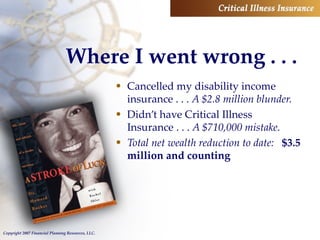

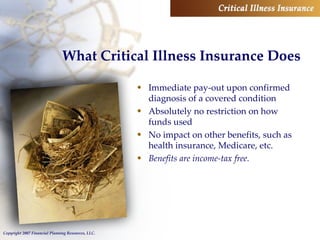

The document discusses the financial risks associated with health crises, highlighting that traditional health insurance often does not cover indirect costs and may lead to bankruptcy. It presents a case study of Dr. Howard Rocket, who faced significant expenses due to a stroke, totaling over $3.5 million in economic losses, exacerbated by the lack of critical illness insurance. Critical illness insurance is proposed as a solution, providing immediate financial support upon diagnosis of covered conditions without restrictions on their use.