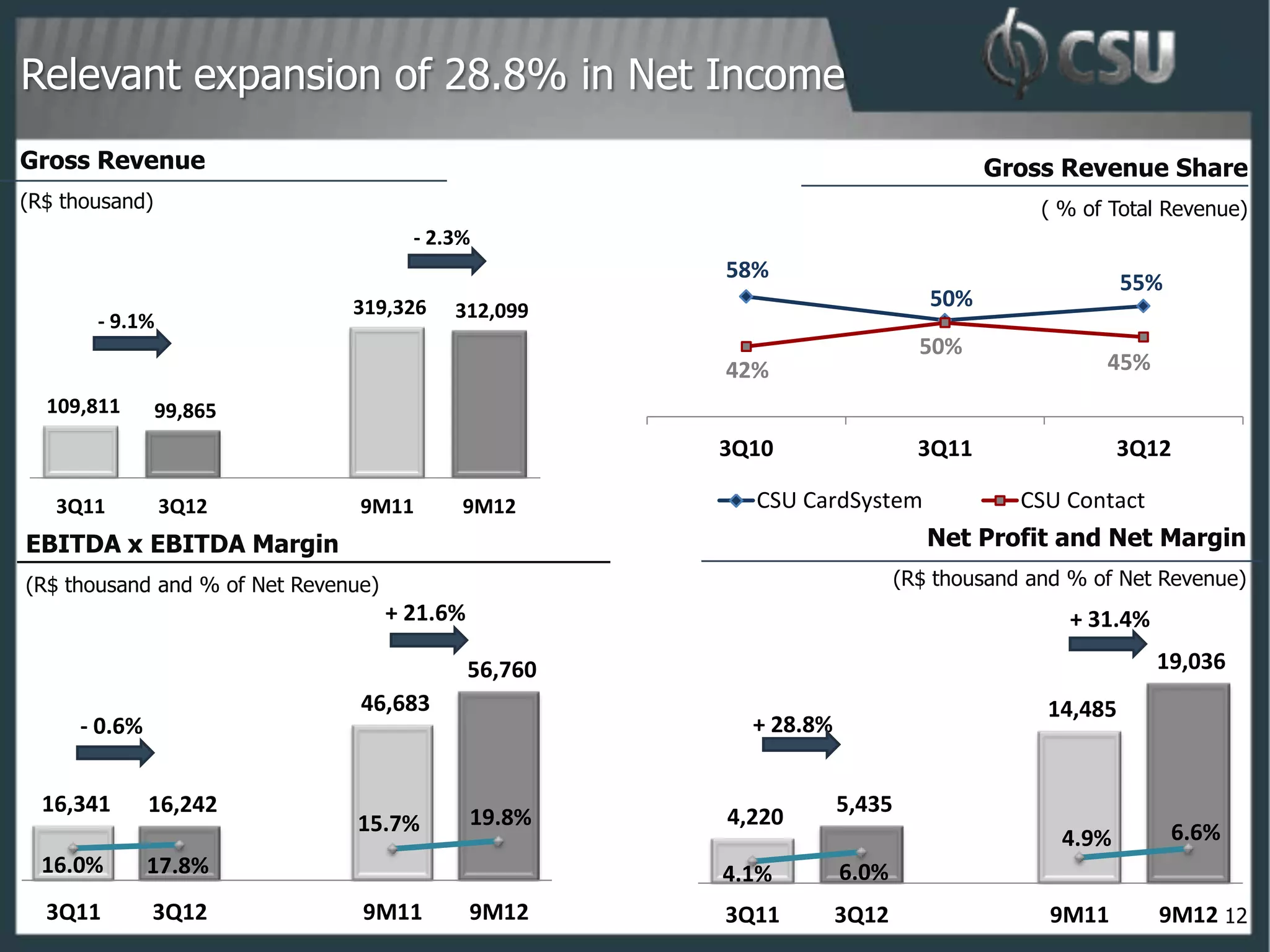

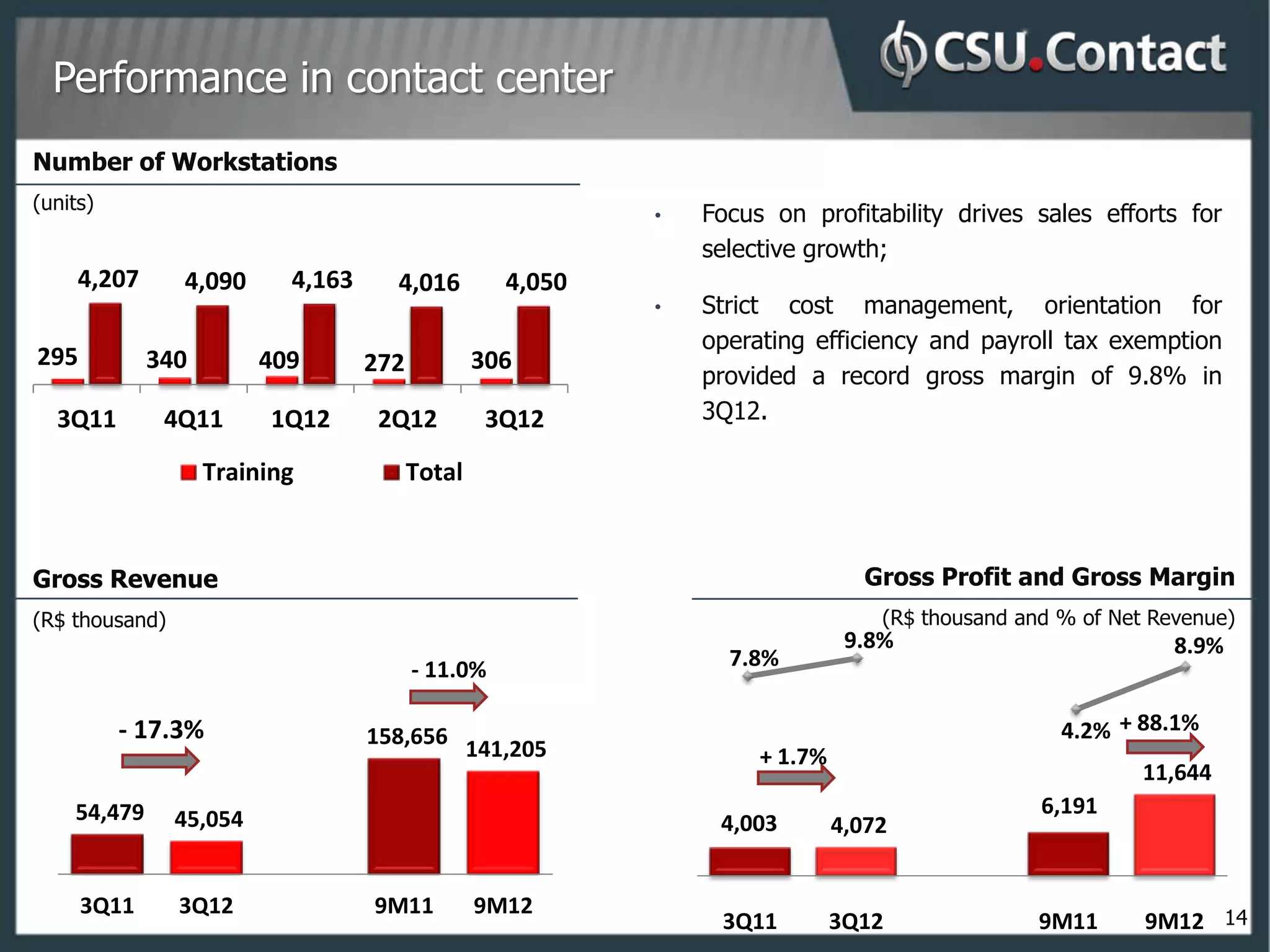

- CSU improved