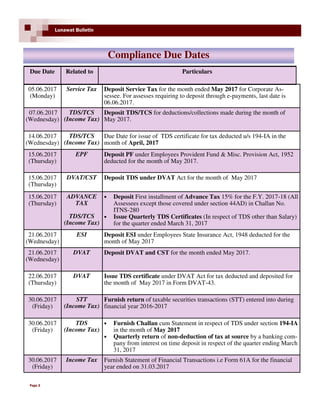

The document provides an update on market trends, including the Sensex and Nifty indices as of May 31, 2017. It highlights compliance due dates for various tax submissions and the importance of linking Aadhaar with PAN for income tax purposes. Additionally, it discusses changes in banking practices allowing account number portability and outlines penalties related to benami transactions.