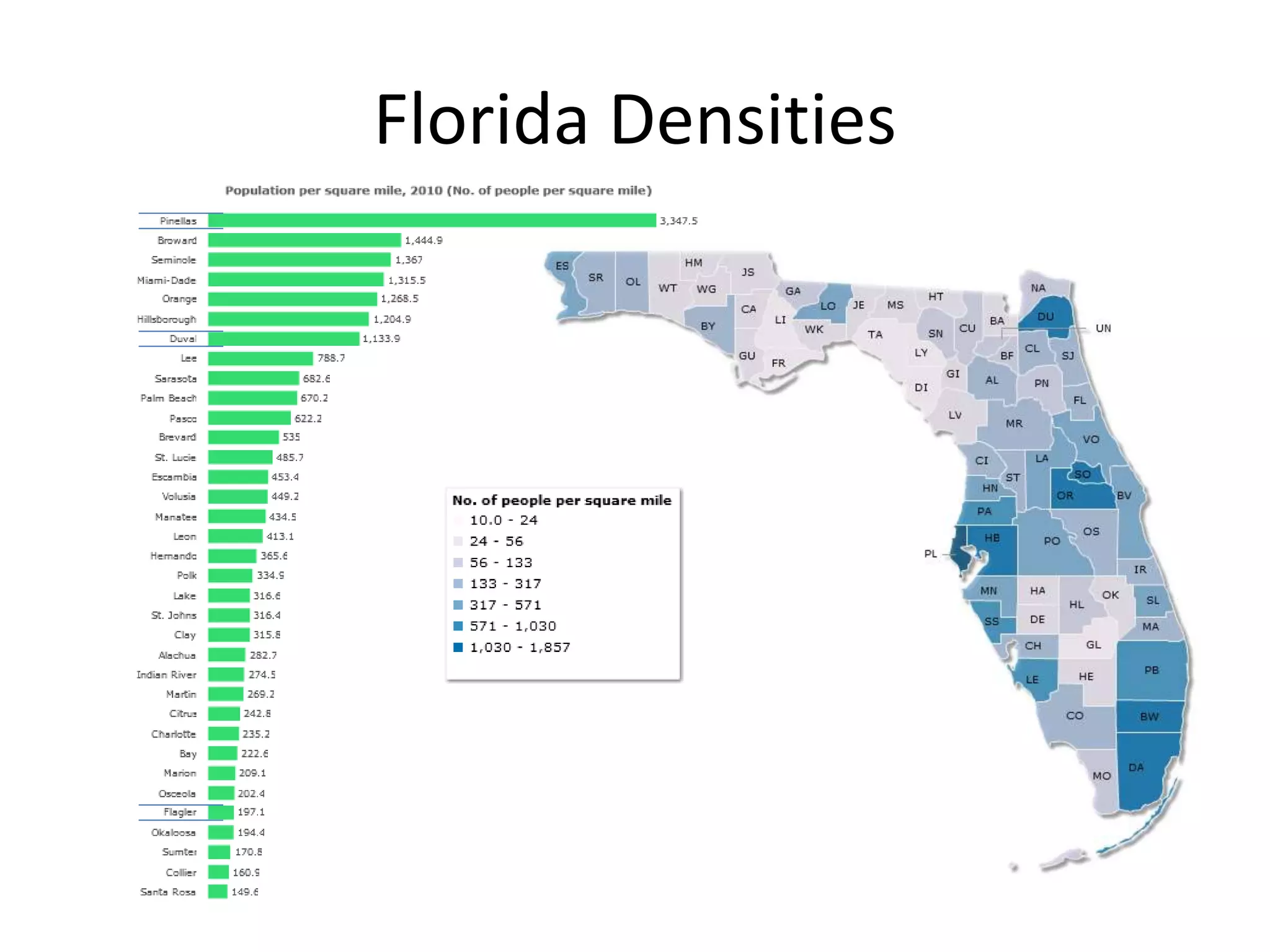

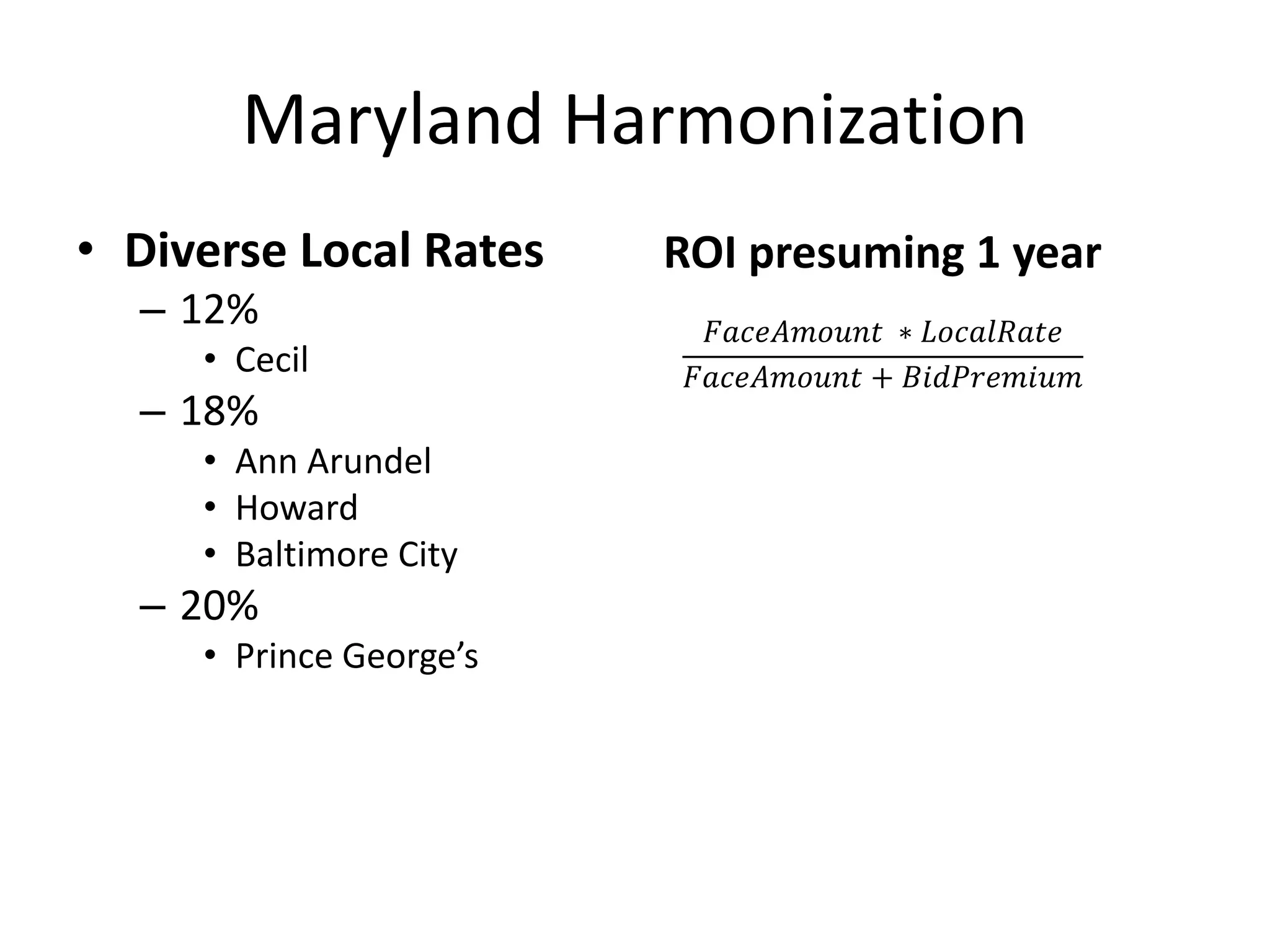

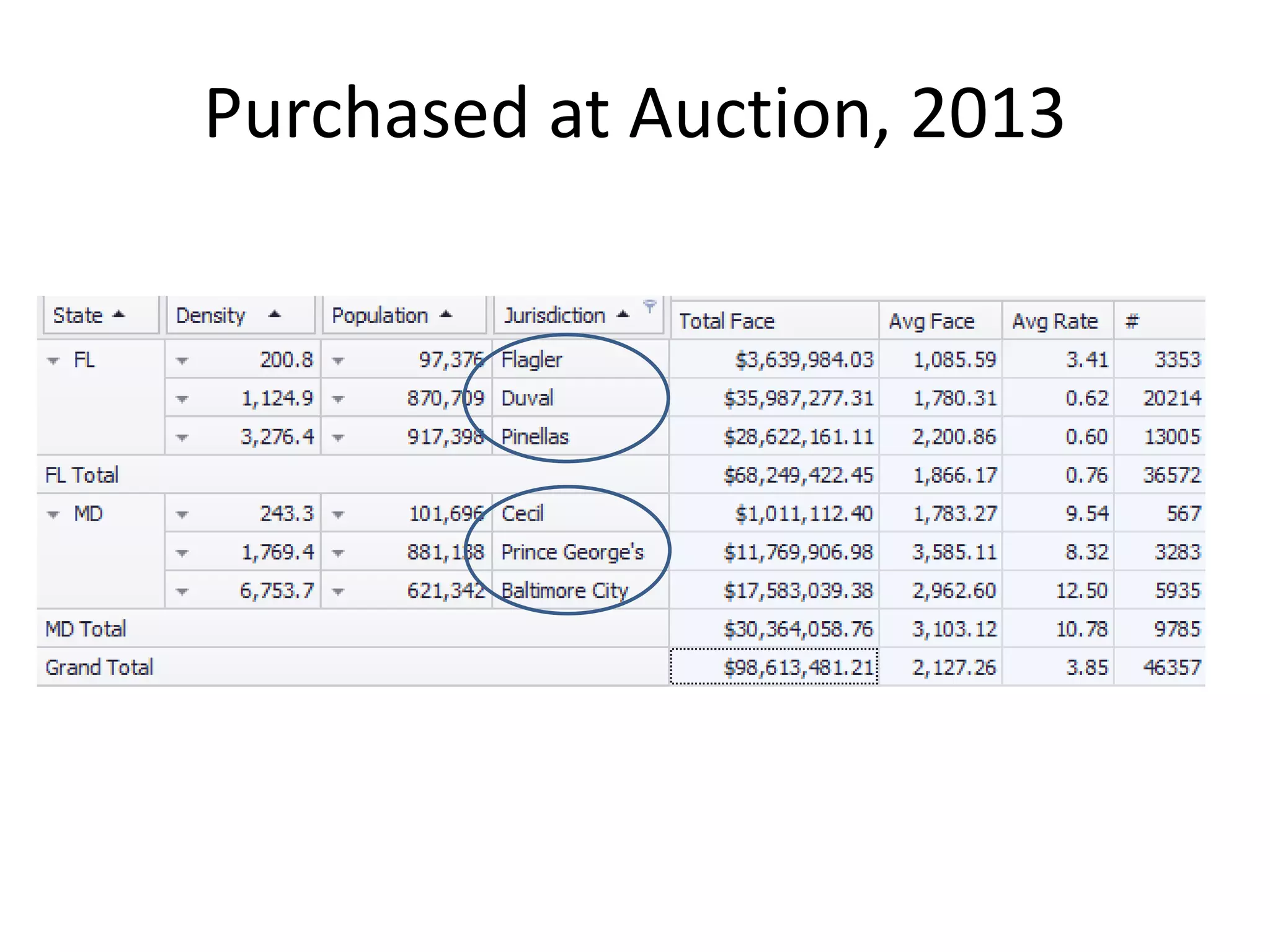