profitability in 3Q12 with net margin of 6.0% and EBITDA margin of 17.8%

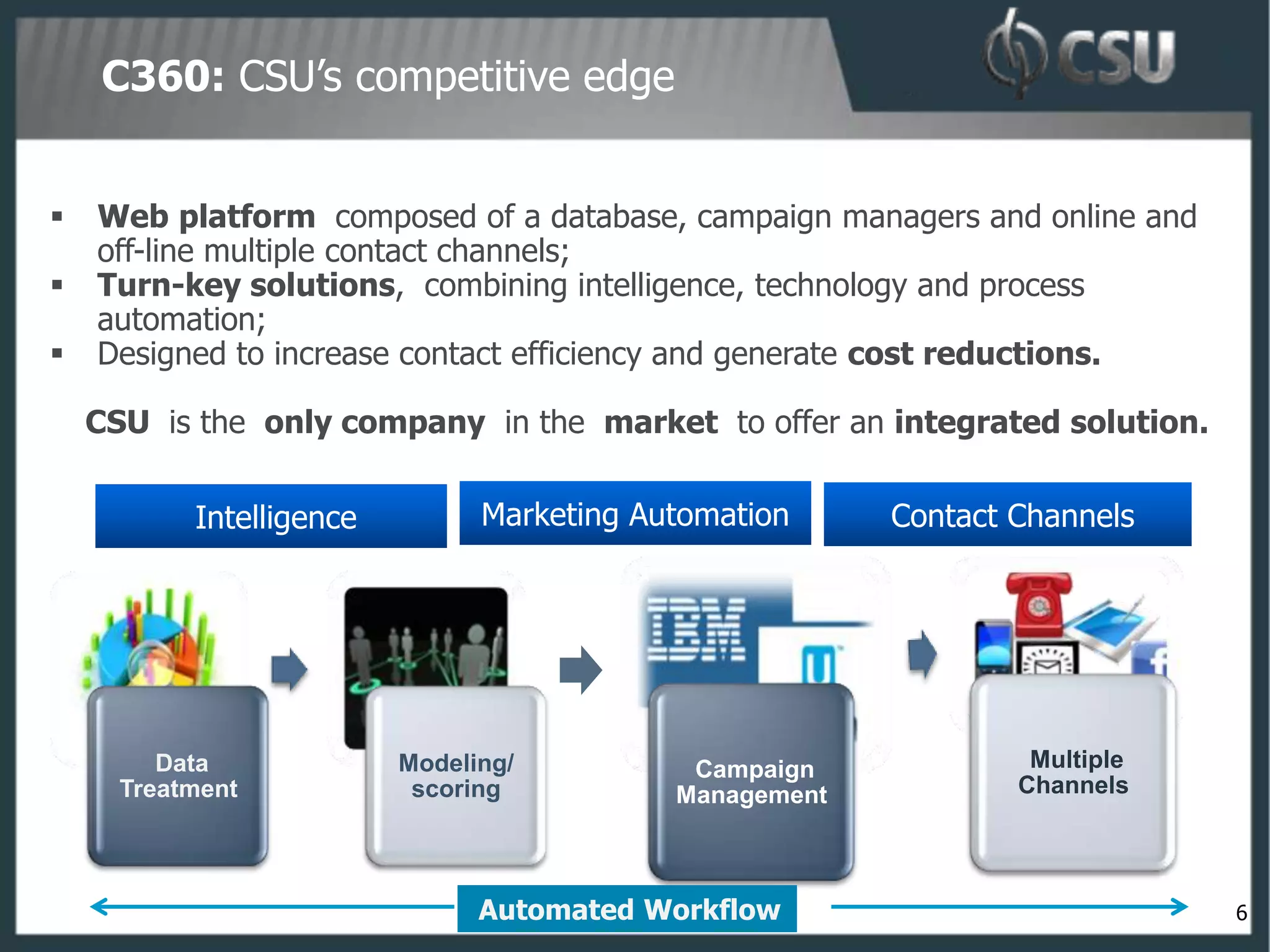

