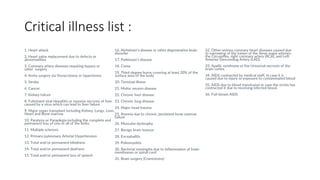

A critical illness policy provides financial protection against life-threatening diseases and offers greater payouts than traditional health insurance, which can be used for various expenses. The document outlines a comprehensive list of critical illnesses covered, including heart attack, cancer, stroke, paralysis, and several degenerative conditions. This insurance is crucial for managing the financial impact of severe health conditions.