Download 15-Module Consumer Finance Guide

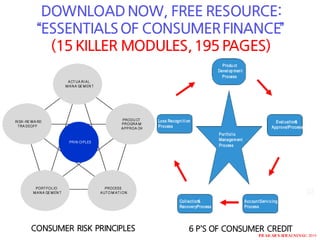

- 1. 02 DOWNLOAD NOW, FREE RESOURCE: “ESSENTIALS OF CONSUMERFINANCE” (15 KILLER MODULES, 195 PAGES) ACTUA RI AL MANA GE MEN T PRIN CI PLES PRODU CT PROGRA M APPROA CH PROCESS AUTO M ATI ON PORTFOL IO MANA GE MEN T RI SK-RE WA RD TRA DEOFF Produ ct Devel op ment Process Portfol io Management Process Eval uation& ApprovalProcess AccountServicing Process Coll ection& RecoveryProcess Loss Recogni ti on Process 6 P’S OF CONSUMER CREDITCONSUMER RISK PRINCIPLES PR AKAR S ATRAI NING© 2019

- 2. PR AKAR S ATRAI NING© 2019 FREE RESOURCE INTRODUCTIONTO CONSUMER CREDIT RISK MANAGEMENT

- 3. ©2019 Prakarsa Training 3 6 P’S OF CONSUMER CREDIT Product Development Process Portfolio Management Process Evaluation& ApprovalProcess AccountServicing Process Collection& RecoveryProcess Loss Recognition Process

- 4. ©2019 Prakarsa Training 4 CONSUMER LENDINGCHARACTERISTIC Large Customer base Large volume, small loans Products tied to customer life cycle needs Reliant on indirect business sourcing Limited/poor financial data available Process dependent, volume approval process Portfolio management by aggregate performance statistics

- 5. ©2019 Prakarsa Training 5 COMMONRISKS FOR CONSUMERLENDINGBUSINESSES Credit/Direct Lending Risk Documentation Risk Operation/Process Risk System Risk Fraud Risk Collateral Risk Interest Rate Risk Legal/Regulatory Risk Political (Sovereign) Risk Disaster/Even Risk

- 6. PR AKAR S ATRAI NING© 2019 FREE RESOURCE CONSUMERCREDIT RISK ManagementPrinciples

- 7. ©2019 Prakarsa Training 7 CONSUMER CREDIT RISK MANAGEMENTPRINCIPLES Actuarial Management Product Program Approach Process Automation Portfolio Management Risk And Reward Trade-off

- 8. ©2019 Prakarsa Training 8 ACTUARIAL MANAGEMENT Based upon actuarial methods, statistical quantification of probabilities Reliable and precise quantification of repayment probabilities and credit-worthiness Attempt to predict overall profit and loss but not individual loss A tool to maximize risk/reward

- 9. ©2019 Prakarsa Training 9 PRODUCTPROGRAM APPROACH An effective management tool to prevent subsequent problems The program analyzes all the key process of the consumer risk management - Product Development Process - Evaluation & Approval Process - Account Servicing Process - Loss Recognition Process - Management Information Process A fully loaded profitability model with minimum 3 years projection

- 10. ©2019 Prakarsa Training 10 PROCESSAUTOMATION Because of the enormous transaction volume, automation is crucial in the following areas : Evaluation & Approval Account Servicing Collection & Recovery Loss recognition Management Information & Reporting

- 11. ©2019 Prakarsa Training 11 PORTFOLIOMANAGEMENT Through good and reliable management system Identify the potential areas of concern in order to take early remedial actions Control quality and limit undue exposures Manage and diversify credit exposures Measure the risk/reward profile of extending credit

- 12. ©2019 Prakarsa Training 12 RISK & REWARD TRADE OFF For all benefits there is an inherent risk Credit officers should not be risk aversive The purpose of consumer risk management is not to be eliminate, but to limit, control and reduce it Optimization of profit is the ultimate goal

- 13. ©2019 Prakarsa Training 13 CONSUMERCREDIT RISK MANAGEMENTMODEL It comprises six processes and links to each other All processes are dynamic and interactive Information derived from one process strongly influences decisions being made in other processes The effectiveness depends a through understanding of all processes and how they interact Our aim in this workshop is to introduce to you how these processes can be effectively managed and its applications

- 14. PR AKAR S ATRAI NING© 2019 FREE RESOURCE CREDIT POLICY & PROCESS

- 15. ©2019 Prakarsa Training 15 APPROVAL RULES Objectives To describe types of authority and delegation of approval To maintain the independent of credit approval To ensure appropriate level of review based on size, complexity of the credit transaction or product program Multiple Initial System Any credit approval requires more than a single approval initial Officers with responsibility and delegation for granting credit Delegation by individual capability, experience, training, and skill. NOT BY POSITION Officers with a credit authority equal to or higher than the amount approved Each officer checks different aspect of each operation Each officer adds a different value to decision criteria

- 16. ©2019 Prakarsa Training 16 APPROVAL HIERARCHY Credit PolicyCommit tee CEO & IntegratedRisk Head ConsumerCredit Officer/ Signer Consumer Head ConsumerSegmentHead Product/Funct ional/Specialists

- 17. ©2019 Prakarsa Training 17 BASED ON TYPE OF CREDIT Requirement for Approval Focused to grant credit to group of clients With similar characteristics With similar product requirements With similar risk profiles Subject to standard terms and conditions

- 18. ©2019 Prakarsa Training 18 REQUIREMENTFOR APPROVAL Approval Rules for Product Programs For new & exiting product programs, the following approval requires: President Director/Integrated Risk Head Consumer Banking Head/Consumer Segment Head Product/functional Specialists Approval rules for Individual Transactions For Individual transactions within a product program, the following approval requires: Credit Risk Management Head Credit Committee Members Credit Officers Credit Signers

- 19. PR AKAR S ATRAI NING© 2019 FREE RESOURCE PRODUCT DEVELOPMENT PROCESS n

- 20. ©2019 Prakarsa Training 20 OBJECTIVES& KEY ASPECTS Objectives Determine feasibility of product in term of : - Revenues / Earnings - Net Credit losses - Profit - Return on total assets Respond to business needs Anticipate environmental changes Key Aspects Market analysis Competitive environment Target market Product features External influences Internal influences Product profitability

- 21. ©2019 Prakarsa Training 21 PRODUCT DEVELOPMENTPROCESSKEY ASPECTS(1/5) 1. MarketAnalysis Size/Growth rate Competition Demographics of the market i.e., customer needs and preference

- 22. ©2019 Prakarsa Training 22 PRODUCT DEVELOPMENTPROCESSKEY ASPECTS(2/5) 2. CompetitiveEnvironment Identify competitors Market share Products and terms offered by competitors

- 23. ©2019 Prakarsa Training 23 PRODUCT DEVELOPMENTPROCESSKEY ASPECTS(3/5) 4. Productfeatures Term/Revolving Direct/Indirect Secured/Clean Recourse/Non-recourse Pricing Interest rate Fees Terms Minimum/Maximum amount Late charges Appraisal requirement