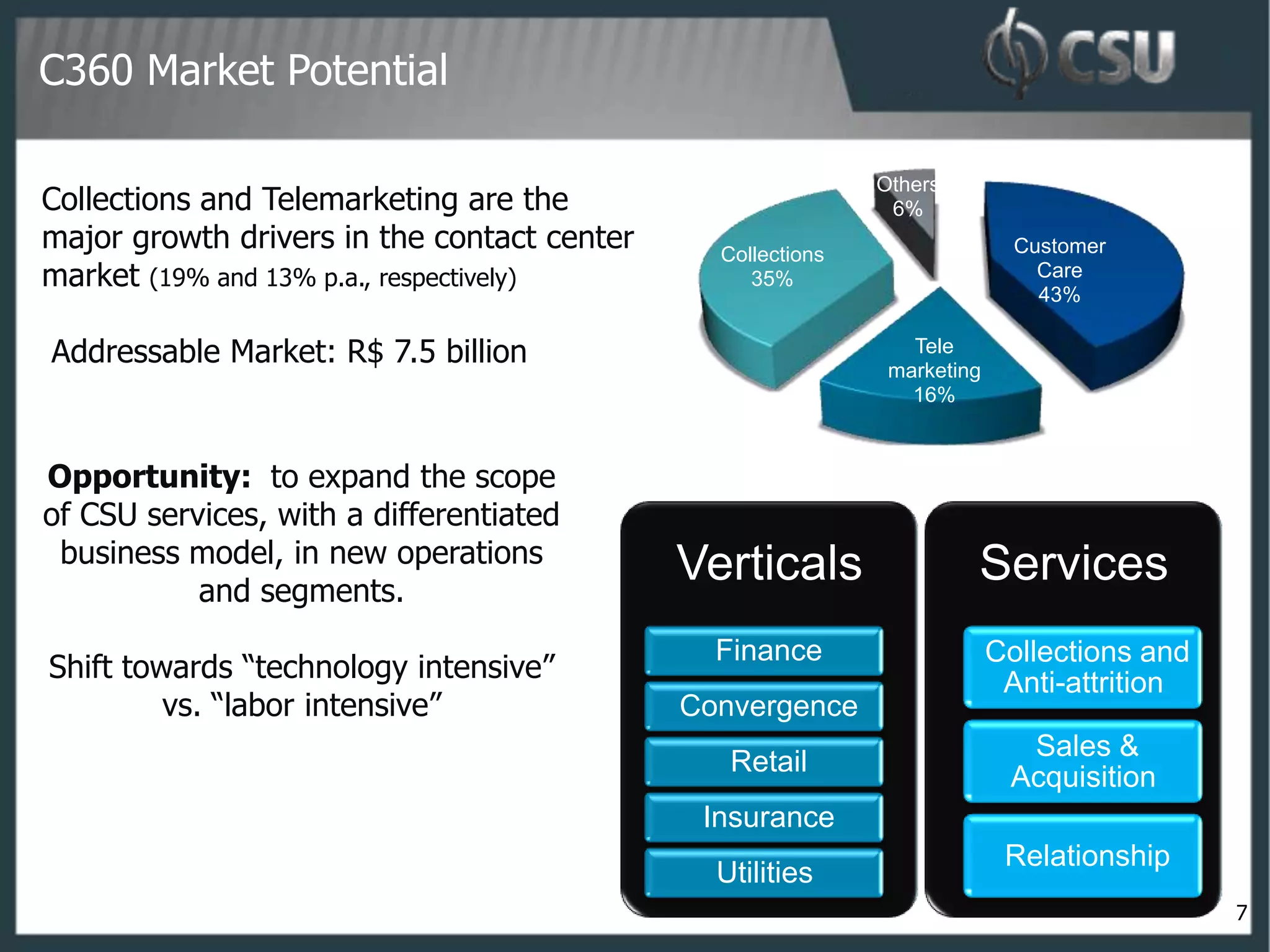

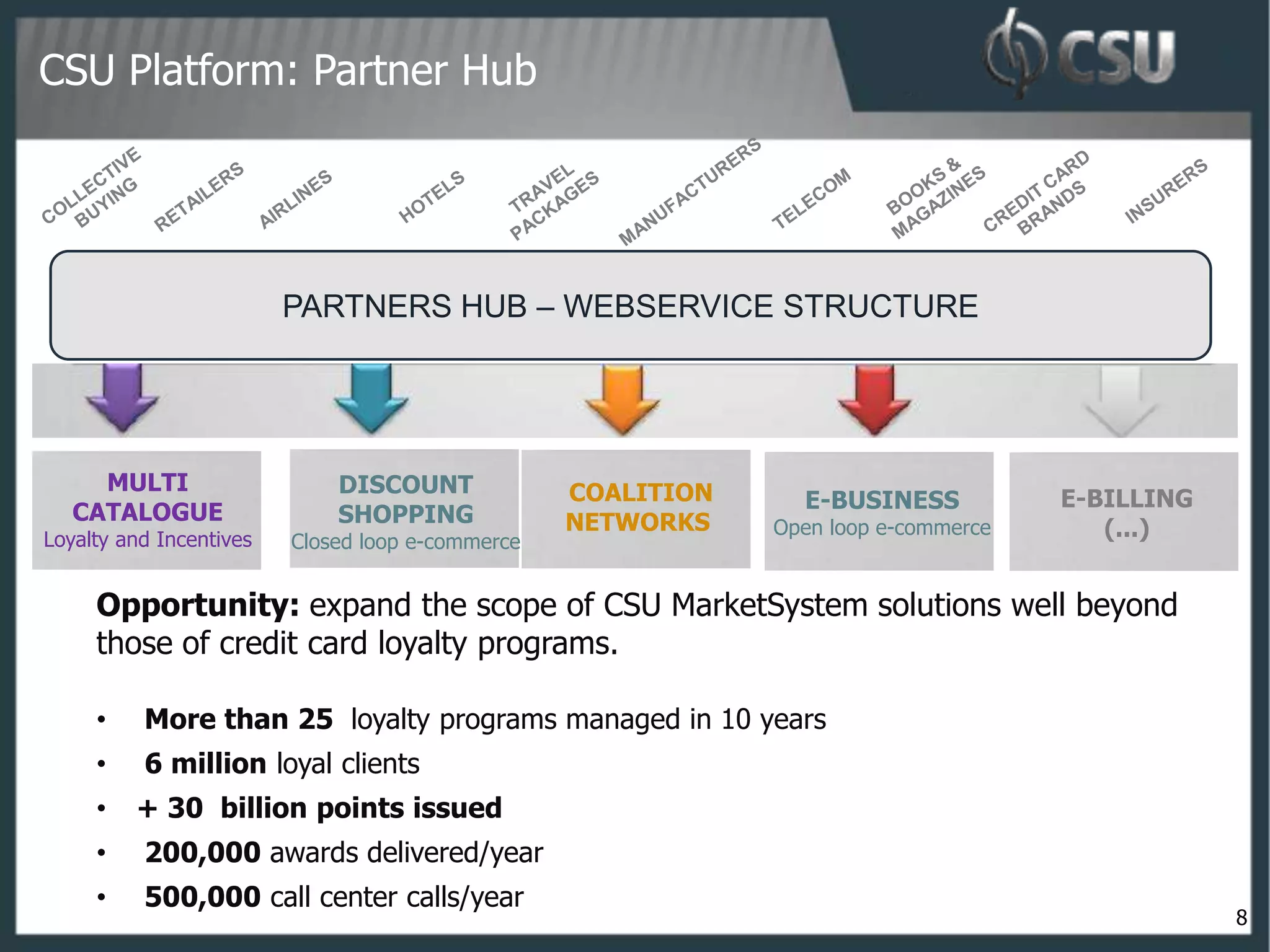

