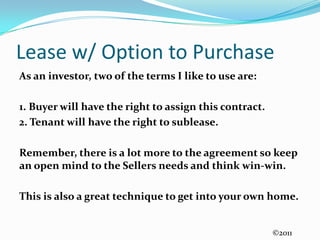

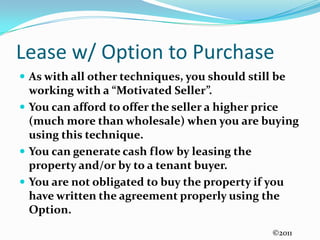

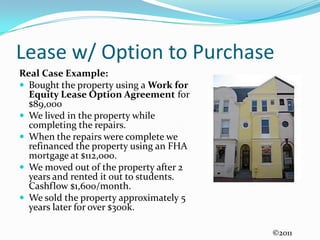

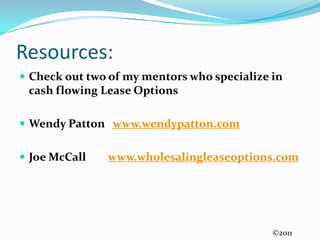

Angela Benjamin shares her experiences in real estate investing, emphasizing the importance of creative financing strategies like lease options. She encourages aspiring investors to think outside the box, learn from both new and old masters, and focus on solutions that work for their unique situations. The document outlines various problems that can arise in real estate transactions and suggests innovative techniques to navigate these challenges effectively.