- 24. ©2019 Prakarsa Training 24 TYPICALCONSUMERCREDIT PRODUCT Consumer Revolving Indirect(a) Unsecured Direct Unsecuredsecured Term / Installment Indirect (a)Direct UnsecuredUnsecured securedsecured Credit Type & Source Typical Credit Products -1st Mortgages -2nd Mortgage -Home Improvements Personal Loan Tuition Loans Auto Mobil Mobile Homes Recreational Vehicle Boats Student loans Loans(B) Large line of Credit secured By 1st or 2nd mortgages Bankcards T&E Cards Large line of Credit Card driven Private Label Retailers Cards a. May be recourse or on-recourse b. Usually guaranteed by the federal Governm

- 25. ©2019 Prakarsa Training 25 PRODUCT DEVELOPMENTPROCESSKEY ASPECTS(4/5) 5. Externalinfluences Economy Employment trends Legal regulatory 6. Internalinfluences Current products Operation capacity Sourcing channels Growth resources

- 26. ©2019 Prakarsa Training 26 PRODUCT DEVELOPMENTPROCESSKEY ASPECTS Questions to consider Is the market saturated ? What can we do to enhance our product or usage? Can we make a profit? Questions to consider Do you have a good monitoring system tracking on the product profitability regularly ? When will the product be profitable? Is it realistic ? Is the projected credit loss in line with the industry? Is the return justifiable versus the risks taken on the product? Does the return meet with the corporate hurdle rate?

- 27. ©2019 Prakarsa Training 27 PRODUCT DEVELOPMENTPROCESS KEY ASPECTS 7. Productprofitability Must understand key revenue and expense drivers Marketing and acquisition expenses precede booking Net customer revenues on installment products begin at a peak and decline; revolving products build up over time Credit extension costs occur in the initial period Collection costs are small initially but rise as accounts become delinquent Set benchmark levels of credit losses Determining break-even point

- 28. ©2019 Prakarsa Training 28 PRODUCT DEVELOPMENTPROCESS Credit product are offered based on : PRODUCTPROGRAMS All relevant aspects of Product Development must be submitted for approval in this document Actual performance can be regularly tracked versus : - Forecasting volume, revenue and expenses - Forecasting delinquency and losses - Forecasting RORA ; ROE etc All NEW programs must be reviewed at least annually For MATURE programs, review can be extended An earlier review may be required when : • Significant adverse changes in performance • Significant changes in terms and conditions • Significant changes in forecasting volumes, i.e.peak outstanding or peak number of accounts ProductProgram

- 29. ©2019 Prakarsa Training 29 PRODUCTPROGRAM The document should cover the following areas : Executive summary Product description Target market and competitive environment Principal terms and conditions Evaluation and approval process Account servicing process Collection and loss recognition process MIS, portfolio performance and commentary Funding strategy Functional organization chart Product profitability model

- 30. ©2019 Prakarsa Training 30 We should establish policies and guidelines governing the level, scope and timing of product review conducted by an independent party The purpose of product reviews are : To evaluate product program performance To alert management to potential risks To take action to prevent product performance deterioration To assess continual strategic fit Product reviews are based on different approved product programs PRODUCTPROGRAM REVIEW

- 31. PR AKAR S ATRAI NING© 2019 FREE RESOURCE PROFITABILITYANALYSIS

- 32. ©2019 Prakarsa Training 32 PROFITABILITYANALYSIS Identify and analyze RISK and REWAR components Segment Customers ‘based on objectives’ Track the Timing of ‘financial component’ Define Products that ‘satisfy objectives’ Manage/Maximize Profitability

- 33. ©2019 Prakarsa Training 33 PRODUCTPROFITABILITY Purpose Control Predictability Maximize profitability; NOT minimize loss Need to understand the components which make a product profitable over time : Acquisition Cost Receivables Trend Revenue Evaluation & Approval Cost Operation Cost Early settlement/Attrition Expenses Collection Cost Loss Wave Recovery Trend Net Credit Loss Others

- 34. ©2019 Prakarsa Training 34 EXAMPLES OF A PRODUCT PROFITABILITY MODEL

- 35. ©2019 Prakarsa Training 35 STAGES OF IMPACT ON FINANCIAL COMPONENTS

- 36. ©2019 Prakarsa Training 36 PRODUCTPROFITABILITY– COST SEQUENCE Fixed Costs : Distribution & Delivery Operation Variable Costs Credit Losses & Collections ExpensesMarketing 0 1 2 3 Time Rp

- 37. ©2019 Prakarsa Training 37 PROFITABILITY“DRIVERS” Manage key ‘Drivers” to achieve profit objectives : Rp CPA ( Cost per account acquired) % Approval % Activation or Loan Take-Down % Line Utilization (for revolving products) % Attrition or Early Settlement % Net Credit Loss

- 38. ©2019 Prakarsa Training 38 PORTFOLIOPROFITABILITY A portfolio P & L is Built from a series of vintage product models. Any acquisition plan must reflect what the portfolio can support reasonably over time Vintage measures performance from the date of booking

- 39. ©2019 Prakarsa Training 39 PRODUCTPROFITABILITY- SUMMARY Exiting and new product planning tool Budget and forecast formulation Reference for measuring and monitoring product performance Identification of area for profitability improvement Price assessment and product funding Product analysis by vintage and acquisition source Differentiation of products by contribution to profit Provide basis for expense distribution Provide basis for performing stress tests/sensitivity analysis

- 40. PR AKAR S ATRAI NING© 2019 FREE RESOURCE EVALUATION & APPROVAL PROCESS

- 41. ©2019 Prakarsa Training 41 ESSENTIALELEMENTS Meet the volume and market penetration targets of the specific credit products Able to predict risk, and to control it Estimate the cost of acquiring new customers Comply with laws and regulations Achieve a risk / reward balance

- 42. ©2019 Prakarsa Training 42 KEY CONSIDERATIONS Products UnsecuredSecured Mortgage Aut o Car d Cleanline of credit Pl Businesschannels Direct Indirect Walk-ins Mail solicitation Take ones Pr omotions Branchreferr al Sales/ Telemar keting Cr oss-sell Portfoliopurchase Credit Evaluation Type of Evaluation Degree of Evaluation COST

- 43. ©2019 Prakarsa Training 43 5 BASICFRONT-ENDEVALUATIONSTEPS Application Complete Mee tcredit Scree ning cr iteria Mee ts Debt burden requir ements Credit Checks Ver ification Returnfor completion Yes Yes Yes Yes No Decline DeclineDecline Decline No No No No Customerapplies For credit Offer credit To customers

- 44. ©2019 Prakarsa Training 44 COST BENEFITOF EVALUATION Screening cost factor : risk vs. return Risk Higher Loan Size How much should you spend for Different product types? * * * * * * * Mortgage Low cost High cost Screening Cost

