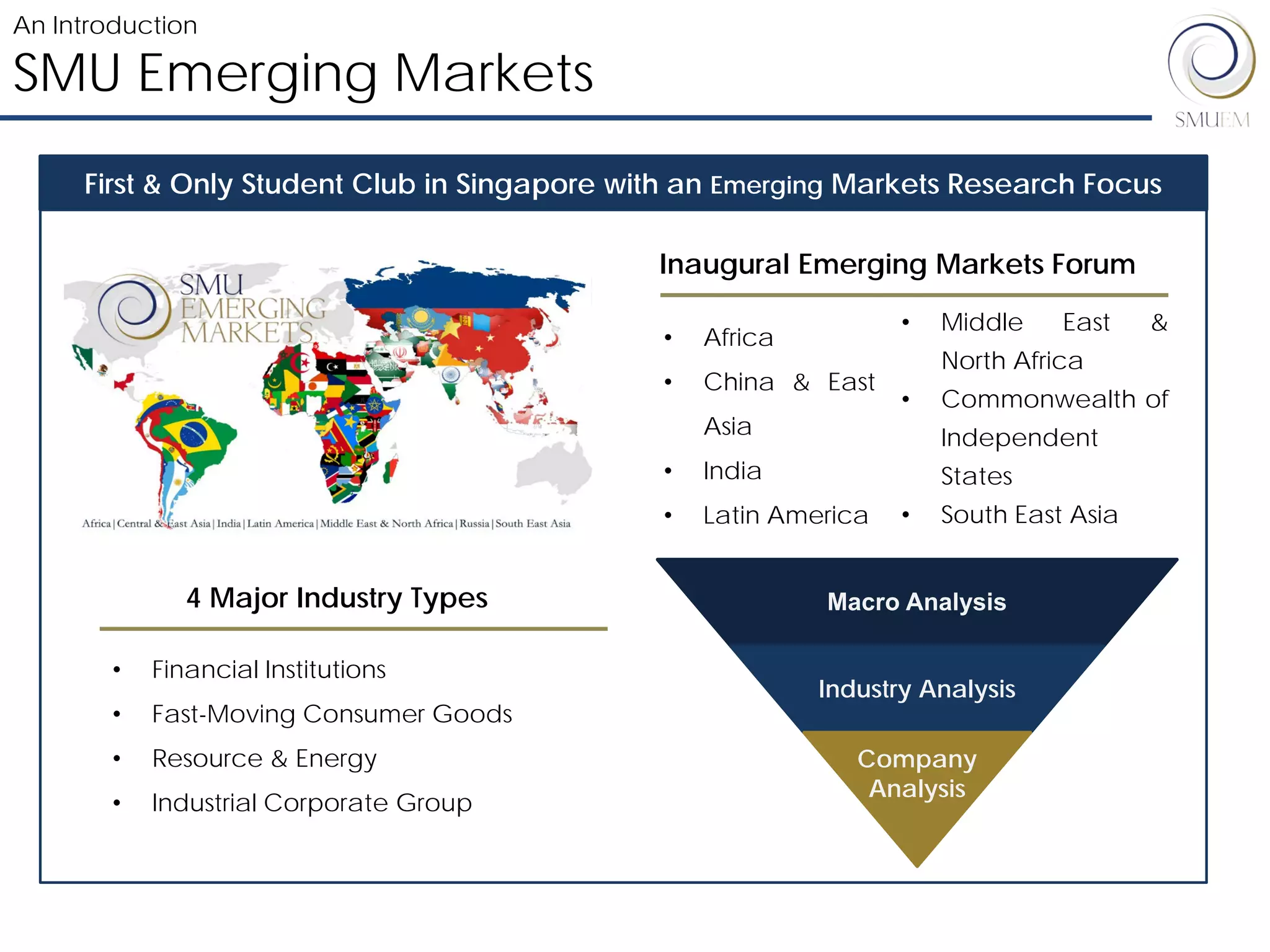

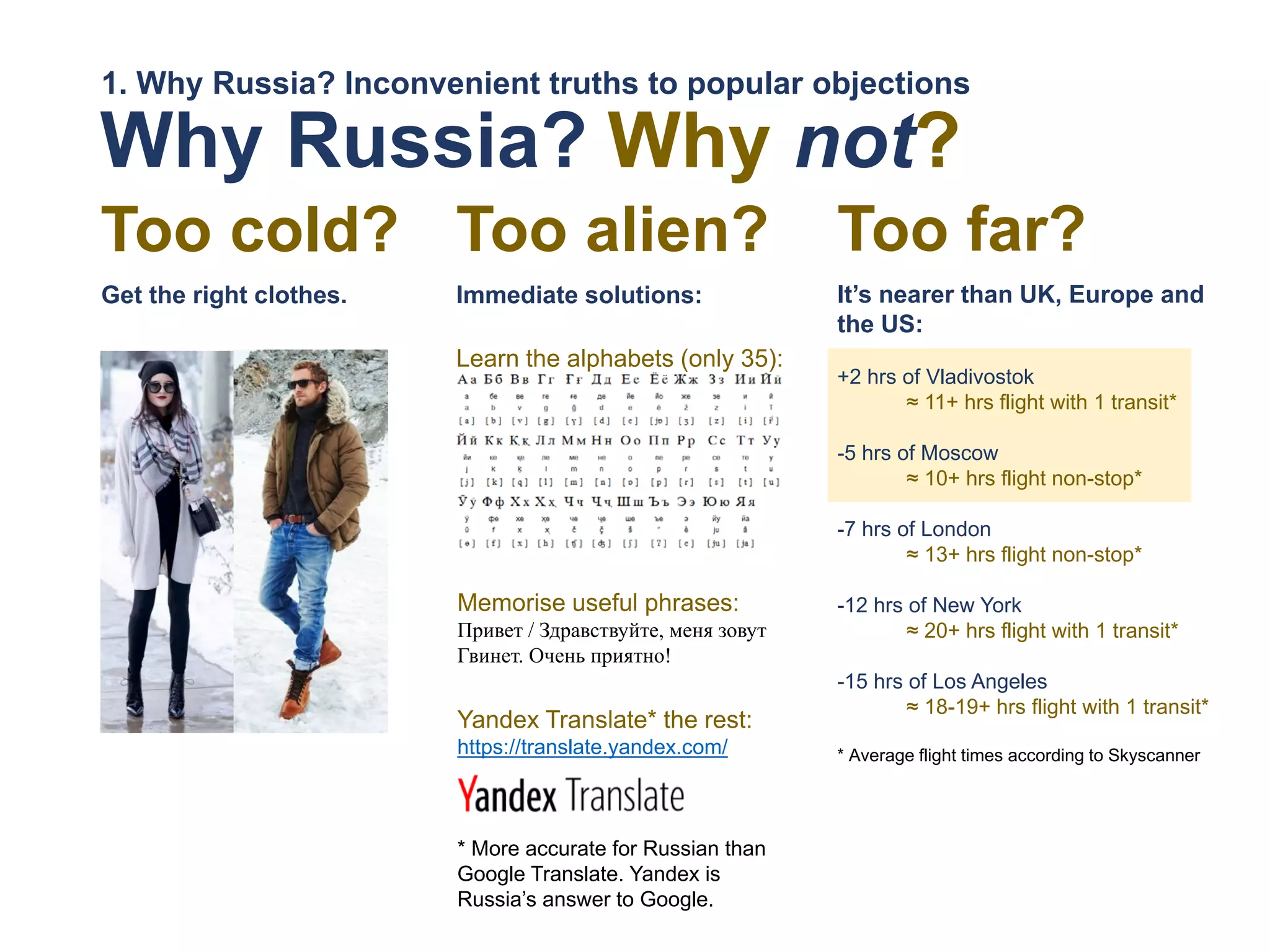

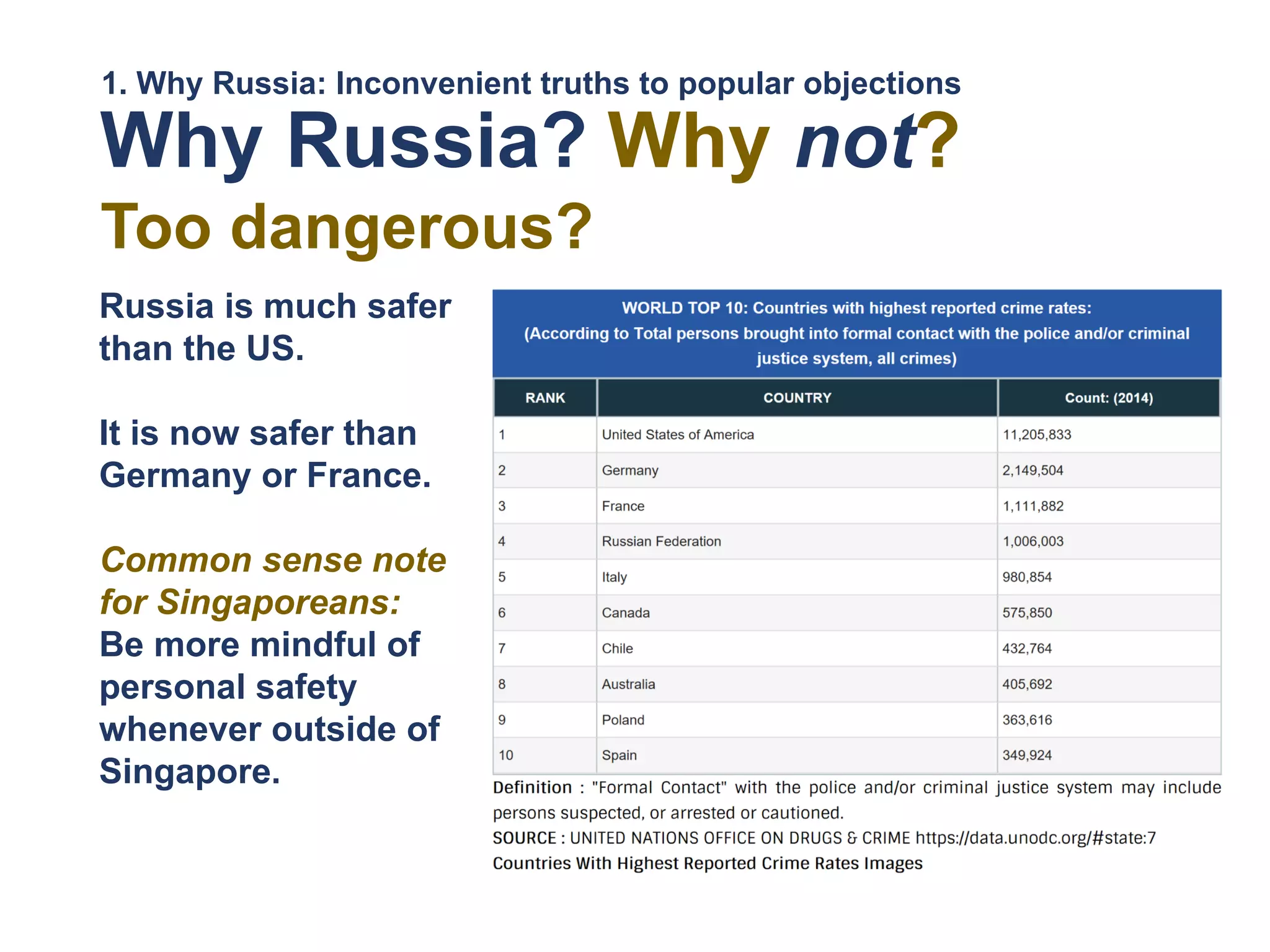

