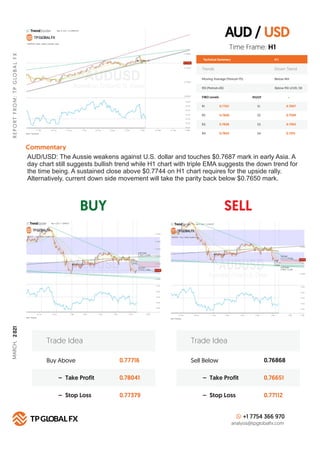

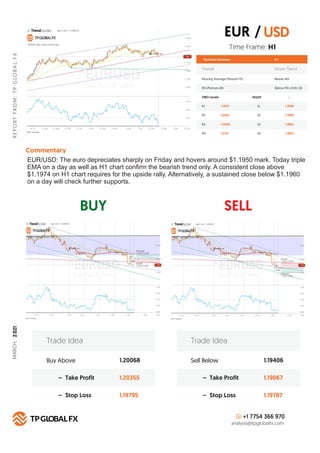

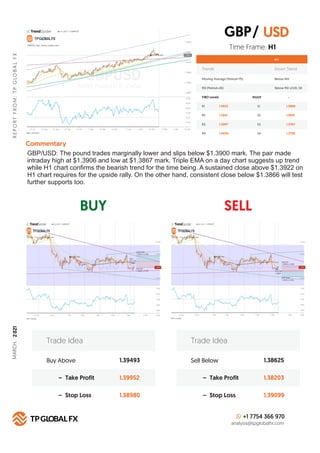

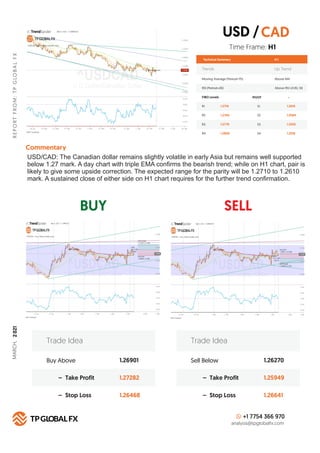

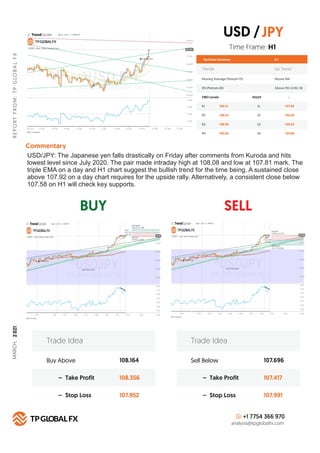

The document provides a daily analysis report from TP Global FX. It includes key Asian market headlines, upcoming economic data releases, commentary on major currency pairs, and technical analysis on AUD/USD, EUR/USD, GBP/USD, USD/CAD, USD/JPY, and XAU/USD. The report finds the Japanese yen weakened after comments from BOJ governor Kuroda, and Asian stock markets declined while gold stabilized below $1,700. Technical analysis provides support and resistance levels and trade ideas for each currency pair based on daily and hourly charts.

![BUY SELL

R

E

P

O

R

T

F

R

O

M

:

T

P

G

LO

B

A

L

F

X

Technical Summary

Trends Down Trend

Moving Average (Period=75) Below MA

H 1

RSI (Period=26) Below RSI LEVEL 50

FIBO Levels PIVOT

R1 S1

1702

R2 S2

1708

R3 S3

1712

R4

Commentary

S4

1722

Buy Above 1702.91

1711.98

1692.68

– Take Profit

– Stop Loss

Trade Idea

Sell Below 1686.08

1677.49

1696.38

– Take Profit

– Stop Loss

Trade Idea

+1 7754 366 970

analysis@tpglobalfx.com

-

Time Frame: H1

XAU/USD (GOLD): The gold weakens noticeably in previous session on robust U.S. factory

orders data. Today pair made intraday high at $1,698 and low at $1,687 mark. The key event for

the day will be U.S. NFP job results. The outcome will provide further direction of it. A day as well

as H1 chart still confirms the bearish trend for the time being. The expected range for the parity

will be $1,712 to $1,645 mark. A sustained close of either side on H1 chart requires to confirm

further directions of the parity.

XAU [GOLD]

USD

/

1687

1677

1661

1645

MARCH,

2

021](https://image.slidesharecdn.com/daily-analysis-report-march-05-2021-210305053648/85/Daily-Analysis-Report-March-05-2021-8-320.jpg)