- 45. ©2019 Prakarsa Training 45 APPLICATIONFORM The first formal contact with customer The key data source about the customer for credit evaluation A permanent business link Servicing Collection Marketing A legal contract

- 46. ©2019 Prakarsa Training 46 APPLICATIONFORM DEVELOPMENTCONSIDERATIONS Business Management Credit Marketing Legal Collections Operat ions/ Legal CustomerService Target Market Time Cost Acquisition Source Product

- 47. ©2019 Prakarsa Training 47 EVALUATION& APPROVAL‘TOOLS’ Judgmental ApplicationScore

- 48. ©2019 Prakarsa Training 48 EVALUATION& APPROVALTOOLS-JUDGMENTALAPPROACH Evaluation based on THREE Cs of Credit Character Capacity Collateral Must follow a decision path based on Documented acceptance criteria Exceptions Highly dependent on the experience/intelligence of evaluators Is adequate when scoring does not apply Achieves a best estimate that repayment likelihood is high

- 49. ©2019 Prakarsa Training 49 EVALUATION& APPROVALTOOLS– APPLICATIONSCORE Statistical credit evaluation method based on actuarial information of past credit experience Scoring quantifies repayment probabilities of “ good” or “ bad” accounts Utilizes a combination of Application data Credit bureau data External data Evaluates new customers Calculated at time of credit request

- 50. ©2019 Prakarsa Training 50 DEBT BURDEN ANALYSIS Quantifies customer’s ability to pay, not willingness Can be considered as a guideline in the credit decision process Purposes Reduces risk Determines the loan amount that can be afforded Applicable to regular installment payment products Type of Analysis Minimum income requirement Debt-to-income ratio Disposable monthly- income ratio

- 51. ©2019 Prakarsa Training 51 DEBT BURDEN ANALYSIS Limitations Data of debts and income are not always complete and accurate People’s situation changes very quickly Expenses vary according to lifestyle and region Not statistically derived Should only be used as a guideline, not as a reason to approve

- 52. ©2019 Prakarsa Training 52 CREDIT BUREAU Agencies that provide information about debts, and individuals’ credit behavior They are dependent on subscribers ‘input and public records Quality of information is inconsistent Do not contain all credit and debt information Limitations Number of subscribers Opportunity and frequency of information update Not all individuals are registered Legal constraints Costs

- 53. ©2019 Prakarsa Training 53 CREDIT BUREAU Early Bureau Check Time Late Levelof risk CreditEvaluation Process Low Risk High Risk Judgmental Evaluation Method Scoring

- 54. ©2019 Prakarsa Training 54 VERIFICATION Final step in extending credit; help to minimize fraud Tries to verify some information supplied by applicant Should be handled by experienced professionals Should have specific procedures to follow Often difficult for self-employed applicant;need to look at trends Benefits of verification must be weighed against cost

- 55. ©2019 Prakarsa Training 55 METHOD OF VERIFICATION Method RelativeCost Used To Verify Check ID Number Low Identity Telepho neinformation Low Residence;residencephone Payrollstubs Low Emplo yment; income Tax return Low income Credit bureau report Moderate Identify;residence,employment Contactcompany Moderate Emplo yment Retail commoditycheck Moderate Dealers(for indirectsourcing) Visit to residence High Residence,collateral Visit to dealers High Collateral

- 56. ©2019 Prakarsa Training 56 AUTOMATEDVERIFICATIONPROCEDURES Work with information from application Program identifies “exceptions” Matching of characteristics predictive of fraud or false information Examples : Age vs. years on job Age vs. income Tear of birth as stated; year of birth as coded in ID number

- 57. ©2019 Prakarsa Training 57 EVALUATION& APPROVALPROCESS- SUMMARY Obtain Tools to obtain information Application form Credit bureau Evaluate for credit decision Judgmental/Scoring Debt burden analysis Verification Customer data Collateral existence & value Evaluate Verify Information

- 58. ©2019 Prakarsa Training 58 EVALUATION& APPROVALPROCESSSUMMARY Credit Evaluation = Risk Control Striking the right risk/reward balance

- 59. PR AKAR S ATRAI NING© 2019 FREE RESOURCE INTRODUCTIONTO CREDIT SCORING

- 60. ©2019 Prakarsa Training 60 CREDIT SCORING A statistical model of a financial institution’s past credit experience A mirror image of the past A predictor of expected risk Scoring quantifies repayment probabilities of “ good” or “bad” accounts Utilizes a combination of Application data Internal data Credit bureau data External data Evaluate new customers (application score) Evaluates exiting customers (behavior score)

- 61. ©2019 Prakarsa Training 61 TYPES OF SCORES Two primary types of score models Credit scoring Behavior scoring Credit scoring models deal with new applicants (demographic) Behavior scoring models deal with exiting customers (behavioral)

- 62. ©2019 Prakarsa Training 62 1 What is your age Under 25 (7) 25-29 (16) 30-34 (10) 35-39(6) 40-44 (13) 45-49(11) 50+ (8) 2 How many year have you lived at your current address Less than1(-10) 1-2(-3) 2-3(0) 3-5(4) 5-9(14) 10 or more(25) 3 Do you own your own home or rent Own (30) Rent (-20) Others (18) 4 How many years have you hold your current job Less than 0.5(-12) 0.5-1.5 (0) 1.5-3(15) 3-10 (18) over10 (10) 5 Do you have a current bank loan Yes (5) No (0) 6 You Gender Male (0) Female(+20) 7 You marital status Single (-5) Married (+10) Other (-7) 8 Do you have a home telephone Yes (8) No(0) 9 How many T&E and Bankcards do you hold (0) 1-3(12) 4-6(10) >6(-5) 1 What is your age Under 25 (7) 25-29 (16) 30-34 (10) 35-39(6) 40-44 (13) 45-49(11) 50+ (8) 2 How many year have you lived at your current address Less than1(-10) 1-2(-3) 2-3(0) 3-5(4) 5-9(14) 10 or more(25) 3 Do you own your own home or rent Own (30) Rent (-20) Others (18) 4 How many years have you hold your current job Less than 0.5(-12) 0.5-1.5 (0) 1.5-3(15) 3-10 (18) over10 (10) 5 Do you have a current bank loan Yes (5) No (0) 6 You Gender Male (0) Female(+20) 7 You marital status Single (-5) Married (+10) Other (-7) 8 Do you have a home telephone Yes (8) No(0) 9 How many T&E and Bankcards do you hold (0) 1-3(12) 4-6(10) >6(-5) -These are 9 of the typical questions to ask new applicants -Possible points are shown in parenthesis -Add up the total number of points obtained Questi ons Poi nts

- 63. ©2019 Prakarsa Training 63 JUDGMENTVS. SCORING Judgmental Scoring Impact of changing Unknown Precise Credit policies Criteria Subjective / Empirical biased

- 64. ©2019 Prakarsa Training 64 SCORECARDDEVELOPMENT Descriptions and product record Portfolio size Volume of application Sample selection Systems capacity and support Legal/regulatory environment MIS Assign project manager and form project team Understand product history and future plans Develop and design sample Determine sample size Select score characteristics Develop model based on statistical methodology Validate result and set cut-off Develop monitoring MIS

- 65. ©2019 Prakarsa Training 65 OVERRIDES Decisions contrary to score High-side Low- side Should be allowed Must be tracked Withdrawals

- 66. ©2019 Prakarsa Training 66 HOW ARE SCORES MANAGED MIS !!

