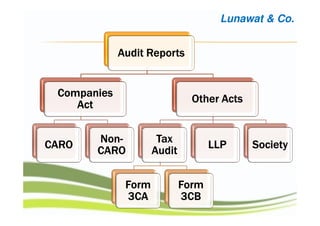

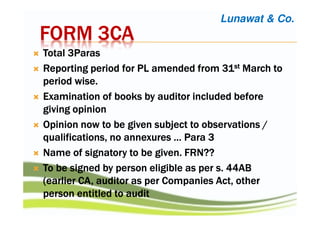

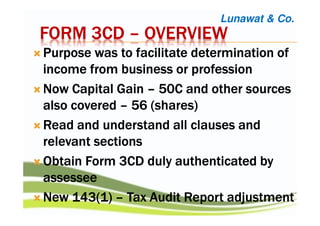

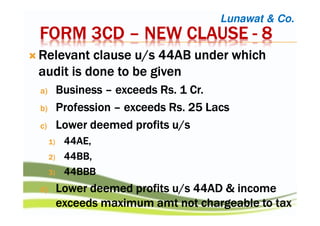

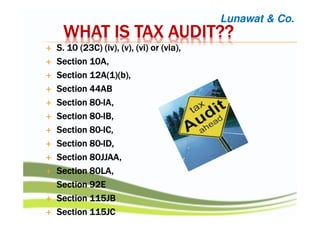

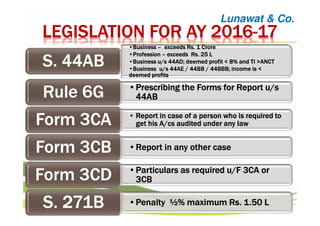

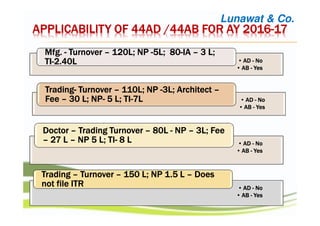

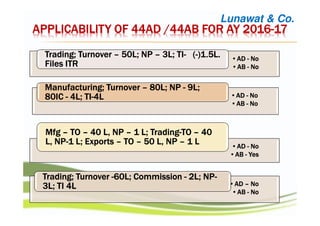

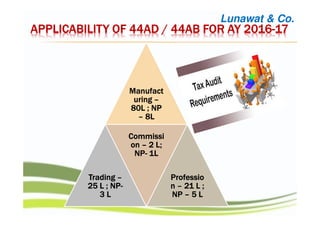

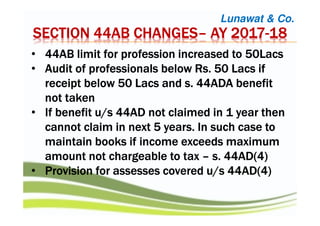

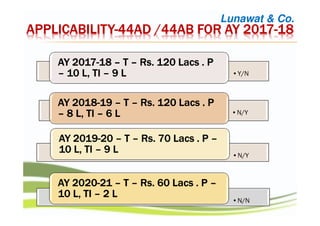

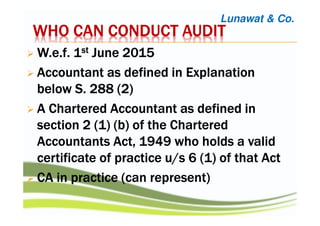

This document provides information about tax audits in India. It defines what a tax audit is and which sections of the Income Tax Act trigger the requirement for a tax audit. It outlines the legislation for the assessment year 2016-17 regarding forms and penalties related to tax audits. It discusses the applicability of sections 44AD and 44AB for various business scenarios. It also covers changes to section 44AB limits for the assessment years 2017-18 onwards and who is authorized to conduct a tax audit.

![QUALIFICATIONQUALIFICATIONQUALIFICATIONQUALIFICATION ---- CACACACA

T.D.T.D.T.D.T.D. VenkataVenkataVenkataVenkata Rao v. Union of India [1999]Rao v. Union of India [1999]Rao v. Union of India [1999]Rao v. Union of India [1999]

237 ITR 315 (SC237 ITR 315 (SC237 ITR 315 (SC237 ITR 315 (SC):):):):

CharteredCharteredCharteredChartered Accountants, by reason of their trainingAccountants, by reason of their trainingAccountants, by reason of their trainingAccountants, by reason of their training

have special aptitude in the matter of audits. It ishave special aptitude in the matter of audits. It ishave special aptitude in the matter of audits. It ishave special aptitude in the matter of audits. It is

reasonable that they, who form a class byreasonable that they, who form a class byreasonable that they, who form a class byreasonable that they, who form a class by

themselves, should be required to audit the accountsthemselves, should be required to audit the accountsthemselves, should be required to audit the accountsthemselves, should be required to audit the accounts

of businesses…. There is no material on record andof businesses…. There is no material on record andof businesses…. There is no material on record andof businesses…. There is no material on record and

indeed in our view, there cannot be that an incomeindeed in our view, there cannot be that an incomeindeed in our view, there cannot be that an incomeindeed in our view, there cannot be that an income----

tax practitioner has the same expertise as charteredtax practitioner has the same expertise as charteredtax practitioner has the same expertise as charteredtax practitioner has the same expertise as chartered

accountants in the matter of accounts. …and it mustaccountants in the matter of accounts. …and it mustaccountants in the matter of accounts. …and it mustaccountants in the matter of accounts. …and it must

be pointed out that these incomebe pointed out that these incomebe pointed out that these incomebe pointed out that these income----tax practitionerstax practitionerstax practitionerstax practitioners

are still entitled to be authorised representatives ofare still entitled to be authorised representatives ofare still entitled to be authorised representatives ofare still entitled to be authorised representatives of

assesseesassesseesassesseesassessees.”

Lunawat & Co.](https://image.slidesharecdn.com/criticalissuesintaxaudit-janakpuri-160921105620/85/Critical-issues-in-Tax-Audit-12-320.jpg)