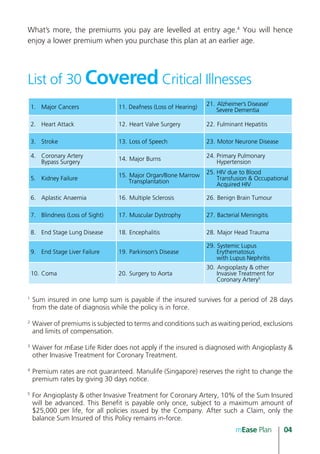

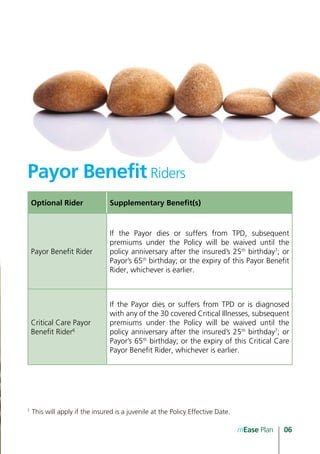

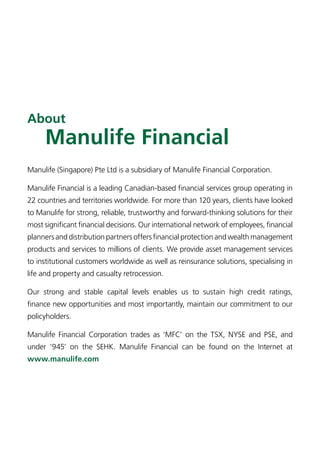

The document provides information about the mEase critical illness insurance plan from Manulife Singapore. The plan provides coverage for 30 critical illnesses as well as coverage for total and permanent disability and death. It pays out a lump sum upon diagnosis of a covered critical illness. Optional riders are available to waive premiums if the policyholder is diagnosed with a critical illness or becomes disabled. The plan also allows policyholders to convert the plan to other insurance products from Manulife without providing additional health information before age 65.