- 67. ©2019 Prakarsa Training 67 KEY FUNCTIONSOF MIS Measure efficiency : Ensure score effectively separating bad customers from good customers Check stability : Validate the recent through the door population similar to the sample on which the development was done Override analysis : Validate the cut-off score being set properly Error rate analysis : Make sure the quality of the underlying data good Bade rate analysis : Track actual bad rate at different scores versus the bad rates of development sample

- 68. ©2019 Prakarsa Training 68 REQUIREDREPORTS Through-the-Door Analysis (T-T-D) Short term Delinquency Analysis Delinquency Analysis Bad rate Analysis Override Analysis

- 69. ©2019 Prakarsa Training 69 BEHAVIOR SCORING APPLICATIONS Marketing Applications Revolving applications Collection Applications

- 70. ©2019 Prakarsa Training 70 MARKETINGAPPLICATIONS Can help business to formulate its risk adjusted pricing strategies Can use data to market low-risk accounts Can help decision to seek out different type of customers Can help determine whether product is being positioned correctly

- 71. ©2019 Prakarsa Training 71 RISK & PROFITABILITYMATRIXFOR NEW PROMOTION No Not Sure Not Sure Absolutely No Not Sure Not Sure Absolutely Low Profitability High Profitability High Risk Low Risk

- 72. ©2019 Prakarsa Training 72 COLLECTIONAPPLICATIONS Segments high risk accounts Aids to predict potential losses and collection costs Used to Reduce mailing and phone expenses Improve customer relationships Reduces net credit losses

- 73. ©2019 Prakarsa Training 73 BEHAVIOR SCORING : COLLECTION CONTACT STRATEGY SAMPLE

- 74. ©2019 Prakarsa Training 74 “ WHY HAVE SOME SCORE MODELS FAILED ?” No clear policies or strategies All functions not involved in the process Participants not carefully chosen Lack of training MIS not ready Insufficient MIS Nor reacting to MIS

- 75. ©2019 Prakarsa Training 75 SUMMARY Advantages Productivity & efficiency gains Consistent credit evaluation Focused management strategies Accurate risk prediction Reliable method for responding to changes Better MIS Limitations A tool to HELP make decisions Not applicable in all situation Requires a sizable portfolio Effectiveness deteriorates with population changes Cost

- 76. PR AKAR S ATRAI NING© 2019 FREE RESOURCE COLLECTIONOVERVIEW

- 77. ©2019 Prakarsa Training 77 COLLECTION Collection is the procedure aimed at obtaining the repayment of a debt after the obligation has become due Key concepts the collection model Basic delinquency definitions / measurements

- 78. ©2019 Prakarsa Training 78 Product Planning Target Market Distribution & Acquisition Collection M IS Control Risk Reduce Loss Retain Rehabilitate CurrentCustomer

- 79. ©2019 Prakarsa Training 79 Product Planning Target Market Distribution & Acquisition Collection M IS Control Risk Reduce Loss Retain Rehabilitate CurrentCustomer Legal / Regulatory/ Political

- 80. ©2019 Prakarsa Training 80 Product Planning Target Market Distribution & Acquisition Collection M IS Control Risk Reduce Loss Retain Rehabilitate CurrentCustomer Legal / Regulatory/ Political Economy

- 81. ©2019 Prakarsa Training 81 COLLECTION Delinquency definition and measurement Defaulted credit obligations are called delinquency How should delinquency be measured By amount / account By perioda

- 82. ©2019 Prakarsa Training 82 COLLECTION – DELINQUENCYMEASUREMENT

- 83. ©2019 Prakarsa Training 83 0 1 30 60 90 120 150 Measurement of defaulted obligation COLLECTION – DELINQUENCYMEASUREMENT

- 84. ©2019 Prakarsa Training 84 PROFIT MODEL BASICS

- 85. ©2019 Prakarsa Training 85 COLLECTIONMANAGEMENT Success Factors A cohesive front back end collection strategy Striking balance between quality and productivity Maintaining high morale Keeping in mind the reputation of the Bank Key Aspects Collection Strategies and Processes Remedial Management Automated Tools of Collection Collection Agency Management Collection MIS Collection Resources

- 86. PR AKAR S ATRAI NING© 2019 FREE RESOURCE COLLECTIONSTRATEGY & PROCESS n

- 87. ©2019 Prakarsa Training 87 COLLECTION MANAGEMENTCONSIDERATIONS Customer Relationship Credit Expense & Credit Losses Credit Expenses Credit Losses

- 88. ©2019 Prakarsa Training 88 Att empts St rategy # 1 Customer Contact No Contact Pr omise Pay ment(yes) No Answer SkipPr omise Pay ment(No) Br oke n Pr omise Customer Dispute RefusalKept Pr omise St rategy # 7 St rategy # 6St rategy # 2 St rategy # 3 St rategy # 4 St rategy # 5 Can’t Pay Will Not Pay Success 7 situations Every product needs a Well thought out strategy COLLECTIONSTRATEGY

- 89. ©2019 Prakarsa Training 89 STRATEGY 1 – AN EXAMPLE Strategy Objective Retain the customer Tactics Letters for small balances Calls for larger balances only, e.g. > IDR 5000.000 Reminder call Low intensity, e.g. one contact per month

- 90. ©2019 Prakarsa Training 90 COLLECTION STRATEGIES How to contact When to contact Which collectors are responsible Where will collection centers be located Who are the collectors How many collectors are required

- 91. ©2019 Prakarsa Training 91 HOW TO CONTACT Mail Telephone Visit THE CONSIDERATIONIS ‘COST’ VS ‘RESULT’

- 92. ©2019 Prakarsa Training 92 WHEN TO CONTACT - TIMING -Costs -Potential negative customer reaction -Already paid -Intends to pay -Relationship customer -Highest payback -Reach customer ahead of other creditors

- 93. ©2019 Prakarsa Training 93 WHEN TO CONTACT Utilizes • Decision table to prioritize calls • Behavior score/risk score Days and hours of operation

- 94. ©2019 Prakarsa Training 94 WHEN TO CONTACT 10 20 30 40 40 30 20 10 Mon Tues Wed Thru Fri Sat Sun D A Y E V E Time of Contact Percentof AttemptsResultingin Contacts Contact by Day of Week

- 95. ©2019 Prakarsa Training 95 WHEN TO CONTACT CONTACT/COLLECTOR/HOUR 25 20 15 10 5 0 Bucket1 Bucket 2 Bucket 3 Bucket 4 Bucket 5 Bucket 6 Auto-Dial AutomatedCollections

