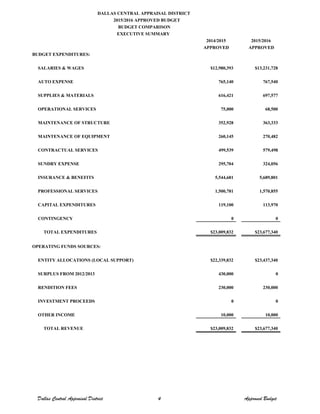

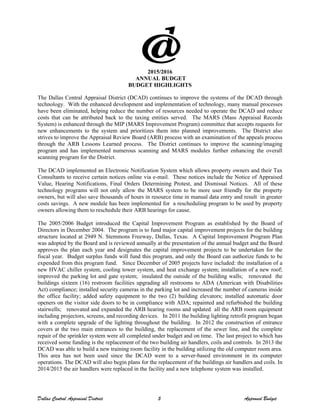

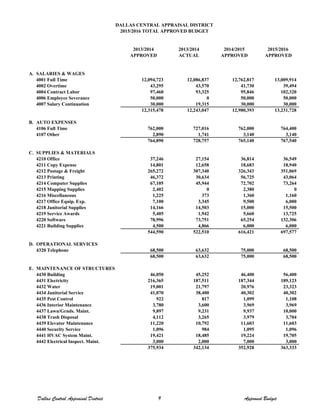

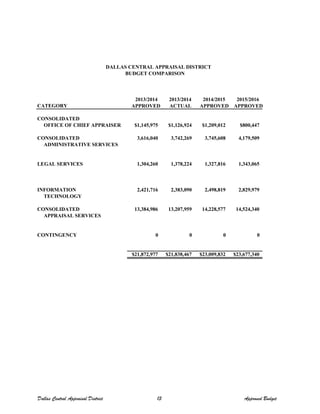

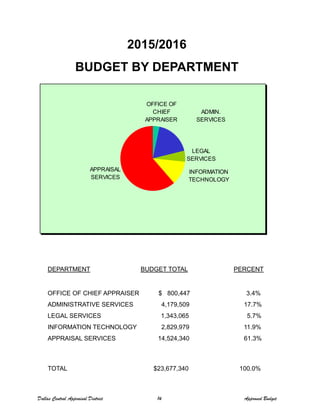

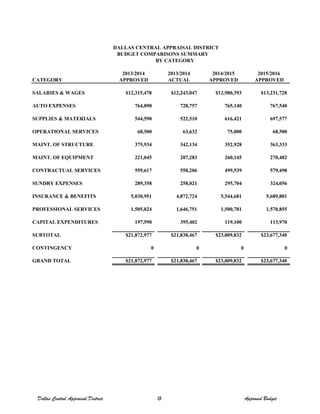

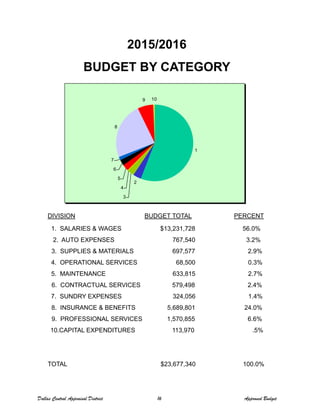

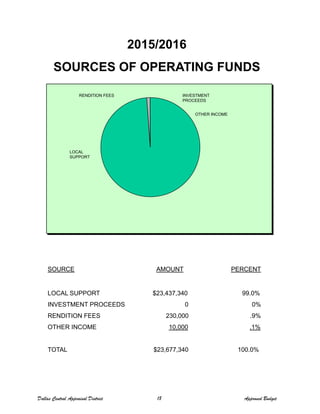

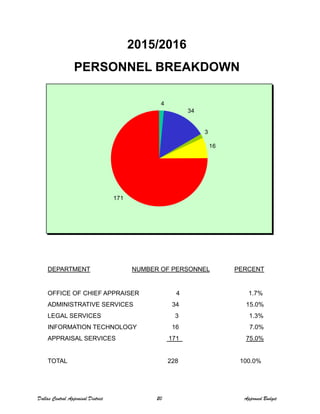

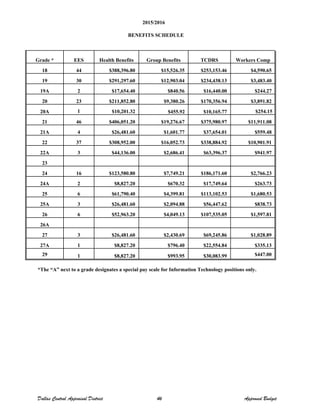

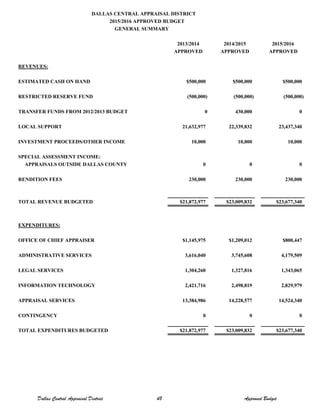

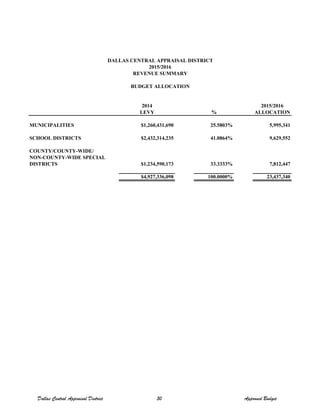

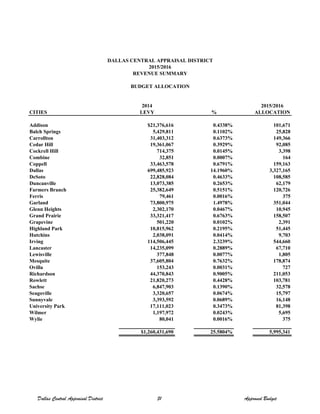

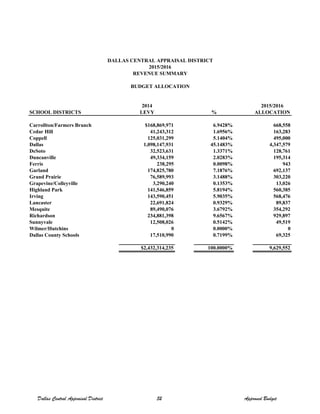

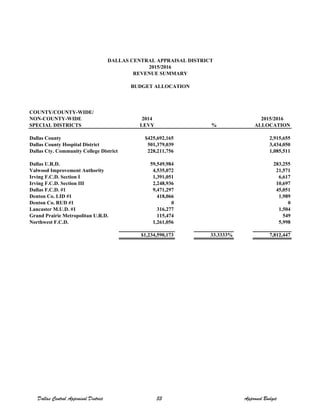

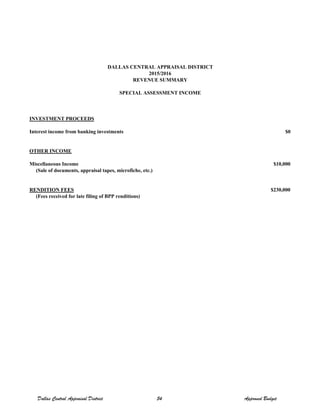

