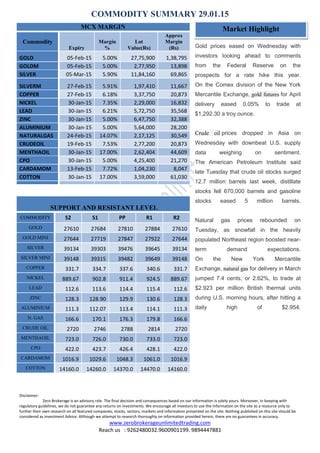

The document provides a market summary for various commodities as of January 29, 2015, including gold, crude oil, and natural gas prices. It notes that while gold prices eased slightly, crude oil experienced a drop due to increased supply, and natural gas saw a rebound driven by demand expectations. Additionally, it emphasizes that the information is advisory and does not guarantee investment returns.