- 96. ©2019 Prakarsa Training 96 WHICH COLLECTORSARE RESPONSIBLE 1. “Specialization” Different collectors deal with borrowers depending on stage of delinquency Early stage collections – auto-dial environment 2. “Cradle to Grave” Same collector is responsible for a specific customer Later stage and recovery collections or high risk vintages Requires more in-depth training 3. Outside agencies Off-load volume Provide special service, i.e. skip tracing, visits Professional service, i.e. Legal

- 97. ©2019 Prakarsa Training 97 WHERE WILL COLLECTIONCENTERSBE LOCATED? Centralized offices usually more efficient Decentralize to take advantage of : • Cost effective labor market • Language • Proximity to customers and/or courts

- 98. ©2019 Prakarsa Training 98 WHO ARE THE COLLECTORS? Collections represents “units of work” – easily divided Early stage : use part time or temps To accommodate shifts and flexible hours Other collection specialists may be required : Later stage experienced collectors Skip traces Repossession/foreclosure/OREO specialists Agency/attorney relationships manager Remedial or workout manager Outside agencies

- 99. ©2019 Prakarsa Training 99 HOW MANYCOLLECTORSREQUIRED? Develop capacity plans to determine the number of collectors required. Need : Collection strategies Productivity standards Volume forecasts Create capacity plans for each product, bucket, process Update daily, monthly

- 100. ©2019 Prakarsa Training 100 CONCEPTUAL EXAMPLE Forecasted Delinquencies Strategy (Intensity) Collector Productivity

- 101. PR AKAR S ATRAI NING© 2019 FREE RESOURCE REMEDIAL MANAGEMENT

- 102. ©2019 Prakarsa Training 102 REMEDIALMANAGEMENT Remedial management refers to collection of back end accounts, i.e. 90 days+ Strategies of remedial management Workout the problem with customers Repossession of the collateral, if any Managing the repossessed assets Sale of the repossessed assets to cover outstanding balance

- 103. ©2019 Prakarsa Training 103 WORK-OUT– GENERICSTRATEGIES Workout strategies are targeted toward customer financial situation 1. Short term problem : ability to catch up Forbearance Deferment 2. Mid-term problem : income now restored but can’t catch up Re-age / curing Balloon deferment Due date change Capitalization 3. Long Term problem : little likelihood of income restoration Lower payment – refinance, term extension,rate reduction Settlement / short sale/ deed-in-lieu

- 104. ©2019 Prakarsa Training 104 COLLECTION PROCESSES Collector work assignment • Collection management system Supervisor monitor performance Define timing and content of various collection activities Process to validate behavior scores, if used Procedures for dealing with bankrupt customers Change-off policy and procedure Policy & procedures for handling repossessed assets

- 105. ©2019 Prakarsa Training 105 COLLECTION PROCESSES Inbound call management Outbound call management Scripting Performance standards MIS

- 106. ©2019 Prakarsa Training 106 COLLECTORPERFORMANCEMEASUREMENT Calls/hours Contact/hour Phone monitoring scores Promise to pay ratio Promises kept ratio Skip finds Rupiah collected

- 107. ©2019 Prakarsa Training 107 COLLECTIONMIS Types Portfolio related Collector performance related Third party agency performance related Effective analytical review Information for credit policy and credit initiation Information for collection strategies Information for collector managemnet

- 108. ©2019 Prakarsa Training 108 SUMMARY “If you don’t make contact, you don’t collect” Collection is a balancing act Cost vs. Result Customer Relationship vs. Asset Protection Requires well thought-out/current/documented strategies, and processes Investment in technology should be consistent with portfolio size/growth Continuous/frequent management involvement required in : Training staff Measuring staff performance Monitoring portfolio activity Monitoring third party activities

- 109. PR AKAR S ATRAI NING© 2019 FREE RESOURCE NON-ACCRUAL & Wr ite-OffPolicy

- 110. ©2019 Prakarsa Training 110 NON-ACCRUAL POLICY Interest are suspended at 90 DPD for all product The only exception will be the Credit Card Business - can accrue interest until 180 DPD - Interest will be reversed at the time of write-off The proposed policy is commonly used by multi- national banks purely for operation efficiency purpose only Approval has not been obtained and subject to clearance from regulation and Internal Financial Control

- 111. ©2019 Prakarsa Training 111 MOST COMMON WRITE-OFF PRACTICE For unsecured loans Delinquent accounts will normally be written-off at 180 DPD For Secured loans - Auto loans : Delinquent account will start to write down from 90 DPD until 180 DPD - Mortgage loans : Delinquent account will start to be written down on 180 DPD to 90% of the updated valuation. Further write-down will be done every six month

- 112. PR AKAR S ATRAI NING© 2019 FREE RESOURCE RISK & REWARD Trade-off

- 113. ©2019 Prakarsa Training 113 RISK & REWARD TRADE-OFF Our objective is NOT to be risk aversive but rather pursuing risk/reward optimization For risk/reward optimization, we need to control absolute risk and reward numbers We must understand credit risk and reward have an inverse relationship Risk and Reward Goals must : Be acceptable and attainable Be able to be attained jointly Balance market reward goals with credit risk goals

- 114. ©2019 Prakarsa Training 114 IF NCL RATE BY ITSELFIS NOT ADEQUATE,WHAT MEASURES COULD WE USE ? RORA Revenue to NCL Coverage Volume Growth Net Profit One single measure may not be adequate

- 115. ©2019 Prakarsa Training 115 RISK & REWARD TRADE-OFF In order to achieve the Risk/Reward Optimization, we need the following in place : A well structured Risk Management Organization A good Product Planning and Development process; Knowing Lifetime Profitability & a Profit Model Having Prudent Credit Policies & Procedures, Credit Evaluation Tools, including statistically validated scoring system

- 116. ©2019 Prakarsa Training 116 RISK & REWARD TRADE-OFF An efficient and customer friendly account servicing process A robust collection/recovery management department with precise collection & write-off policies and processes Adequate portfolio management with appropriate & sufficient MIS Availability of strong SYSTEMSdepartment & a reliable data base

- 117. ©2019 Prakarsa Training 117 SUMMARY Measuring activity by risk/reward is appropriate, but some risks are unacceptable at any level of reward Risk moves swiftly and you have to know what is happening- if God is in the details, then predictability is in the MIS Consumer lending is a statistical business – but only when there is a history on which to build statistics. Testing is therefore key

- 118. ©2019 Prakarsa Training 118 REMEMBER Credit is an ART as well as a SCIENCE - IF NOT, machines could take the blame for variances

- 119. ©2019 Prakarsa Training 119 6 P’S OF CONSUMERCREDIT Portf olio Management Process Product Development Process Evaluation& Approval Process Loss Recognition Process Collection& Recovery Process Account Servicing Process

- 120. PR AKAR S ATRAI NING© 2019 FREE RESOURCE PORTFOLIO MANAGEMENT DYNAMICS

- 121. ©2019 Prakarsa Training 121 WHAT IS A PORTFOLIO A gathering of customers grouped by common characteristics : Type of Product Type of Guarantee Type of credit Terms / Rates Refinancing Plan