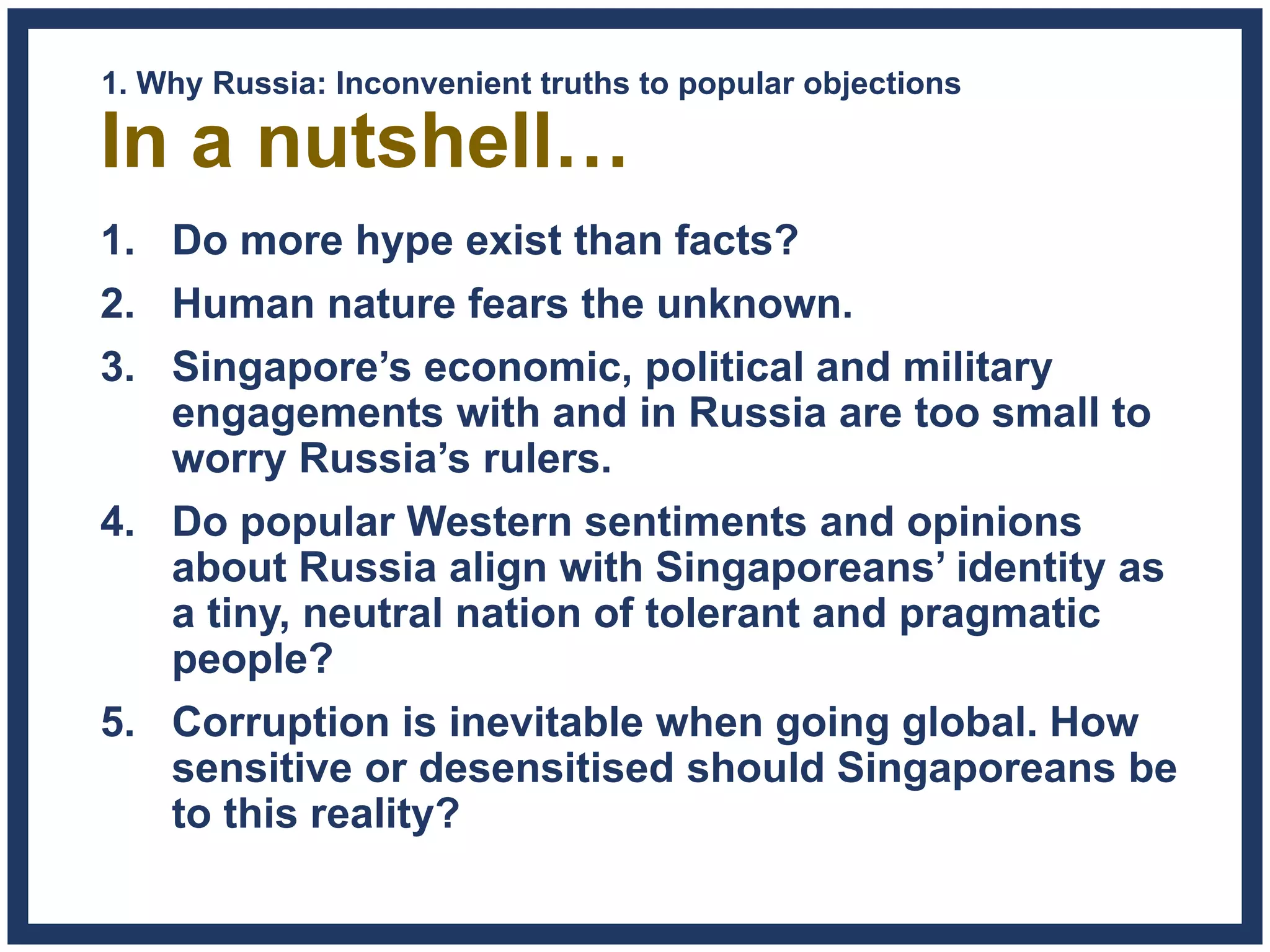

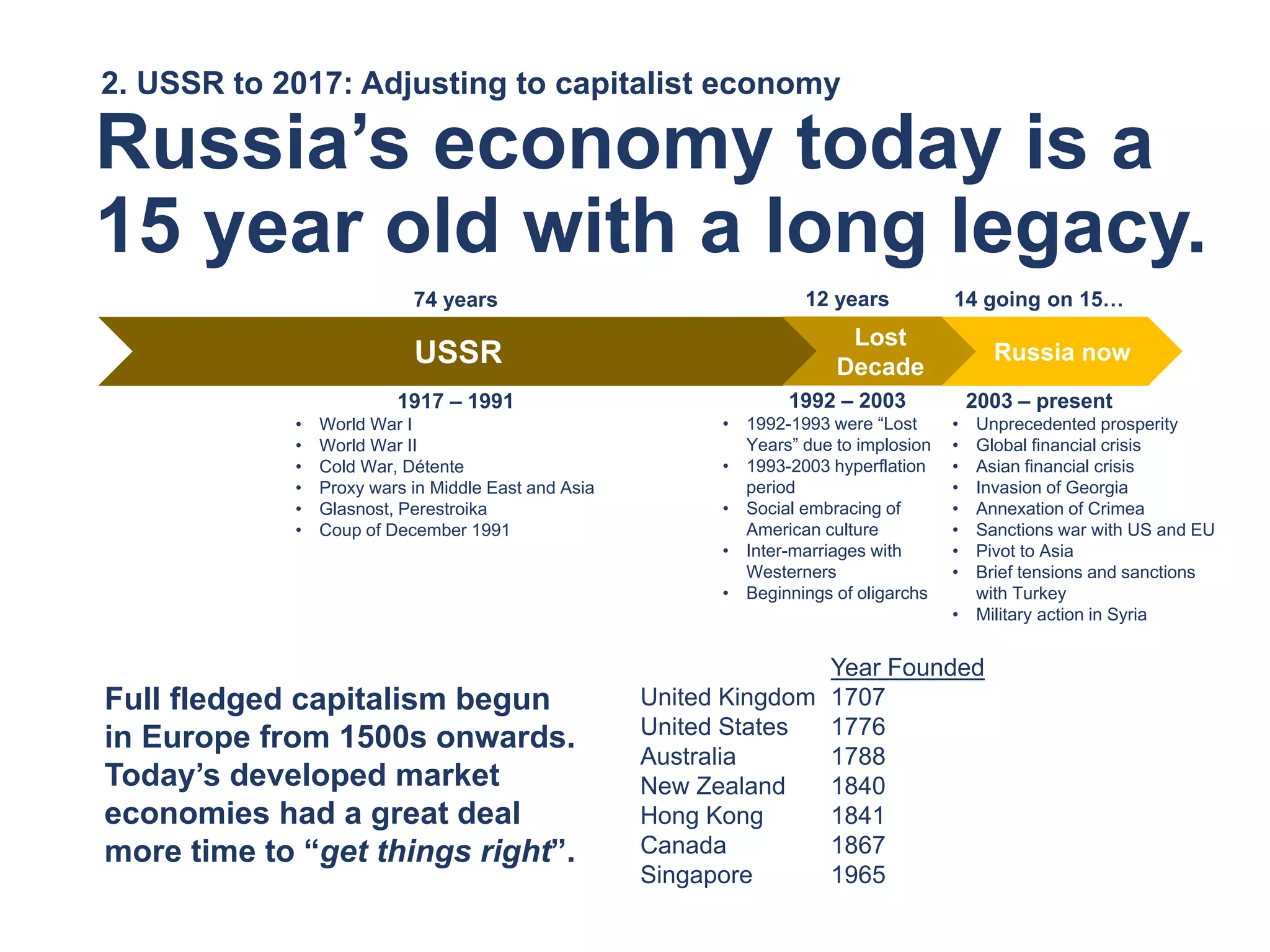