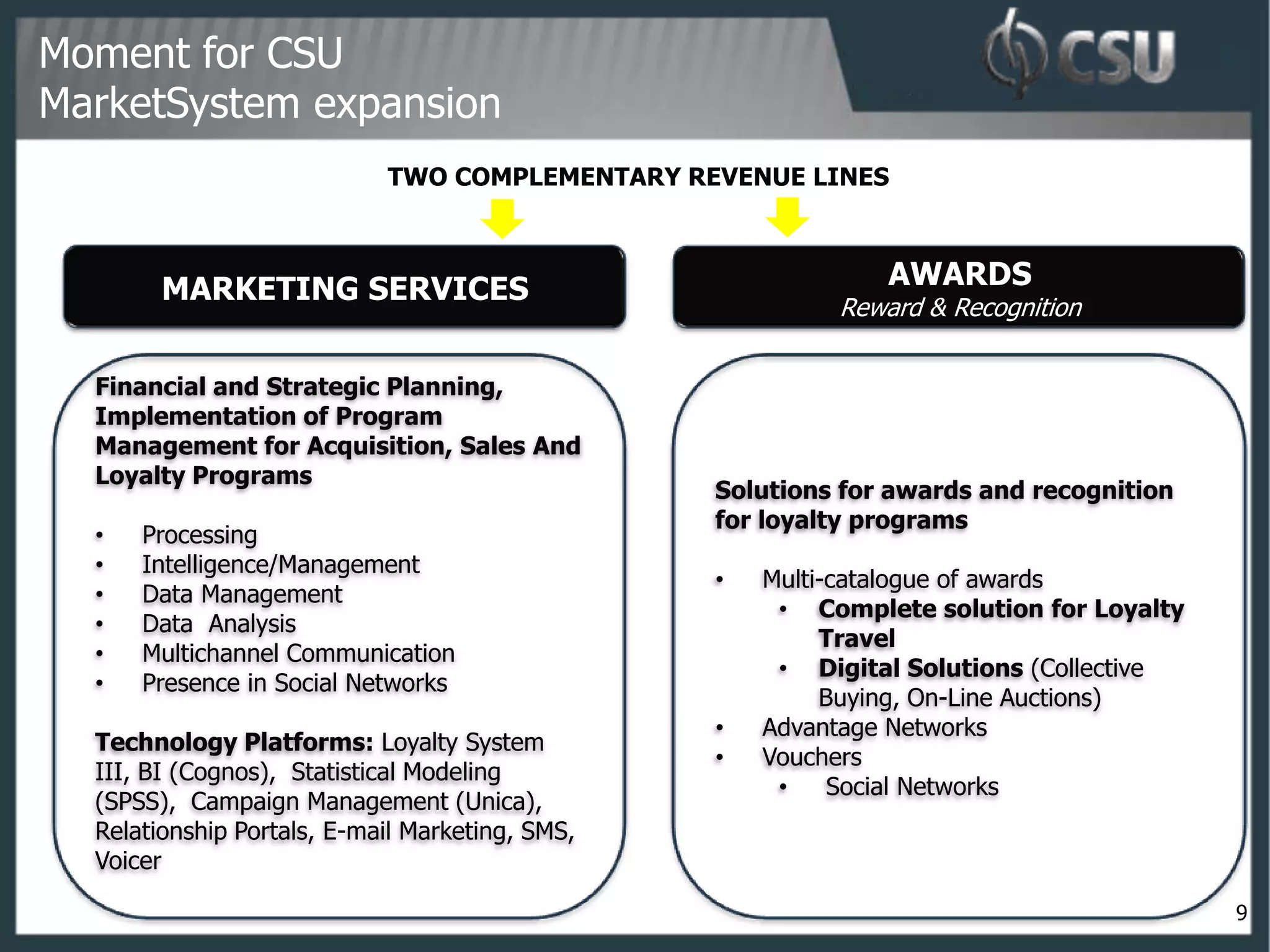

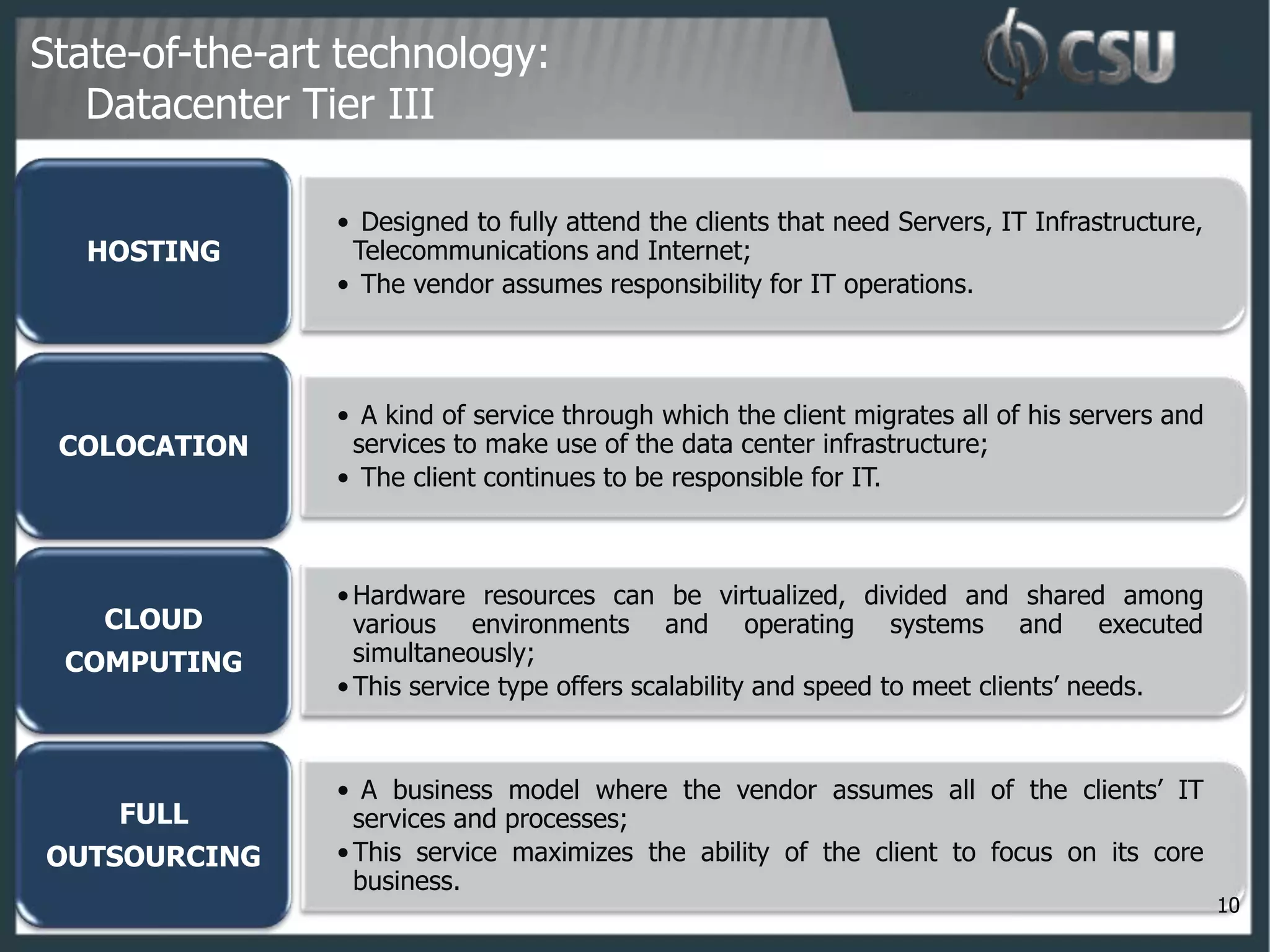