- 122. ©2019 Prakarsa Training 122 WE USE PORTFOLIOMANAGEMENTTO Evaluate asset performance versus Business plan Product Program Industry / competitor Analyze trends versus Historical Seasonal Economic cycles

- 123. ©2019 Prakarsa Training 123 RESULTSIN TAKINGACTIONSTO Improve profitability from future acquisition Enhance profitability from exiting portfolio Control exiting portfolio

- 124. ©2019 Prakarsa Training 124 PORTFOLIOMANAGEMENTREQUIRES Knowledge of • Business objectives • Customer expectations • Product characteristics, profit drivers • Operations, and inter-relationship of credit risk management •Establishment of policies and procures System infrastructure Planning for unexpected events Accurate / timely MIS

- 125. ©2019 Prakarsa Training 125 THE KEY TO EFFECTIVEPORTFOLIOMANAGEMENTIS MIS

- 126. ©2019 Prakarsa Training 126 WHAT IS MANAGEMENTINFORMATIONSYSTEM (MIS) An Informationsystem that facilitatesbusinessplanningand control Data Conversion Alternative Information Decisio n Control& Validation Resou rcesResults

- 127. ©2019 Prakarsa Training 127 CHARACTERISTICSOF GOOD MANAGEMENTINFORMATION Present at all stages of the credit risk management Relevant data base Structured to support decision making Short term Medium term Long term Compare against appropriate benchmark and historical standards

- 128. ©2019 Prakarsa Training 128 CHARACTERISTICSOF GOOD MANAGEMENTINFORMATION Reaches all organization levels with the required level of detail Relevant, timely, consistent Data Integrity

- 129. ©2019 Prakarsa Training 129 INFORMATIONFLOW

- 130. ©2019 Prakarsa Training 130 THREE TYPE OF PORTFOLIOMANAGEMENTINDICATORS 1. Leading New Accounts 2. Coincident Active Accounts 3. Lagging Problematic Accounts

- 131. ©2019 Prakarsa Training 131 TWO LEVELSOF ANALYSIS MACRO – Total Portfolio, “The Big Picture” MICRO – Segmentation Analysis, “Peeling the Onion” The Goal is to Understand : What’s working What isn’t Why?

- 132. ©2019 Prakarsa Training 132 DEVELOPMENTOF ANALYTICALTOOL Off-the-shelf software Develop proprietary analytical tools Dependent on available data Line management’s involvement important Knowledge of the business or product dynamics is important

- 133. PR AKAR S ATRAI NING© 2019 FREE RESOURCE PORTFOLIO SEGMENTATION

- 134. ©2019 Prakarsa Training 134 WHAT IS PORTFOLIOSEGMENTATION The identification of homogeneous behavior segments requiring different portfolio management actions The development Of further customer sub- segments based on demographics/customer habits to aid in the design of specific marketing programs to induce favorable customer behavior Types : Single / Multi- dimensional

- 135. ©2019 Prakarsa Training 135 SINGLEDIMENSIONALPORTFOLIOSEGMENTATION Identify risky segments of customers in a portfolio Describe higher risk customer, which may help to enhance credit acceptance policies Does not provide information on who are profitable customers, and profitable customer behavior

- 136. ©2019 Prakarsa Training 136 BEHAVIORSEGMENTSUMMARY Segment 1 : Demographic sub-segments Common Profiles : Majority single female,aged between 26 – 40 High gold card penetration Distinct profiles : Heavy cash sales, at least 1 cash advance transaction a month Boutiques type of transaction are more than average

- 137. ©2019 Prakarsa Training 137 BEHAVIORSEGMENTSUMMARY Segment 1 Potential Management Actions : Need to retain good relationship in high loyalty programs.Important for retention Acquire new customer with similar profiles through customized Member-Get-Member program Cross-sell opportunities

- 138. ©2019 Prakarsa Training 138 PORTFOLIOSEGMENTATIONDATA BASE CRITERIA - EXAMPLES All characteristics that relate to new business demographics All characteristics that relate to new business fields other than demographics fields All characteristics that relate to portfolio financial demographic All characteristics that relate to portfolio demographics All characteristics that relate to portfolio field other than demographics All characteristics that relate to account closures All characteristics that relate to customer behavior

- 139. ©2019 Prakarsa Training 139 SUMMARY Effective portfolio management requires detail and specific understand of customers which are provided through portfolio segmentation analysis Portfolio segmentation analysis requires a through understanding of the business dynamics Portfolio segmentation analysis must provide information that leads to actionable management decisions It requires massive data base covering financial, behavior and demographics of customers Data quality and data accuracy is critical Inputs from multiple functional areas is mandatory for success

- 140. PR AKAR S ATRAI NING© 2019 FREE RESOURCE PORTFOLIO CREDIT PERFORMANCEINDICATORS

- 141. ©2019 Prakarsa Training 141 3 DIFFERENTTYPES OF CREDIT PERFORMANCEINDICATORS Leading New Accounts Coincident Exiting Accounts Lagged Problematic Accounts

- 142. ©2019 Prakarsa Training 142 LEADINGINDICATORS What Are Leading Indicators? Provide information to understand the direction of the business Utilize information gathered during the account acquisition stage Give insight into success of acquisition strategies, target marketing, appropriateness of credit policies and processes; type of customers acquired In a score environment, provide insight into actual booking versus expectation

- 143. ©2019 Prakarsa Training 143 TYPES OF LEADINGINDICATORS Through-The-Door (TTD) analysis Demographics of applying customers Account Acquisition Analysis Acquisition channels Approvals / Declines Response Rate Analysis Are we attracting right target market Score Analysis Population Stability Report Override Analysis report – by score range

- 144. ©2019 Prakarsa Training 144 ANALYZING LEADINGINDICATORS Taking Action From LeadingIndicator Analysis Targeting Strategy Right product for prospect “Adverse Select” Wrong people responding Product Feature Underwriting Criteria

- 145. ©2019 Prakarsa Training 145 COINCIDENTINDICATORS What Are CoincidentIndicators? Provide Information to understand product drivers : Revenue Activation % Utilization % Payment Rates Attrition / Retention % Expense Delinquency % / Rp

- 146. ©2019 Prakarsa Training 146 WHAT ARE COINCIDENTINDICATORS Illustrate present performance of accounts : Point in time snapshot Trends of a single segment/program Comparison of different segments / program at same relative time Possible external factors ( seasonality, economic shifts) “ Is There somethingwe did or not do or should have known“

- 147. ©2019 Prakarsa Training 147 Account & Customer Relationship Analysis Credit line increases Credit line renewals / attrition Fraud Delinquency tracking and analysis Flow Rates tracking and analysis

- 148. ©2019 Prakarsa Training 148 DELINQUENCYTRACKINGAND ANALYSIS Concept Of Buckets Each time segment of delinquency, which is usually in 30-day intervals, is called a bucket They define the delinquency status of an account, customer, or amount When group together, they indicate the credit condition of the portfolio The information allow management to compare portfolio performance to past results and business forecasts

