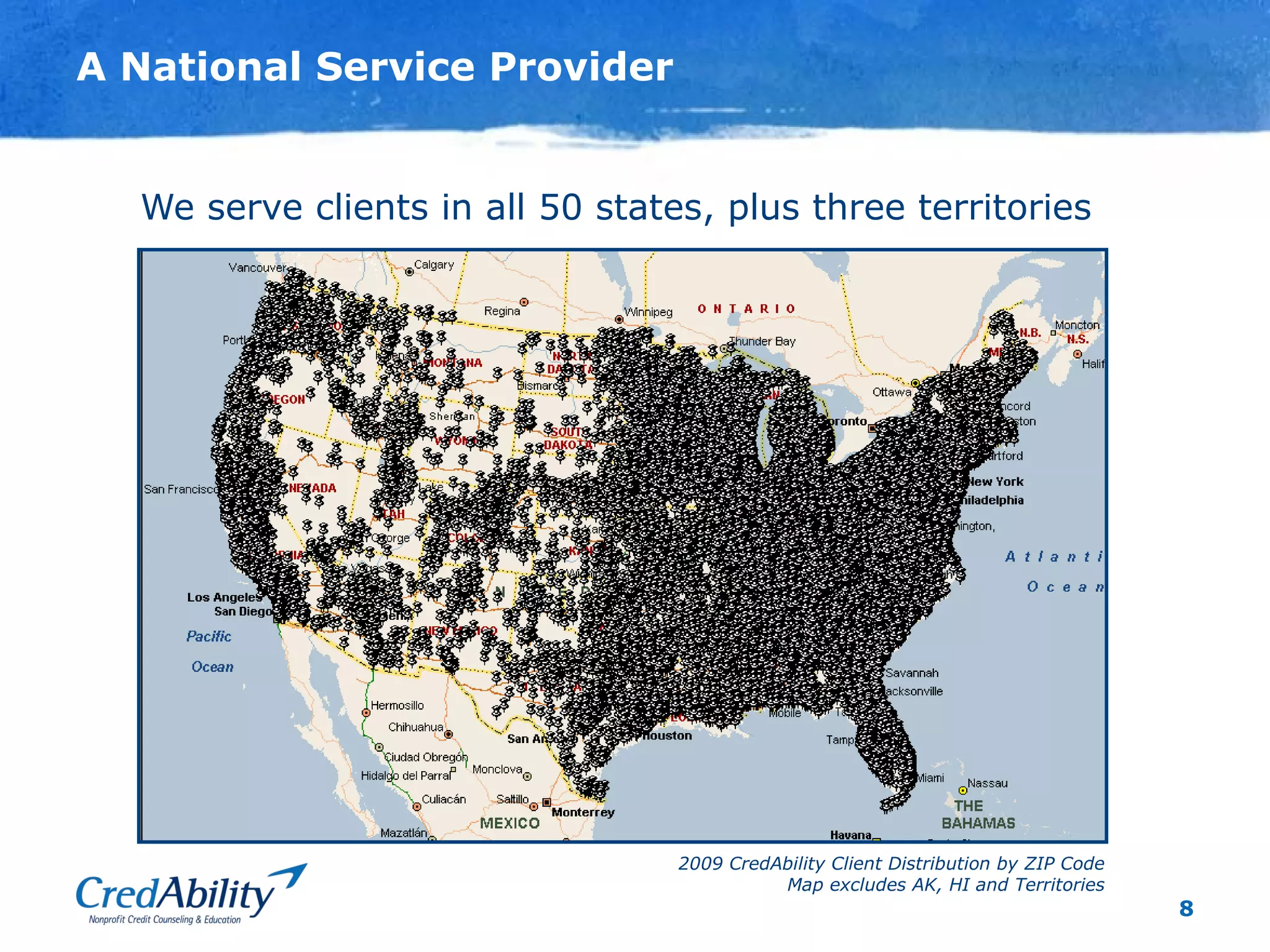

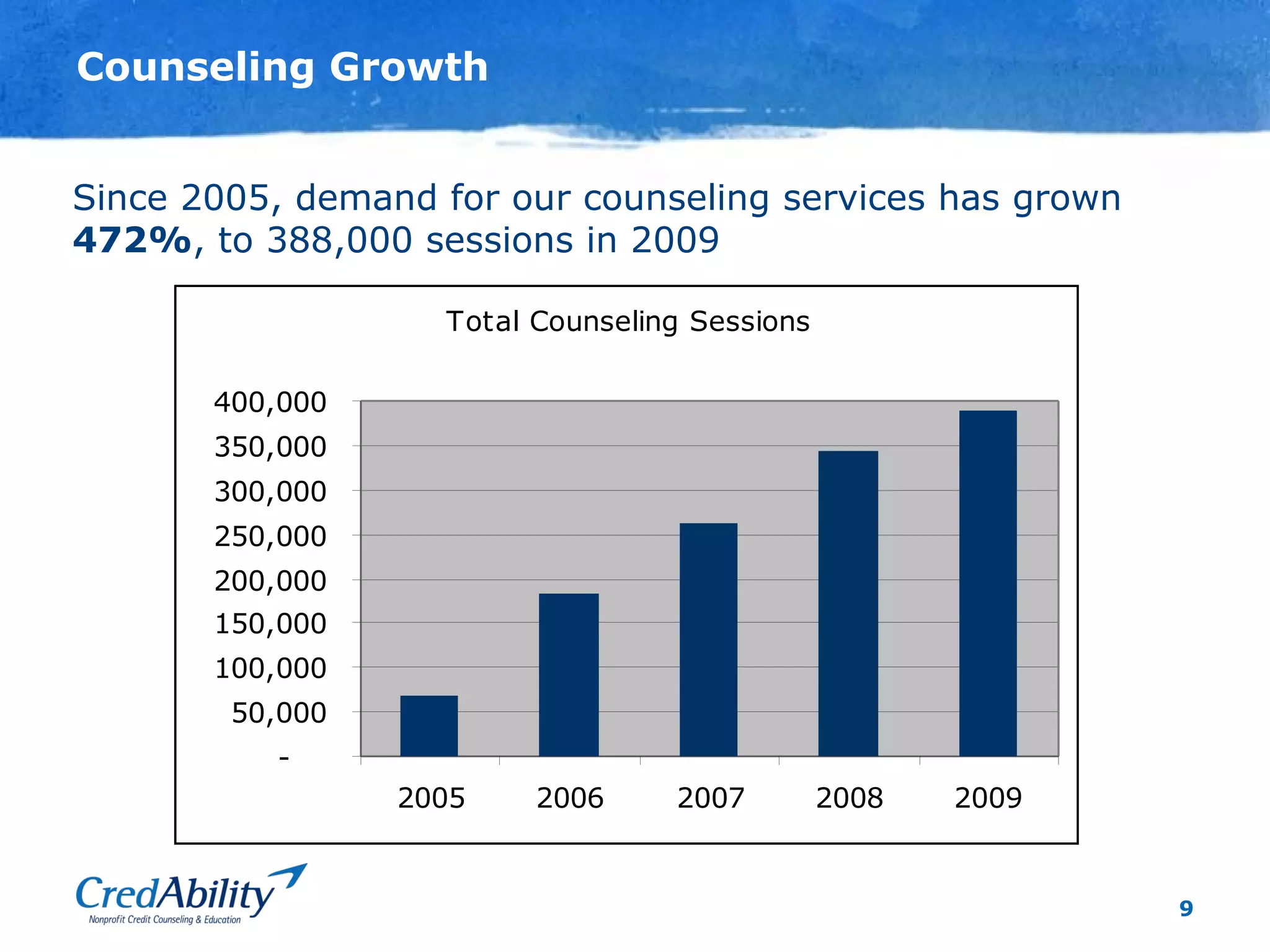

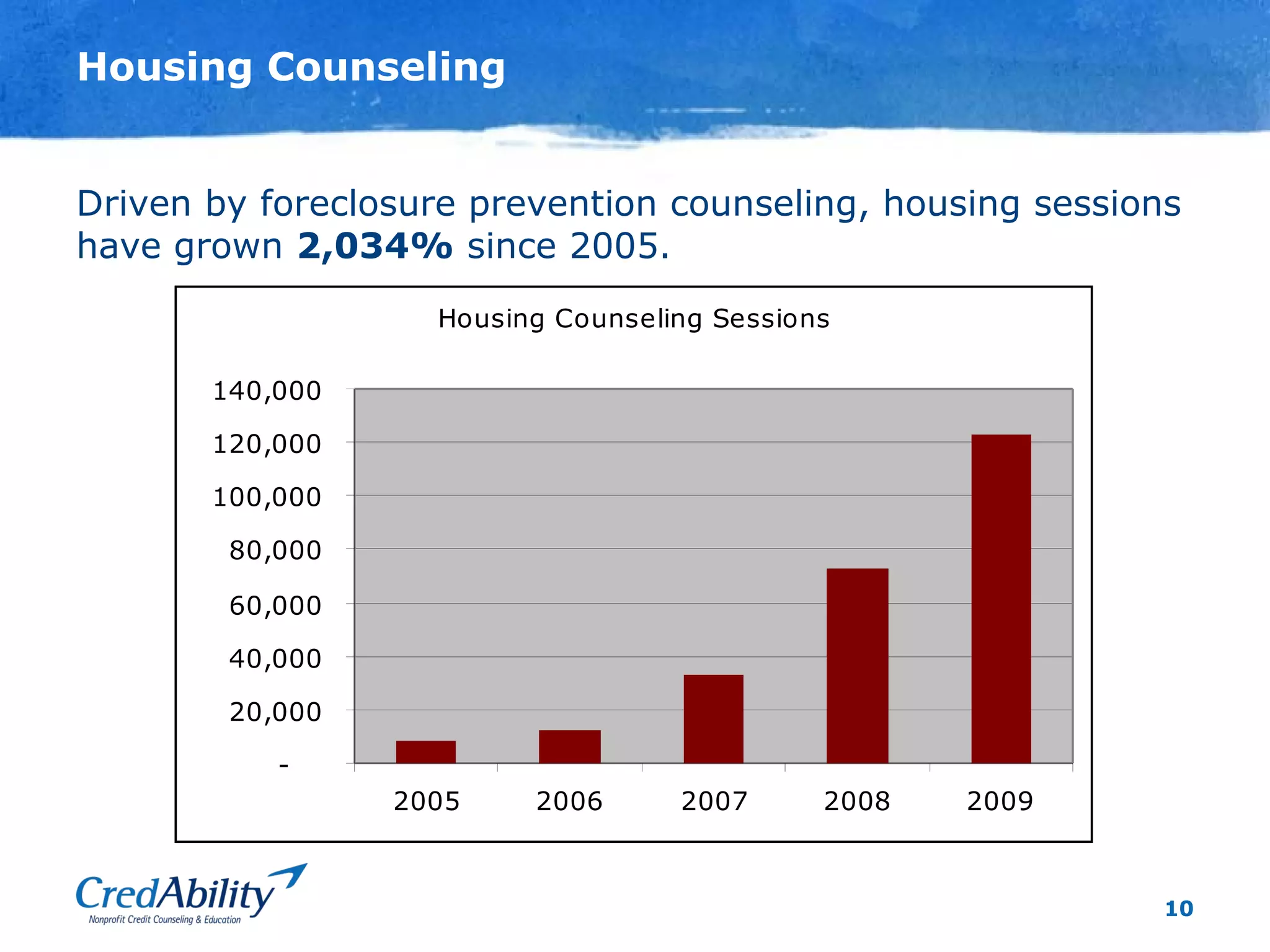

CredAbility was formerly known as Consumer Credit Counseling Service of Greater Atlanta. It is a nonprofit organization providing financial counseling services to help individuals and families in need. CredAbility assists over 1 million clients annually with services such as housing counseling, budget and credit counseling, debt management plans, education, and bankruptcy assistance. It has experienced significant growth in counseling sessions, especially for housing-related issues. Research shows clients improve their financial confidence and most are able to avoid foreclosure after receiving CredAbility's counseling.