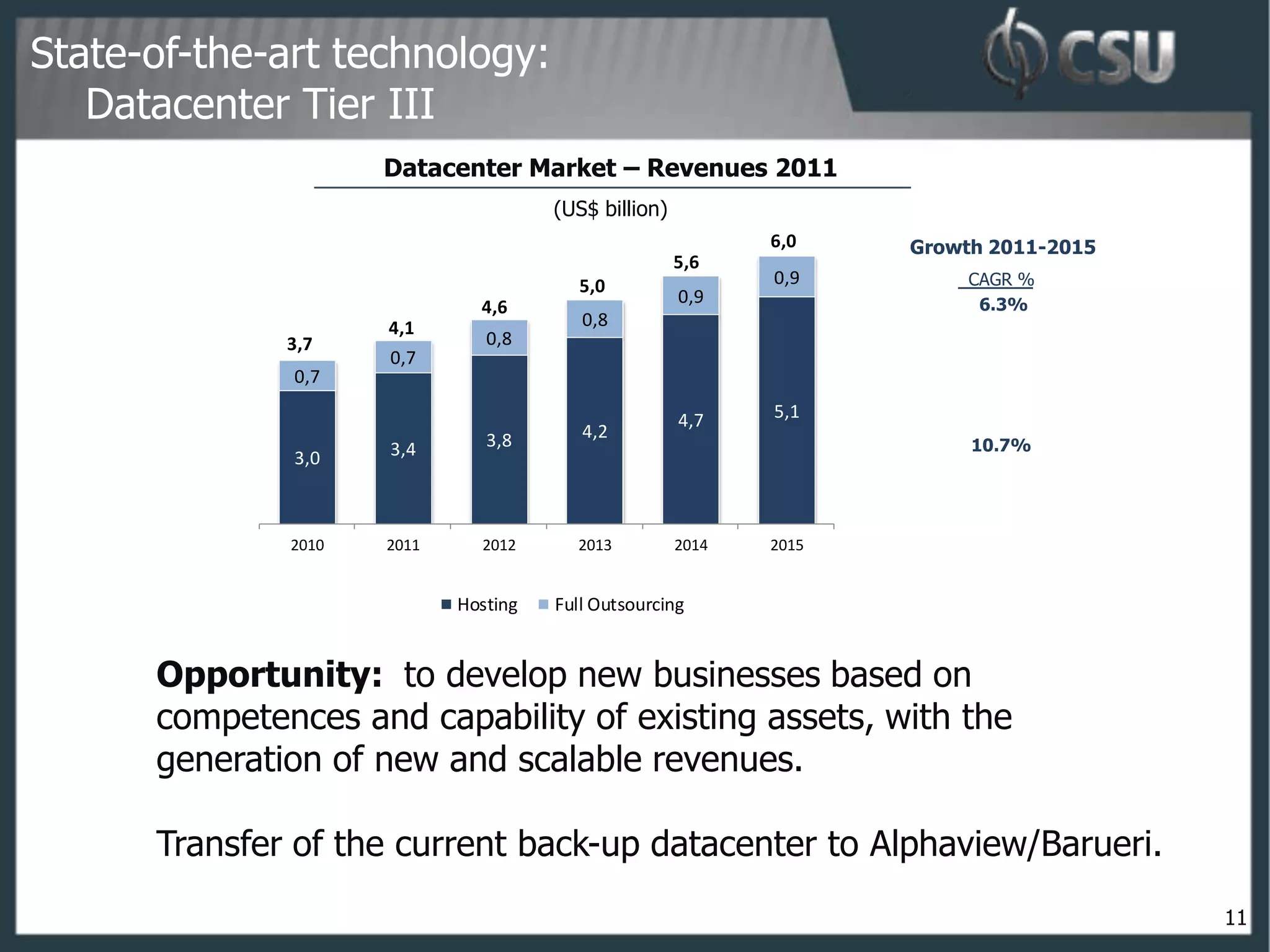

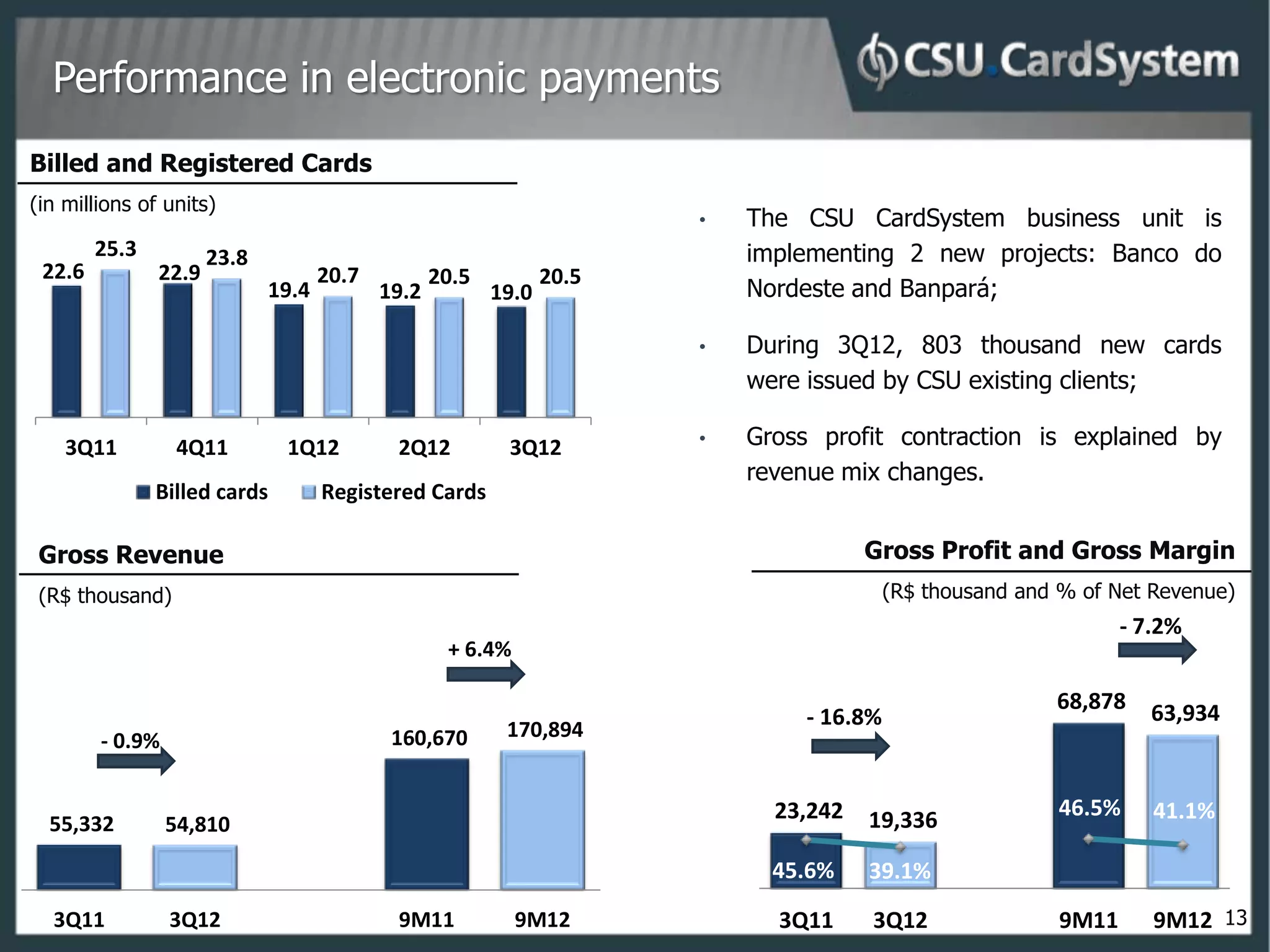

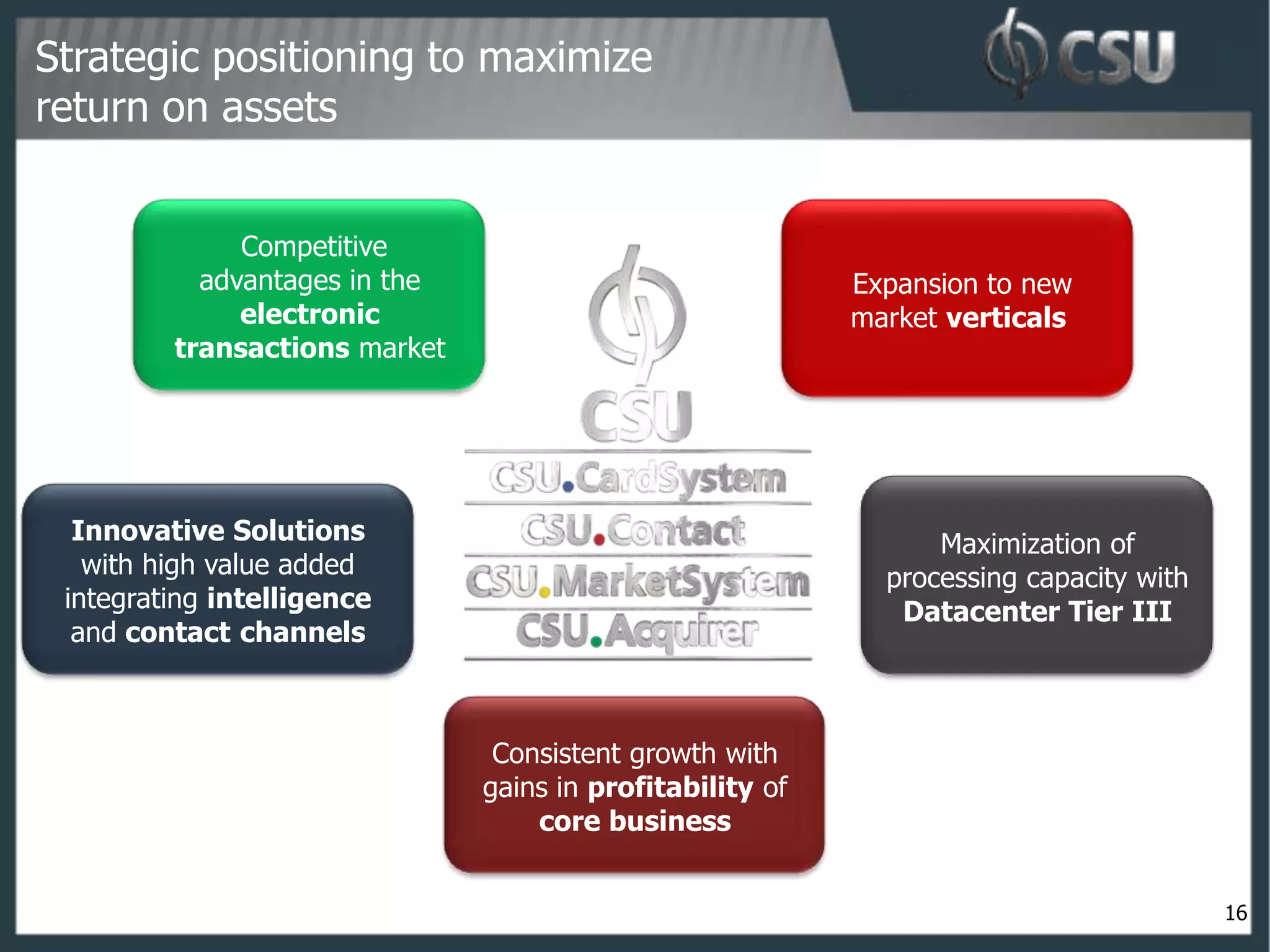