- 149. ©2019 Prakarsa Training 149 DELINQUENCYTRACKINGAND ANALYSIS Coincident rate Lagged rate 30 DPD+ - 30DPD+ Delinquency Delinquency ( two missed payments) 90DPD+ - 90DPD+ delinquency delinquency ( four missed payments)

- 150. ©2019 Prakarsa Training 150 LAGGED DELINQUENCY Definition: A percentage calculation that relates delinquency or losses to previous (lagged) receivables

- 151. ©2019 Prakarsa Training 151 LAGGED DELINQUENCY Attributes: Provides a better picture of portfolio performance Factors out growth in the receivables to determine true delinquency level

- 152. ©2019 Prakarsa Training 152 Is a method for forecasting future delinquencies and gross write-offs using balances in the existing delinquency buckets As net flow movements remains consistent within a range. It is possible to forecast future gross write-offs

- 153. ©2019 Prakarsa Training 153 NET FLOW EXAMPLE 30 to 60 Net Flow Rate = 60-89 DPD This Month 30-59 DPD Last Month Net Flow means that accounts in the 60-89 DPD bucket could have : flowed from 30-59 by missing a payment,or Stayed in the 60 day bucket by making one payment, or Flowed back from higher delinquency by making more than one payment

- 154. ©2019 Prakarsa Training 154 TYPES OF NET FLOW

- 155. ©2019 Prakarsa Training 155 NET FLOW FORECASTING Direct impact on Collections and P & L : Front-end flow deterioration has significant impact on delinquency volumes and potentially gross write-off Back-end flow improvements go directly to the bottom line by reducing GWO

- 156. ©2019 Prakarsa Training 156 USES OF THE NET FLOW TECHNIQUE Reasonable check on forecasts by credit/collection manager Bankruptcy adds volatility Review corrective actions being implemented Collector staffing levels Capacity planning using number of accounts Forecast gross write-offs

- 157. ©2019 Prakarsa Training 157 TAKINGACTION FROM COINCIDENTINDICATORS 1. Revenue production program Activation Cross-sell Line increase Retention 2. Credit performance Collections staffing and strategy Account monitoring strategy 3. Marketplace - Comparable data ( other lenders)

- 158. ©2019 Prakarsa Training 158 LAGGINGINDICATORS The final measure of evaluation of the performance of decisions / programs : Takes time until results are in : Up to 24 months to see stable measures In mature markets / portfolios, can evaluate quality in 3-6 months and get a good picture in 1-2 years performance

- 159. ©2019 Prakarsa Training 159 VINTAGEDELINQUENCYMEASUREMENT “Vintage” denotes batch of accounts booked at specific time frame and tracked separately Accounts perform differently over time Vintage delinquency measures delinquency from date of booking

- 160. ©2019 Prakarsa Training 160 MONTH ON BOOK - MOB Denotes grouping of accounts based on length of times the accounts have been opened ( on Books) It Is used for account life-cycle performance analysis This analysis can be used together with vintage analysis

- 161. ©2019 Prakarsa Training 161 TAKINGACTION FROM LAGGINGINDICATORS 1. Communicate to : Acquisitions Credit policy 2. Revise recovery strategies : 3rd party attorney/agency

- 162. PR AKAR S ATRAI NING© 2019 FREE RESOURCE FORECASTINGLOSSES

- 163. ©2019 Prakarsa Training 163 COMPONENTSOF LOSSES– GROSS WRITE-OFF Occurs when debt reaches specific stage of delinquency based on the Bank’s write-off policies Forecasting gross charge-off is a function of assumed flow rates to predict delinquency volume by bucket Methodology for forecasting gross write-off varies based on product type

- 164. ©2019 Prakarsa Training 164 COMPONENTSOF LOSSES - RECOVERIES Wr iting off an accountdoes not mean that Collectionaction will be stopped Recovery Collections after Write-off Considered as Income to reduce Gross write-offs

- 165. ©2019 Prakarsa Training 165 FORECASTING LOSSES Most predictive tool is net flow rates to derive gross write-off Net flow assumptions may be based on Average historical flow rates Historical trends Take into consideration the type of forecast required 12 month forward 6 month forward 3 month forward

- 166. ©2019 Prakarsa Training 166 FORECASTINGLOSSES Adjustments to be made for anticipated or sudden situations That has long term impact That has short term impact Forecast accuracy will be enhanced by differentiating segments (of the portfolio) based on Vintage Month-on-Book (MOB) Special customer segments Forecast recoveries based on trend

- 167. ©2019 Prakarsa Training 167 FORECASTINGLOSSES Forecast for next 12 months ( Annual Planning) Bucket Flow Rates Adjustment Factors AdjustedBucket Floe Rates WeightedAvg Flow Rates Vintage Segment1 Vintage Segment2 Vintage Segment3 Special Progra m1 (Rewrite) Special Progra m2 (Teststudents) Changein Legal/Social Constraints Changein CollectionStra tegy Economic Changes Credit Waves Total Product Portf olio Forecast Vintage Segment1 Vintage Segment2 Vintage Segment3 Special Progra m1 (Rewrite) Special Progra m2 (Teststudents) Gr osswrite-off

- 168. ©2019 Prakarsa Training 168 FORECASTINGLOSSES Forecast for next 3 months ( forecast updates) Bucket Flow Rates Adjustment Factors AdjustedBucket Floe Rates WeightedAvg Flow Rates Vintage Segment1 Vintage Segment2 Vintage Segment3 Special Progra m1 (Rewrite) Speci al Pr ogram2 (MKT Test Pr ograms) Changei n Collecti on Capaci ty Changei n Collecti onManager Collecti onIncentive Pr ogramsbursts Infrastructure Breakdowns Unanti ci patedLoss In Collecti onhours Storm s,Ear thquakes,etc Total Product Portf olio Forecast Vintage Segment1 Vintage Segment2 Vintage Segment3 Specialized Progra m1 (Rewrite) Special Progra m2 (MKT Test Progra ms) Gr ossCharge-off

- 169. ©2019 Prakarsa Training 169 AUTO LOANS Auto Loan Loss Forecast Upo n Re-possession Not disposed After 6 months Not Repossessed At/ over 90 DPD+ Disposal deficiency Not Repossessed At/ over 180 DPD+ Difference between O/S & FSV 100 % O/S 50% of O/S 100% O/S Difference Bet ween Sale processed And O/S

- 170. ©2019 Prakarsa Training 170 FORECASTINGLOSSES- SUMMARY The basic methodology utilize delinquency MIS and net flow trends to predict delinquency volume by bucket This “benchmark” must be adjusted based on the various factors which can influence loss forecast Type of product/business Changes in legal and social constraints Seasonality Maturing vintages Credit wave Accuracy can be improved by forecasting individual segments to be aggregated into a total portfolio view Always a degree of judgment on the assumptions used