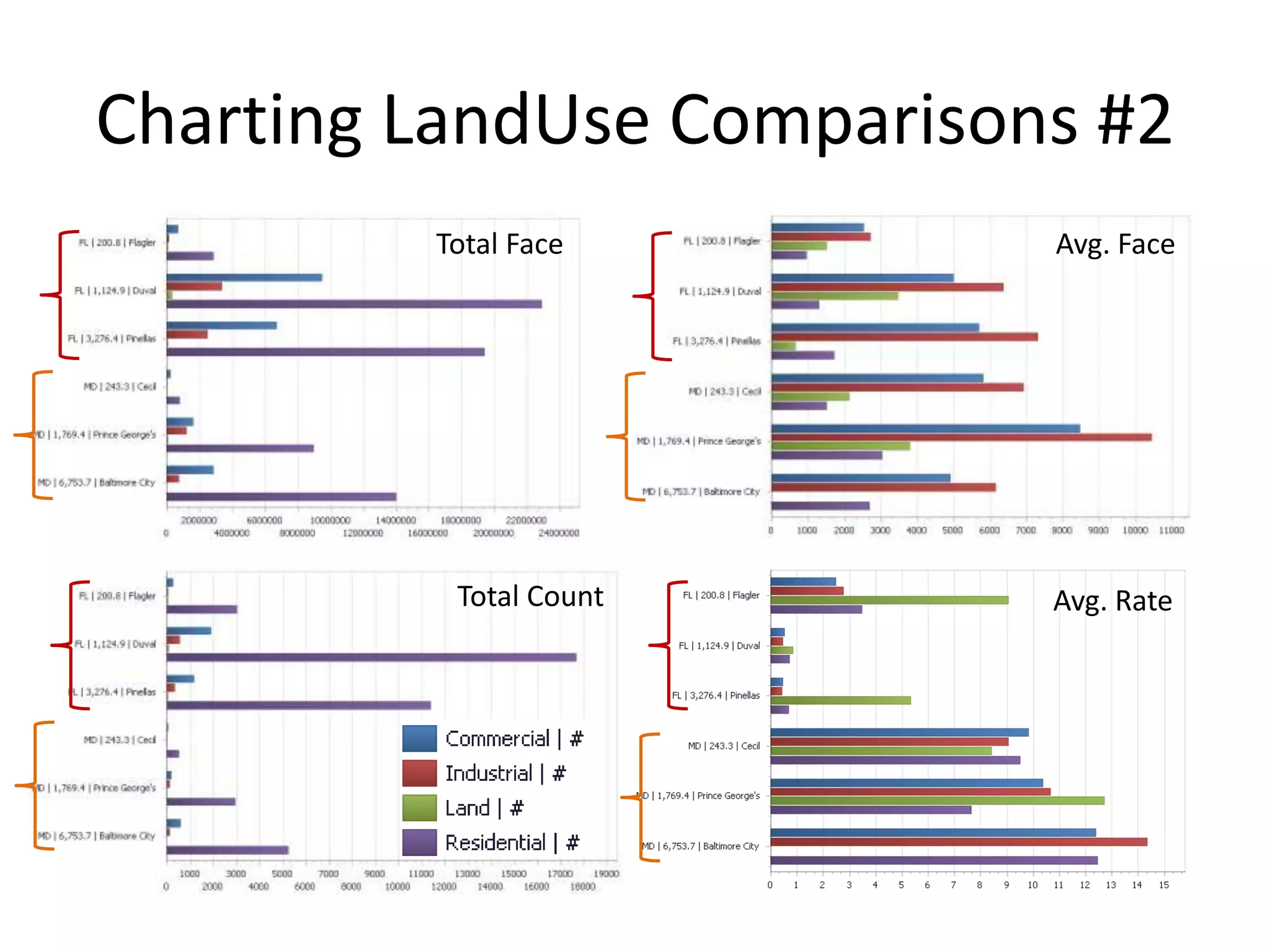

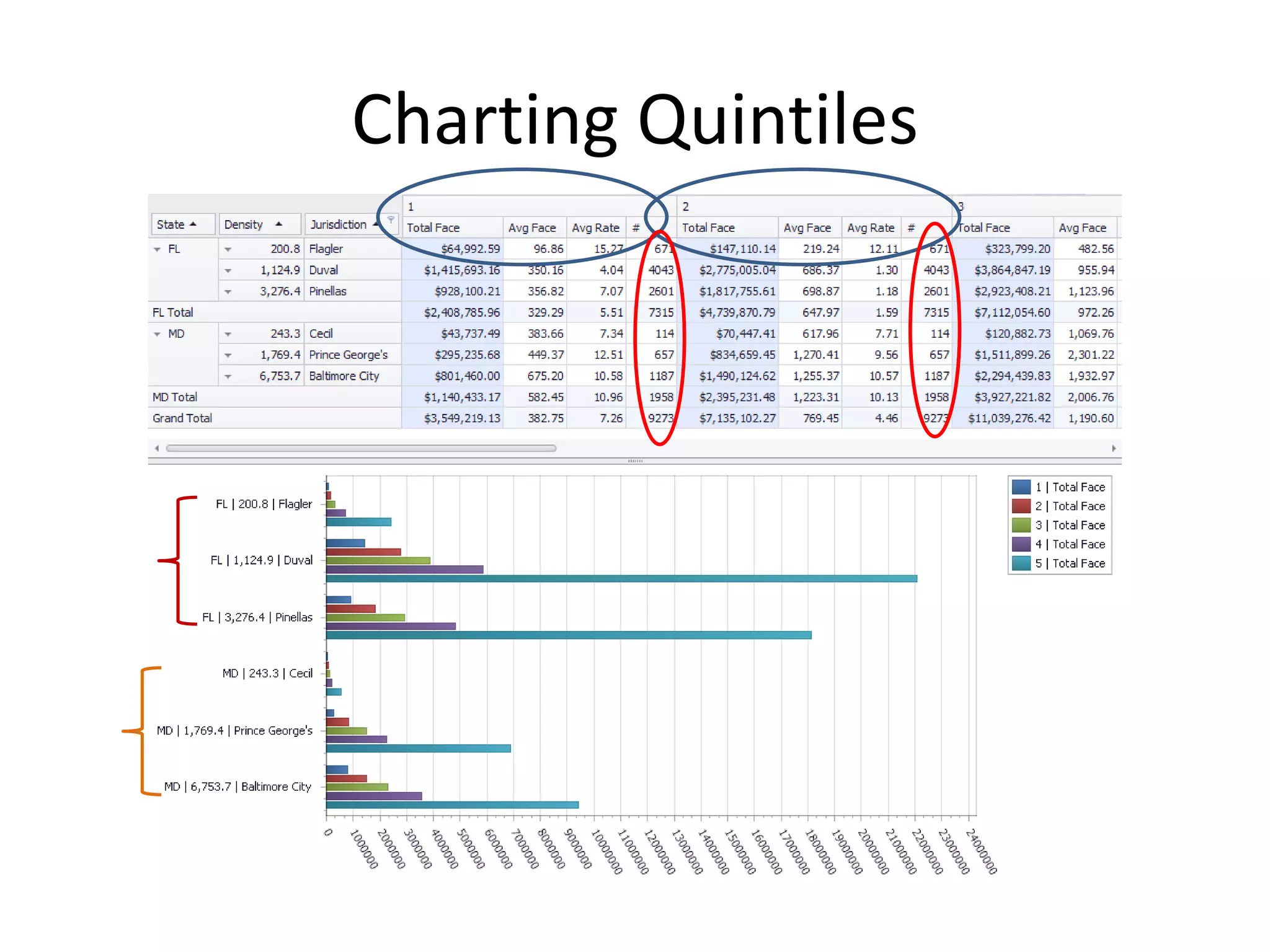

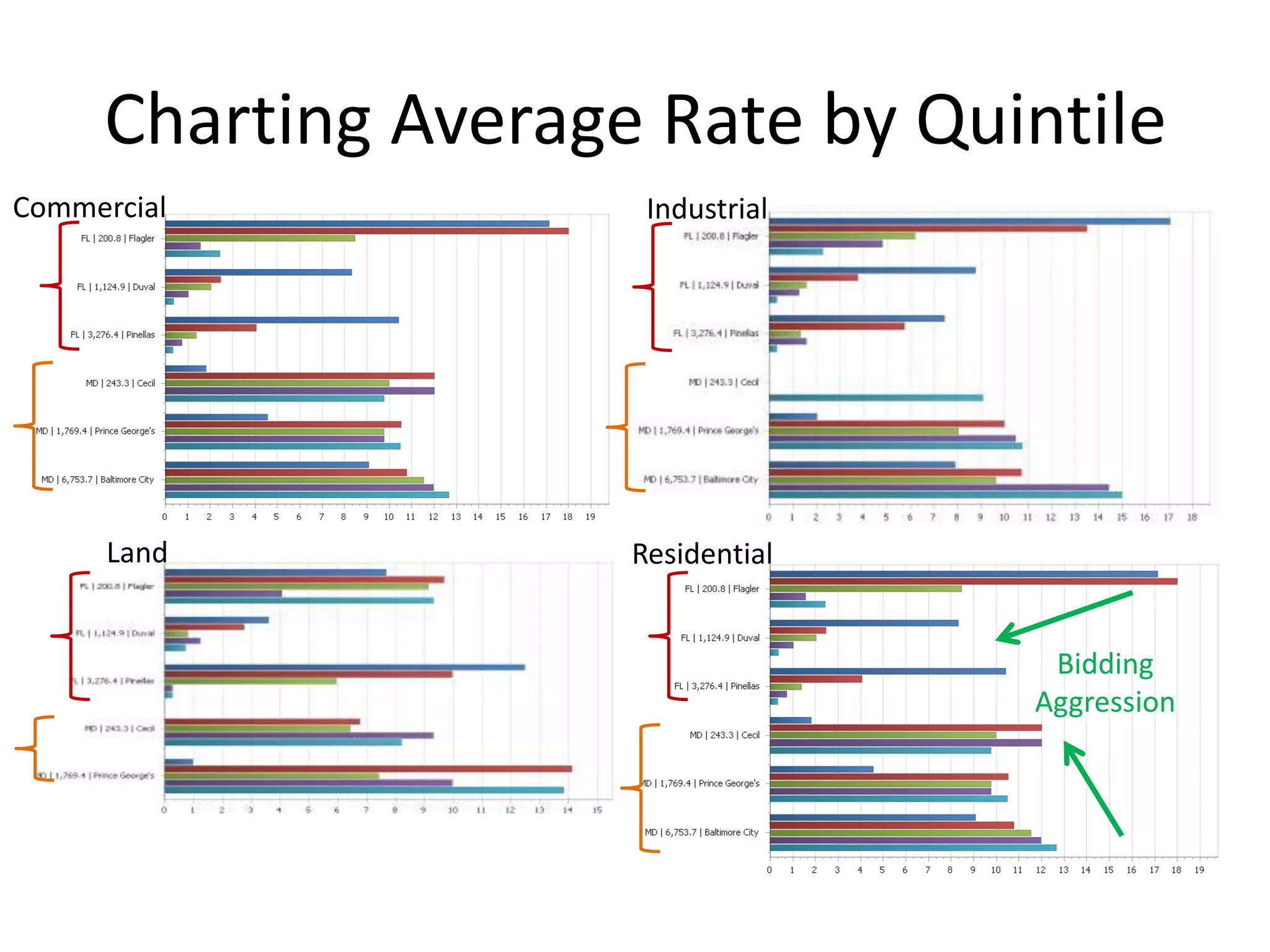

The document analyzes tax lien certificate policies across various U.S. states and localities to identify effective models for local residents, investors, and tax lien delinquents. It emphasizes the need for comparative metrics, integration of property information, and analysis of bidding behavior to improve tax lien outcomes. Key findings include diverse local rates and the influence of land use on bidding aggression and lien redemption.