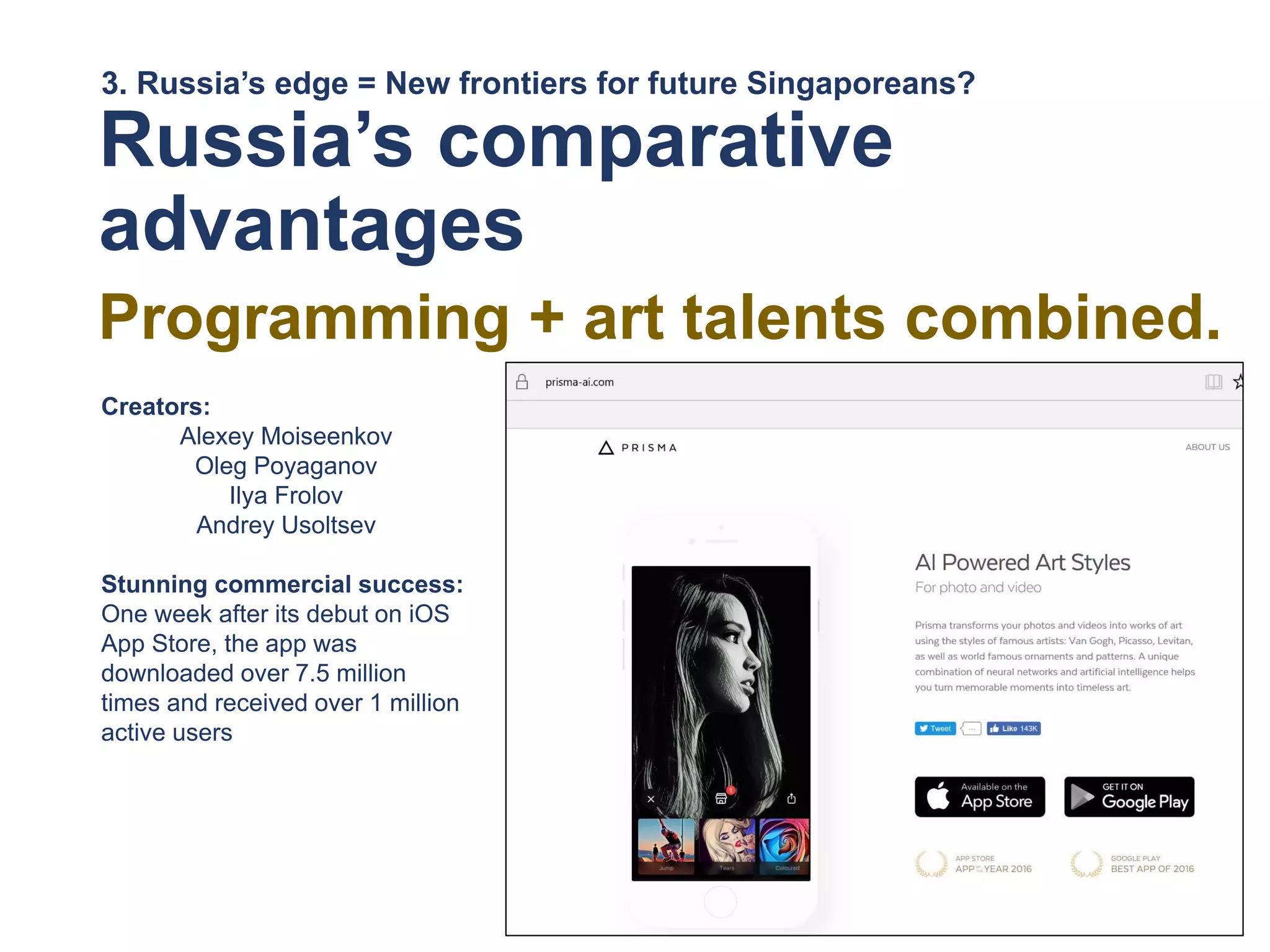

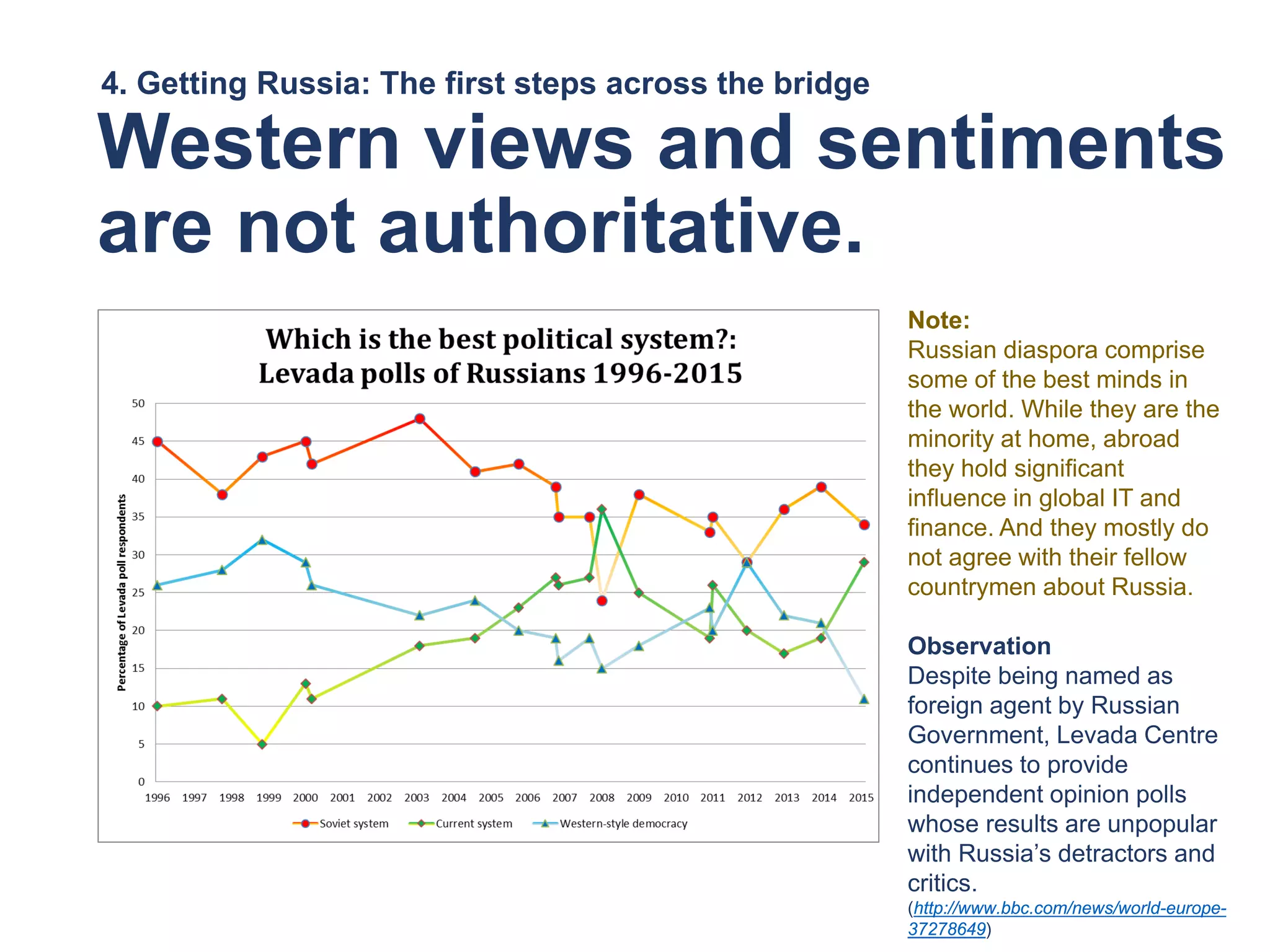

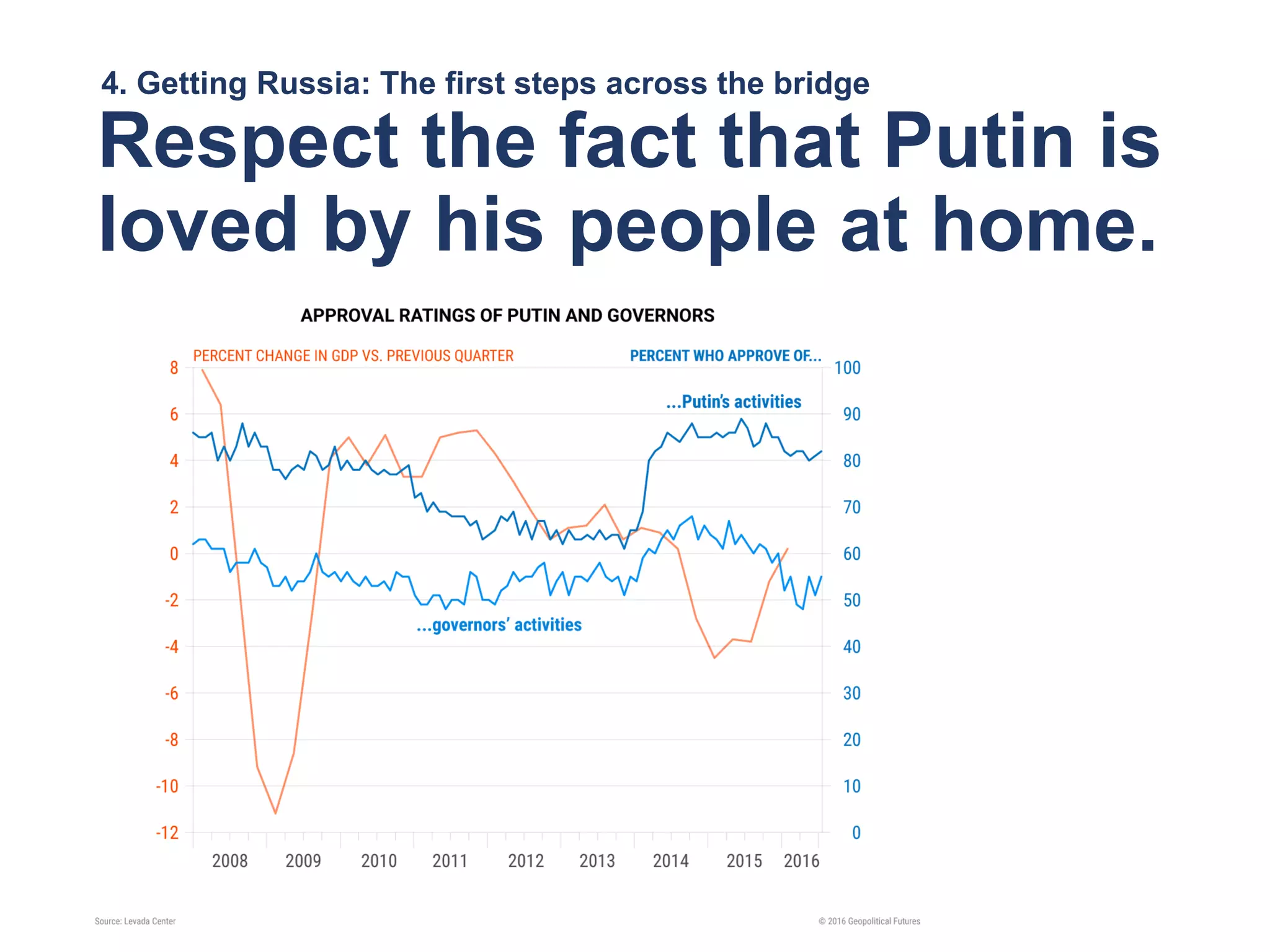

The SMU Emerging Markets Forum 2017 focused on understanding the growth opportunities and challenges in Russia, aiming to educate Singaporean students about this complex market. The event featured speakers with extensive experience in various sectors, including finance and industry, who shared insights on doing business in Russia and its evolving landscape. Emphasizing independent research and critical thinking, the forum highlighted Russia's significance as an emerging market for future Singaporean engagements.