- 171. PR AKAR S ATRAI NING© 2019 FREE RESOURCE PRODUCTS AUTO

- 172. ©2019 Prakarsa Training 172 PRODUCTFEATURES GENERAL • A “secured” lending product • A loan, not a line of credit • Transaction size • A repayment schedule • Interest rate – fixed and floating • Early settlement not unusual • Collateral value • Direct and indirect sourcing Form of Financing • Hire purchase • Lease purchase • Bank Loan • Conditional sale • Operating ( or True ) lease Terms & Conditions • Down Payment • Payment in advance • Tenor • Interest Rate • Dealer recourse, Non-recourse & commission

- 173. ©2019 Prakarsa Training 173 RISK PROFILE– TARGET MARKET Dual/triple target marketing process Vehicle preference ( your collateral) Valuation efficiency Secondary market Buyer demographic ( your customers ) New and used car buyers Lifestyle and behavior Dealer demographic ( our pipeline )

- 174. ©2019 Prakarsa Training 174 RISK SENSITIVITY + Interest rate Down payment New car Price + Interest rate Down payment New car Price -

- 175. ©2019 Prakarsa Training 175 RISK PROFILE– INSURANCERISK Risk of coverage Loss beneficiary Cover note vs. insurance policy Premium payment receipt Second and subsequent years renewal Strength of insurance company

- 176. ©2019 Prakarsa Training 176 RISK PROFILE– COLLATERALRISK Assumption Depreciatedvalue – 1Y = 30% 2Y = 55% 3Y = 80% 4Y = 90% 1. Untuk kredit dengan jangka waktu 36 bulan maka nilai collateral akan selalu dibawah outstanding kredit. 2. Untuk kredit dengan jangka waktu 48 bulan, nilai jaminan akan berada dibawah outstanding kredit mulai dari bulan ke-15 /16 sampai bulan ke 43 3. Untuk kredit dengan jangka waktu 60 bulan nilai jaminan akan berada di outstanding kredit mulai dari bulan ke 9 /10 sampai dengan bulan ke-55 Financin g% : 85% InterestRate : 8% p.a.flat

- 177. ©2019 Prakarsa Training 177 RISK PROFILE DocumentationRisk Title Vehicle registration document Permit to own Transfer documents Loan documentation Fraud Risk Fraudulent title document Double financing Non – existence of collateral Phantom customers Dealer’s misrepresentation

- 178. ©2019 Prakarsa Training 178 PORTFOLIOMANAGEMENTMIS Establish Portfolio Performance MIS Monthly, quarterly, Y-T-D Delinquency – leading, coincident, lagged, flow rate Exceptions and overrides Repossession, success rate Average loss/repo Loss by make, new and used split Recovery ratio, NCL Fraud

- 179. ©2019 Prakarsa Training 179 PORTFOLIOMANAGEMENTMIS Establish Portfolio Performance MIS ( Cont.) Loss resulted from insurance claim Insurance company exposure Breakdown by dealers & other key sourcing channels Loan/marketing officer performance Customer service data : complaints,volume,etc Establish Portfolio Review policy Frequency, timing Dealer annual review Accountability

- 180. PR AKAR S ATRAI NING© 2019 FREE RESOURCE FRAUD RISK MANAGEMENT

- 181. ©2019 Prakarsa Training 181 FRAUD DEFINITIONS External fraud Deliberate action by outside party to obtain credit in a manner intended to deceive the lender Internal fraud Deliberate wrong doing by an employee for personal benefit.It includes violations of established risk management processes for such purposes

- 182. ©2019 Prakarsa Training 182 TYPE OF FRAUD

- 183. ©2019 Prakarsa Training 183 FRAUD MANAGEMENTSTRATEGIES 1. Prevention 2. Detection 3.Recovery 4. Deterrence

- 184. ©2019 Prakarsa Training 184 PREVENTION Build a strong internal control process Build fraud management awareness among front line staff

- 185. ©2019 Prakarsa Training 185 STRONGINTERNALPROCESS Third party appointments to base on establish criteria Use several third parties Customer and collateral verification Physical check of collateral for secured loans Check sales/purchase document ; commodity checks for secured loans

- 186. ©2019 Prakarsa Training 186 STRONGINTERNALPROCESS Collection agency : Account for all recoveries; verify with customers Repossession frauds : Clear disposal procedures Engage reputable auctioneers, monitor the auction process Track fraud experience through use of portfolio analysis Build fraud transaction data base Investigate known frauds

- 187. ©2019 Prakarsa Training 187 PREVENTION Build fraud management awareness among front-end staff Train sales staff and monitor sales activities Update loan processing staff on new fraud patterns Include fraud case discussion into staff meetings Build a Strong internal Process Build fraud management awareness among front line staff

- 188. ©2019 Prakarsa Training 188 DDEETTEECCTTIIOONN • Develop and implement fraud detection systems • Allocate more fraud management resources to proactive detection • Use detection rate targets for fraud management staff performance • Analyze fraud trends • Maintain excellent communication with other functions • Participate in local market Associations

- 189. ©2019 Prakarsa Training 189 RECOVERY Aggressive investigation, document and collect Pursue fraud cases to recover loss cost effectively

- 190. ©2019 Prakarsa Training 190 DETERRENCE Build and maintain image of a well defended organization In process controls In discipline sales staff In alert front end staff In authorization parameters

- 191. ©2019 Prakarsa Training 191 FRAUD REPORTINGAND FRAUD LOSS RECOGNITION Fraud incidencemust be reportedimmediately accordingto policy guidelines,exceptfor card fraudswhich should be reportedon monthly basis Establishcorporatepolicy for fraud loss recognitionaddressing Fraud types Timing of loss recognition Treatment of recovery

- 192. ©2019 Prakarsa Training 192 While fraud management is the jurisdiction of a single department, all functions within the Bank has responsibility over controlling fraud Run-away fraud losses can bring down a business

- 193. Berdiri sebagai badan hukum di 2019, Prakarsa Anak Negeri sebagai Perusahaan Penyedia Jasa Profesional di bidang Pelatihan, Penelitian, dan juga Konsultasi di Indonesia. Kami ingin menjadi ” Sahabat Anda untuk senantiasa bertumbuh & beradaptasi” dalam menghadapi berbagai tantangan juga peluang di Era VUCA ini. Misi kami: Menciptakan nilai bagi Stakeholder kami dengan menyediakan layanan Pengetahuan yang Unggul dan Kompetitif, serta Menjadi Penyedia Jasa Pelatihan & Konsultasi Manajemen yang disegani p r e s e n t a . c o . i d 01 prakarsa-anak-negeri.com Tentang Kami Prakarsa Anak Negeri Misi Kami

- 194. 1 Marketing& Sales Academy Strategy& PerformanceAcademy BusinessInno vation Academy Governance,Risk,and ComplianceAcademy OperationAcademy Credit & Collection Academy GeneralFinancial ServicesAcademy Soft Skill s 2

- 195. THANK YOU When You stop learning You stop growing Kenneth H Blanchard ©2019 Prakarsa Training