- CSU is focusing on commercial expansion to leverage existing assets and enter new markets and segments

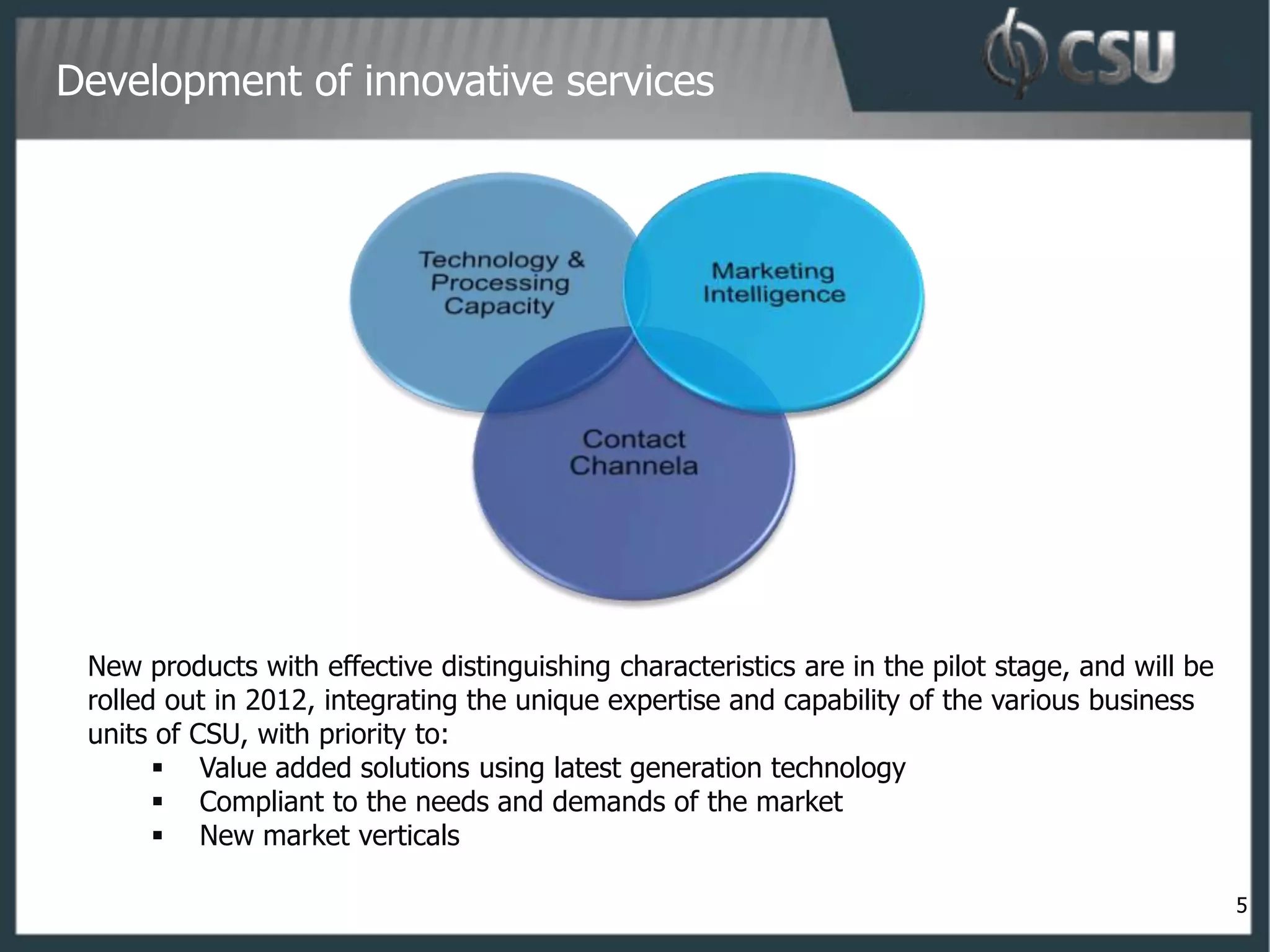

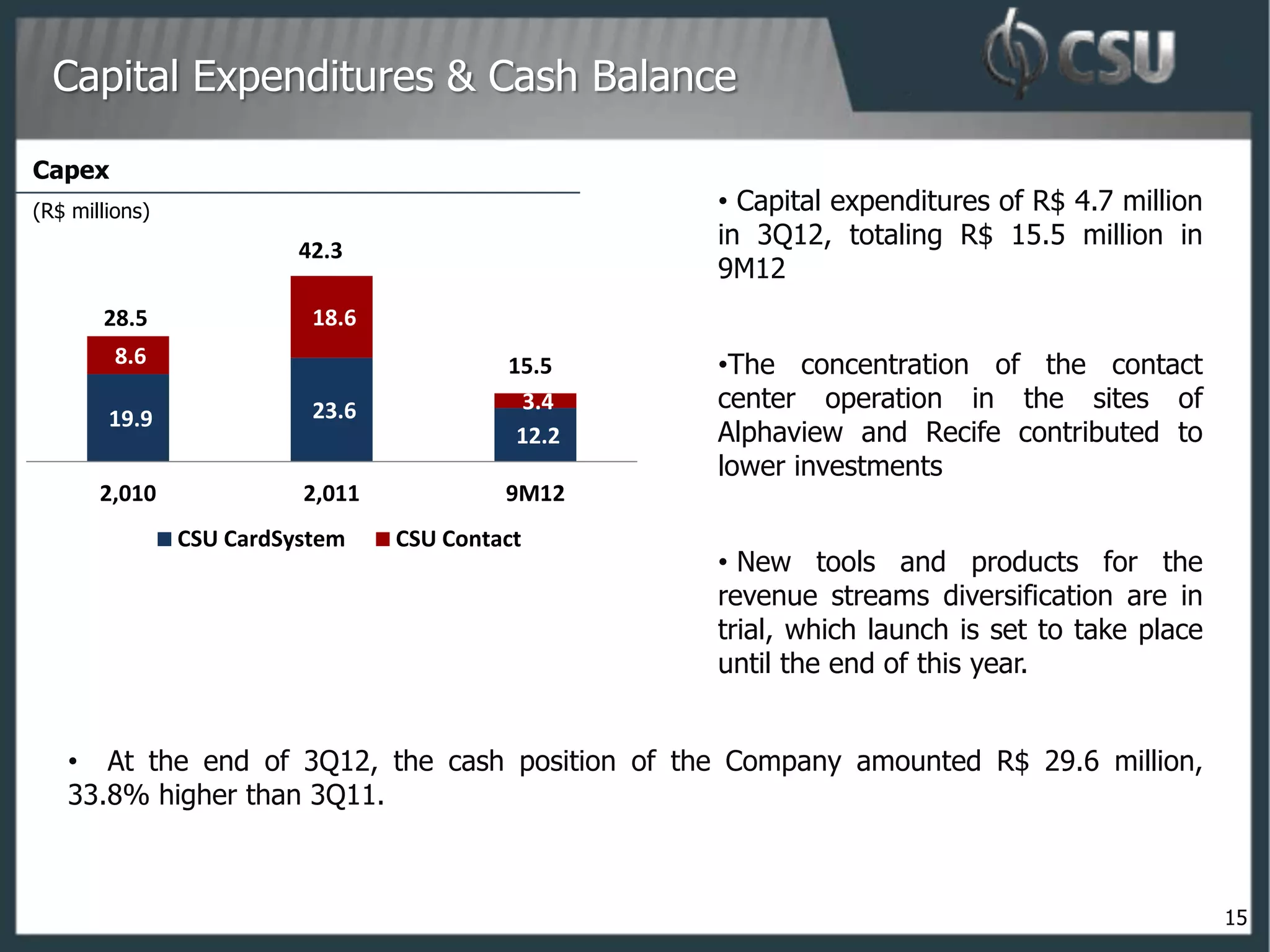

- CSU aims to launch new high-technology products with profitability by the end of 2012 to drive growth