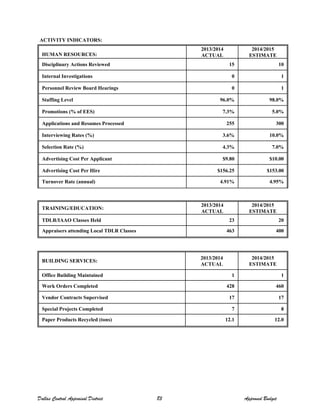

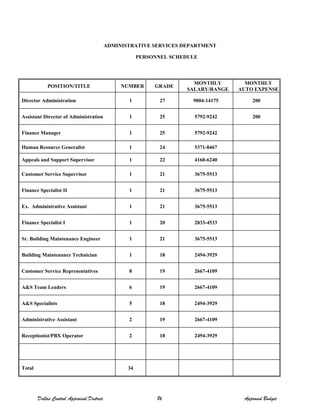

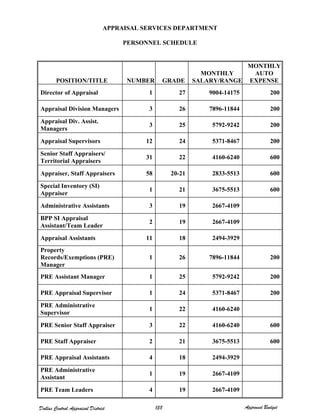

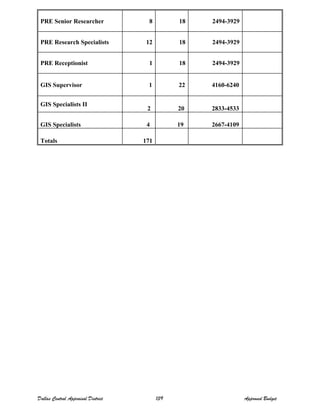

The 2015-2016 approved budget for the Dallas Central Appraisal District totals $23,677,340, a 2.9% increase from the 2014-2015 approved budget of $23,009,832. Major expenditures include $13,231,728 for salaries and wages, $767,540 for auto expenses, and $5,689,801 for insurance and benefits. Revenues are projected at $23,437,340 from local entity allocations and $230,000 from business personal property rendition fees. The budget maintains staffing at 228 employees and includes a 3% merit increase.